First Solar (NASDAQ:FSLR), the leader in thin-film solar panel manufacturing, just announced its financial results for the third quarter ending September 25, 2010.

Third quarter 2010 net sales were $797.9 million, an increase of $210.0 million from the second quarter of 2010, primarily due to increased system sales (driven principally by the sale of the 60 megawatt Sarnia Phase 2 project in Canada), partially offset by a decline in module average selling prices and lower blended euro exchange rates. Quarterly net sales grew 66 percent from $480.9 million in the third quarter of 2009, due to increased systems revenue and module production volumes, partially offset by a decline in module average selling prices and lower blended euro exchange rates.

For 2010, First Solar projects:

- Net sales of $2.58 billion to $2.61 billion, increased from the previous guidance range of $2.5 billion to $2.6 billion.

- Earnings per fully diluted share of $7.50 to $7.65, increased from the previous guidance range of $7.00 to $7.40.

- Total capital spending of $550 million to $600 million.

- Operating cash flow of $595 million to $620 million.

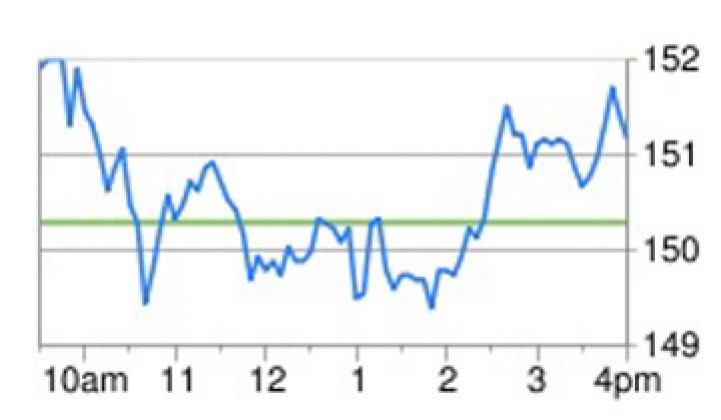

The firm's shares were down almost 7 percent in late trading to $141.18 despite better than anticipated third quarter results. The pressure on the stock is likely due to the firm's gross margin in the quarter falling from 50.9 percent a year ago to 40.3 percent this quarter.

We'll provide more details and more analysis in a bit. In the meantime, read about First Solar's supply chain issues with tellurium here and their potential struggle with efficiency improvement here.