Back in 2016, First Solar proved in a California pilot project that utility-scale solar farms can provide critical transmission grid services. Four years later, the leading U.S.-based solar module maker has taken the next big step in turning this capability into a real-world grid resource: convincing a grid operator to pay for it.

Chilean grid operator Coordinador Eléctrico Nacional (CEN) has added First Solar’s 141-megawatt Luz del Norte PV power plant to its list of generators approved to provide grid services. According to First Solar, it's the first-known instance anywhere in the world of a utility-scale solar system offering up its inverters and control systems to a grid operator’s ancillary services market.

Over the past month, CEN has been sending the Luz del Norte plant second-by-second commands via its automatic generation control system to ramp real power output up and down to mitigate frequency disruptions. That’s a task usually assigned to fossil-fired power plants and hydroelectric dams, or, in a growing number of cases, batteries.

Adding solar farms to that list of assets could offer grid operators a new tool to deal with the challenge of integrating more and more carbon-free, yet intermittent and sometimes unpredictable, wind and solar power, said Troy Lauterbach, senior vice president of First Solar’s Energy Services business.

CEN’s work to integrate that potential into real-world grid operations allowed the company "to take a proven concept and implement a commercially and technically viable solution,” Lauterbach said.

How it works: Staying ahead of the curve

First Solar’s 2016 project with California grid operator CAISO and the U.S. Energy Department’s National Renewable Energy Laboratory indicated the range of services a solar farm can provide for the grid. Much like rooftop solar or behind-the-meter battery inverters, utility-scale solar PV inverters can inject or absorb reactive power to mitigate frequency and voltage disruptions — not only during daylight solar production hours but also when they’re sitting idle at night.

Solar farms can also modulate how much power they’re feeding to the grid, slightly limiting their output to provide “headroom” to move that output up and down, much like hydroelectric or natural-gas-fired turbines do today. In fact, solar farms and batteries can respond more quickly than spinning generators, which can be a valuable tool for grid operators facing increasingly complex and fast-changing grid conditions.

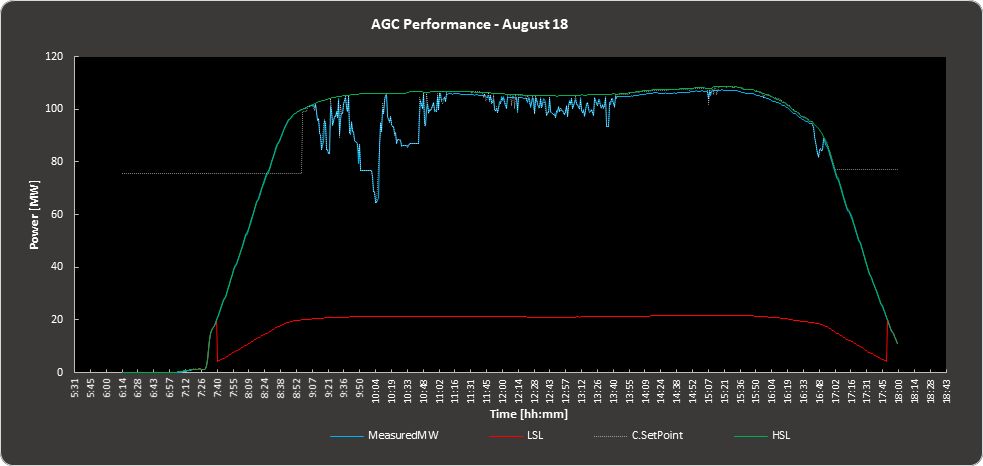

In Chile, the Luz del Norte plant is being controlled in this latter fashion, offering solar curtailment to provide secondary frequency control for CEN. This chart indicates how, on a typical day in August, the solar farm fluctuated its output in megawatts (the blue line) below its maximum output (the green line) to smooth things out, at one point providing 40 megawatts of regulation.

As with North American and European frequency regulation markets, CEN uses a combination of bids and auctions to pit different resources against each other to offer services at competitive prices. At times, it may issue direct instructions during grid emergencies. This helps avoid the need to invest in more expensive grid equipment or upgrades to mitigate frequency problems.

Chile’s northern Atacama Desert region has been a testing ground for a number of innovative grid projects, from some of the earliest grid-scale battery installations from AES Energy Storage (now part of the Fluence joint venture with Siemens) to the more recent efforts by Fluence to use batteries to increase transmission hosting capacity.

The Atacama’s large-scale mining operations have traditionally strained the region’s remote grid, although a newly completed transmission line connecting its northern and central-south electrical systems has provided more stability and flexibility, according to Gabriel Ortiz, First Solar's asset manager responsible for Luz del Norte.

Given the changing solar output characteristics of Chile’s winter and summer seasons, the Luz del Norte plant can offer between 80 and 110 megawatts of curtailment, Ortiz said. CEN has established a total requirement of 120 megawatts of downward frequency regulation support for this year, meaning the solar farm “can easily provide most of the reserve needed,” he said.

Will other solar farms follow suit?

Whether or not solar farms in other regions will find that this type of market opportunity aligns with their economic imperatives is an open question. It’s important to remember that every megawatt of solar output reduced to get paid for grid services equals a megawatt that isn’t earning revenue for the real power it’s generating. While frequency regulation isn’t needed very often, power plant operators will need to determine what impact that curtailment might have.

First Solar has been exploring the potential to move traditional solar power-purchase agreements (PPAs) away from energy-only compensation structures and more toward capacity-based constructs, John Sterling, director of market and policy affairs, wrote in an email. These “solar tolling agreements” could incentivize developers to provide flexible dispatch from their projects, he said.

Also at issue is the value that individual grid operators and market programs provide for this kind of service. Frequency regulation tends to be more lucrative than other energy market services because it’s absolutely vital for keeping the transmission grid stable and requires fast response and high levels of technical expertise.

At the same time, frequency regulation is a relatively tiny fraction of a transmission grid’s overall energy, capacity and ancillary services needs, meaning that markets can be saturated fairly quickly and changes to market rules can have outsize impacts on the value available to participants.

That’s what happened with the market operated by mid-Atlantic grid operator PJM, which provided the biggest battery storage opportunity in the United States during the early part of the decade, only to rework its rules in 2017 in ways that made it far more challenging for batteries to earn their keep.

But these past market ups and downs may be eclipsed in importance by the decarbonization goals being pursued by governments and utilities around the world. Adding more and more intermittent wind and solar power to the grid creates far more uncertainty for grid operators and creates new opportunities for resources with the flexibility to help solve them — including, in this case, the same utility-scale renewable systems that are driving the disruption.

Wind and solar farms, both with and without batteries to store and shift their output, are being examined for their grid services potential in markets from California to the United Kingdom.

First Solar noted that the Mission Innovation program, a group of 24 countries including the United States and the European Commission working on clean energy innovation, contends that expanding the kind of ancillary services First Solar is demonstrating in Chile to utility-scale solar plants around the world — and replacing the need for fossil-fueled plants to offer the same services — could yield a carbon emissions reduction of up to 30 million metric tons per year by 2030.