The global fossil fuel industry faces a loss of $28 trillion in revenues over the next two decades if the world takes action to address climate change, cleans up pollution and moves to decarbonize the global energy system.

The assessment, made by leading European brokerage Kepler Cheuvreux, underlines what’s at stake for the fossil fuel industry, including factors such as a push for cleaner fuels and concerted efforts to reduce emissions, and helps explain the significant pushback from the oil and coal industries against such policies.

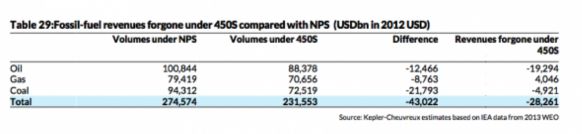

The Kepler Cheuvreux report, penned by a team led by Paris-based analyst Mark Lewis, a former head of Deutsche Bank’s carbon and energy team, says the oil industry has the most to lose, with a potential loss of $19.3 trillion in revenues in the period 2015-2035. The coal industry stands to lose $4.9 trillion, while the gas industry could lose $4 trillion.

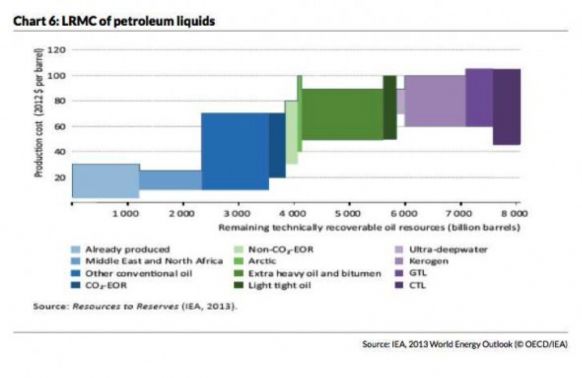

The most at-risk projects are the high-cost, high-carbon sources -- particularly deepwater drilling, oil sands and shale-oil plays -- which rely on high prices for oil.

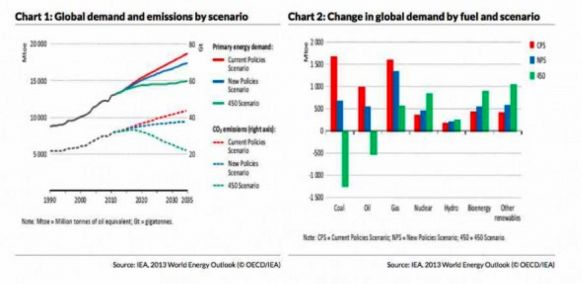

Kepler Cheuvreux arrives at its primary conclusions by comparing the forecasts included in the International Energy Agency’s “New Policies Scenario,” which is effectively a business-as-usual scenario, and what would be needed to meet the 450 Scenario, which is based on the parts-per-million level seen as a benchmark for capping global warming to a maximum 2°C. These graphs below illustrate the emissions reduction path, as well as the IEA’s estimate of how this might affect production of various energy sources.

But Kepler Cheuvreux says that its predictions do not rely on there being a global climate agreement struck in Paris at the end of 2015. The report notes that trillions of dollars are still at risk from unilateral and regional action, pollution controls such as those being implemented by China, and the falling of cost of renewables, which will likely displace more coal, gas and oil production.

“The oil industry’s increasingly unsustainable dynamics...mean that stranded-asset risk exists even under business-as-usual conditions,” Kepler Cheuvreux writes. “High oil prices will encourage the shift away from oil toward renewables (whose costs are falling), while also incentivizing greater energy efficiency."

The following graph illustrates the problem. Much of the existing production is low to medium cost, but the remaining reserves -- such as those locked under the Arctic -- are complicated and expensive to extract.

On this point, the report reflects the majority view of leading investment houses, including Citigroup’s latest assessment that the “age of renewables has begun” on the basis of costs, and Sanford Bernstein’s recent warning that the world faced a scenario of energy price deflation because of the impact of the plunging cost of solar and its likelihood of displacing of fossil fuels across the world.

The global fossil-fuel industry has been clinging grimly to the IEA’s New Policies scenario, seeking to justify the huge investment it is making in exploration and ever-more capital-intensive projects to both shareholders and bankers.

Kepler Cheuvreux is particularly critical of ExxonMobil’s recent carbon risk report, saying it had focused almost exclusively on business-as-usual scenarios and “did not advance the debate at all.”

The report says that most existing fossil-fuel production is not at risk. Instead, the risk is in the proven reserves that yet to be developed. As Citigroup and others, including HSBC and Deutsche Bank, have previously noted, these proven but as yet undeveloped assets form a significant part of some company’s market and asset valuations.

On the subject of renewables, Kepler Cheuvreux reports that major cost reductions have been achieved in recent years, and this is likely to continue over the next two decades -- just as the upward trajectory for oil costs becomes steeper.

“This suggests, perhaps paradoxically, that there could be a real risk to the oil industry from rising oil prices under a business-as-usual scenario, as combined with continuing reductions in the costs of renewable technologies, this could drive the accelerated substitution of oil in the global energy mix over the next two decades,” the report states.

“In turn, this would risk creating stranded assets over the medium to longer term both for the oil industry itself and -- owing to the central role of oil in energy pricing more generally -- for the global fossil-fuel industry as a whole.

“The implications of such a scenario would be momentous, as it would mean that the oil industry potentially faces the risk of stranded assets not only under a scenario of falling oil prices brought about by the structurally lower demand entailed by a future tightening of climate policy, but also under a scenario of rising oil prices brought about by rising demand under increasingly constrained supply conditions.”

As noted, the Kepler Cheuvreux report is highly critical of ExxonMobil’s recent assessment of how it is managing carbon risk. The brokerage said Exxon was too focused on business-as-usual, was dismissive of the risk of a coordinated global policy response ever happening, and was far too “binary” in its assessment of the climate-policy risks the oil industry faces.

“We have already acknowledged that a 450 ppm deal by December 2015 does not look at all likely, but the point about global climate policy is as much the direction of travel as the speed.

“And in effectively dismissing the likelihood of policymakers ever getting genuinely serious in terms of policy ambition, we think ExxonMobil is giving itself a free pass in terms of the need to at least contemplate what a 450-ppm world would mean."

The report also notes that certain kinds of investments -- notably high-cost, high carbon assets such as Canadian oil sands -- could become socially unacceptable as investments for growing numbers of institutional investors over time. Indeed, this was one of the assets explicitly cited by shareholders that forced Exxon to write its carbon risk report.

“We can also envisage a risk of stranded assets arising for oil companies under a scenario of rising oil prices,” Kepler Cheuvreux writes.

“Specifically, if oil prices rise faster in the future than currently assumed by the IEA in its base-case projections, we think this could lead to an acceleration of the policy incentives for, and deployment of, renewable-energy technologies and energy-efficiency measures, and hence a faster shift away from oil in the global energy mix over the next three decades than ExxonMobil assumes."

***

Editor's note: This article is reposted from RenewEconomy. Author credit goes to Giles Parkinson.