VC funding for your new thin-film solar factory or fuel cell firm might be hard to come by these days. At least from investors on Sand Hill Road in Menlo Park, California.

But capital-light, enterprise-level energy efficiency plays that look a little like the successful firm Opower? That might be a simpler funding story.

We reported on FirstFuel's seed funding of $2.4 million in September of last year. The firm looks to be on a roll and just closed a $10 million round A led by new investor Rockport Capital, which is joining existing investors Nth Power and Battery Ventures.

Put simply, the firm is a commercial building energy analytics startup.

"FirstFuel Software is a great example of an exciting cleantech startup that can be capitalized within the constraints of venture capital and that leverages proven software product development models," said Jason Matlof, a partner at Battery Ventures. Another investor, Rodrigo Prudencio of Nth Power said, "I'm excited about FirstFuel because they are scalable unlike any other company I've seen in the energy efficiency space. Global reach (any building with a smart meter), best engagement (they walk into a customer with the information the customer wants to know) and the recommendations are relevant and actionable. For what it can charge (and for the margins it makes) FirstFuel drives great value to the facility, utility or service channel."

While many building energy analysis firms have to reach out and "touch" the customer by installing some sort of sensors and monitoring equipment, FirstFuel Software never has to contact the customer. It's this non-intrusive, touchless process that allows the firm to scale.

One of the milestones that might have driven the new investment was FirstFuel's recent selection by the DoD’s Environmental Security Technology Certification Program (ESTCP) to demonstrate its technology and potential savings on military installations. The Office of the Deputy Under Secretary of Defense Installations and Environment estimates that the DoD is the premier energy user in the U.S. and spent more than $3.5 billion on facility energy consumption in 2010.

In the words of CEO Swapnil Shah, FirstFuel provides "behind-the-meter intelligence for the utility without them having to go behind the meter." The firm does this without on-site audits or connectivity to building systems.

In fact, the firm suggests that actually meeting with the building manager does not always help them identify the biggest problems or the real energy bandits in a building.

Shah added, "We've seen faster-than-planned demand for our zero-touch building energy assessments, since it's apparent that you cannot invest in what you don't know, and there is a level of urgency to identify the savings opportunities rapidly and cost effectively, especially among entities that have targets/mandates." He added that "We have pilots/deployments with federal and state government agencies, large U.S. utilities, as well as European utilities, and strategic partnerships -- some of which we plan to announce shortly."

The Waltham, Mass.-based startup is proving that its zero-touch process can remotely determine the energy characteristics of a structure via a method that's somewhat like taking a CAT scan of the building.

The utility provides energy usage data for electricity and perhaps for gas on 15-minute or hourly intervals, as well as the building's address and physical location. FirstFuel then references that information to hourly climate data and maps that to sophisticated GIS information to understand the geometry and 'energy metabolism' of the building.

FirstFuel generates a highly detailed map of the building that yields square footage, elevation, number of floors, glazing characteristics, etc., and determines whether the building has chillers or an underground garage or heat pumps.

Other firms like Retroficiency focus on data analytics software to better target cost-effective efficiency retrofits. San Francisco-based SCIEnergy gathers building meter and submeter data to cross-reference with its building efficiency management software.

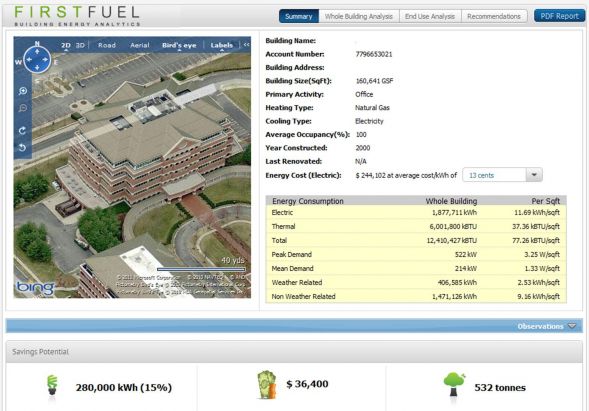

Here's an example of First Fuel's analytics:

The IP of the firm resides in its data analytics and the "ability to analyze the consumption patterns of a building remotely." FirstFuel can then provide a summary dashboard that shows that building owner which areas they should be focusing on to maximize the effectiveness of efficiency measures.

Should the building focus on plug load or lighting? Cooling or heating?

In this example, lighting and cooling are the areas that can offer the most improvement.

Seasonal patterns and insights are identified:

The "CAT scan" of the building can reveal weekend and weekday patterns using metrics like heating, cooling, weather and occupancy. The data can also reveal the impact of sun and wind and what percentage of energy is being lost through the building shell.

Once the data is analyzed and presented, the startup's software can make low-capital recommendations and provide guidance for retrofits. The firm can also recommend region-specific utility programs and rebates that the customer can exploit.

Instead of the utility just engaging with the customer via a bill, it can provide a meaningful dialogue with the customer and share best practices. Customers can communicate with the utility on these matters and the utility can apply these savings towards RPS goals or other PUC mandates.

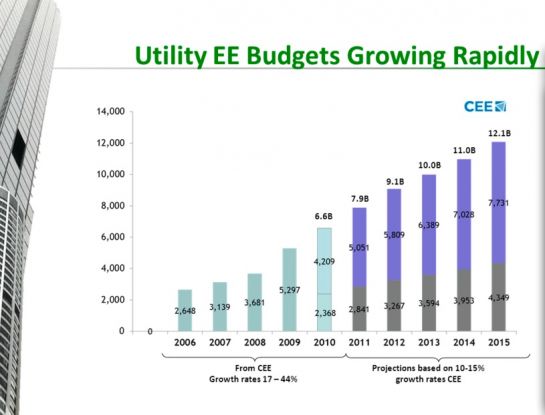

FirstFuel's customers are the utilities or the DoD, not the building owners. And the size of the utility spend in energy efficiency is large. Commercial and industrial buildings made up 40 percent of the U.S. utility industry’s $6.6 billion energy efficiency budgets in 2010, according to the Consortium for Energy Efficiency. That total is predicted to grow to $12 billion in 2015. According to the CEO, San Francisco, New York City, and Boston are all passing laws which require buildings to meet an efficiency mandate.