Something very interesting happened at MEMC’s Capital Markets Day yesterday. With the company planning on formally changing its name to SunEdison, SunEdison has effectively gone public.

At this point, the change is more optical than anything else: it simply confirms the fact that for the better part of the last two years, the solar project development division has emerged as both the immediate revenue engine as well as having the most potential for long-term growth, over and above its solar and semiconductor materials businesses. That this is so is due to both the nature of recent solar dynamics (the transfer of pricing power from upstream to downstream), as well as the simple fact that SunEdison is good at what it does: developing solar projects in a timely and cost-effective manner.

Hindsight is 20/20, they say, but it really does seem that in retrospect, the company could only have moved in one direction the day MEMC announced its purchase of SunEdison back in October 2009. Wafers had become the first segment of the value chain to be commoditized, and Chinese behemoths such as GCL, ReneSola and LDK were pouring hundreds of millions of dollars into vertical integration (crucible and wire production) and capacity expansion. With the global landscape looking as it did at the time, MEMC’s then-existent manufacturing model of tolling its low-cost FBR poly through Taiwanese wafer contractors only ever made sense as an internal hedge for SunEdison against undersupply. And its semi wafers business had stalled a while back -- it was why the company got into solar wafering in the first place.

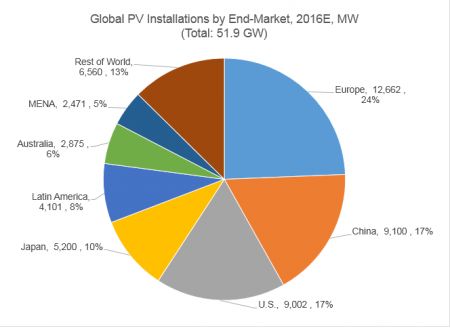

Source: GTM Research Competitive Intelligence Tracker

MEMC’s metamorphosis also highlights an interesting trend, in terms of business models adopted by American solar companies in contrast to their European counterparts. All three remaining publicly traded American solar pure-plays -- SunPower, First Solar, and now MEMC/SunEdison -- started out purely as manufacturers, but made bold, preemptive moves downstream and have now morphed into full-fledged project developers that happen to have upstream manufacturing capabilities. In the cases of SunPower and SunEdison, their manufacturing models are relatively capital-light; except for the core IP step, they rely on a network of strategic partners, as well as contract manufacturers such as Flextronics and Celestica. This dynamism and willingness to transform the fundamental business model stands in contrast to the relative conservatism shown by leading European solar giants such as Bosch, REC, and SolarWorld to move the core of their business away from manufacturing in the face of a changing world (although it’s interesting that even with such an emphasis on manufacturing, the European firms have also been far less technologically innovative than their American peers, REC’s FBR polysilicon technology aside).

Now it’s hardly clear which, if any, of the three American firms discussed above will eventually be successful. The challenges in their way are multitudinous -- much of their hopes rest on the shoulders of growth markets such as MENA and Latin America, whose path to development as markets of consequence is littered with obstacles and uncertainty. While GTM Research forecasts these two regions to add an impressive 6.5 gigawatts in 2016 (compared to just 400 megawatts in 2012), it is far from clear who will enjoy the spoils of the hunt at this early stage. And competition from China Incorporated remains ever-present -- though in theory, First Solar and SunPower could at some point shed their manufacturing assets if they proved to be a liability, and thus leverage China's solar supply chain instead of fighting it. But experience and access to financing are the key competitive advantages in project development, and there is no doubt that each of these three firms has at this point accumulated deep knowledge and significant experience with regard to developing projects -- and possess significant pools of capital.

Source: GTM Research Competitive Intelligence Tracker

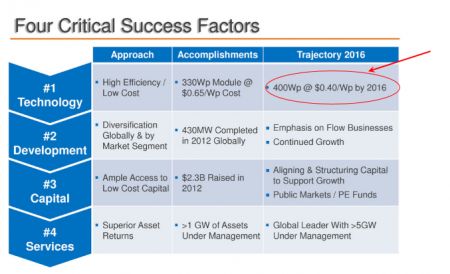

One final point, which concerns SunEdison’s module cost roadmap: There’s been some incredulity expressed regarding GTM Research’s best-in-class manufacturing cost and module ASP estimates of 42 cents and 47 cents per watt, respectively, for 2015 and 2016. Quite a few people think they are impossibly low. As shown below, MEMC is targeting an all-in module cost of 40 cents per watt in 2016, leaving one to wonder what the likes of cost leaders such as ReneSola, Jinko or Yingli could achieve by that date (supply bottlenecks notwithstanding). It underlines the point that as much as module costs have declined, the long-term floor is still a long ways away -- at least 40 percent away, by our and MEMC's -- I mean SunEdison’s -- count.

Source: MEMC/SunEdison

Shyam Mehta is a Senior Analyst at GTM Research. For more information on GTM Research’s products and services, click here.