The markets did not like First Solar's earnings news one bit. It's not as if the solar sector as a whole is being celebrated by the stock market, but First Solar got taken down a notch after announcing its second-quarter results.

First Solar (Nasdaq: FSLR), the largest solar company in the world by market capitalization, just announced its financial results for the second quarter of 2011. Net sales were $533 million, down from $567 million last quarter (with the Street expecting about $583 million).

First Solar attributed the lower sale figures to lower ASPs and "policy uncertainty" in Italy, Germany, and France.

First Solar also lowered its 2011 guidance.

Guidance last quarter was for net sales in 2011 of $3.7 billion to $3.8 billion (trimmed from an upper bound of $3.9 billion). That number has been taken down even further for a guidance of $3.6 billion to $3.7 billion.

However, there is some optimism for the second half of this year. Rob Gillette, the CEO of First Solar, said in the earnings statement: “We expect stronger performance in the second half of 2011 as we build projects from our systems pipeline, develop promising new markets, execute our cost reduction roadmaps and continue to improve module efficiencies.”

First Solar’s updated 2011 guidance is:

- Net sales of $3.6 billion to $3.7 billion

- Operating income of $900 million to $960 million

First Solar produced 483 megawatts of modules in the second quarter with an annualized capacity per line of 62.1 megawatts and a conversion efficiency of 11.7 percent, a number that slowly climbs every quarter.

Module efficiency goals are for 13.5 percent in 2014. The firm recently reached 17.3 percent in the lab.

Module manufacturing cost remained in the $0.75-per-watt range.

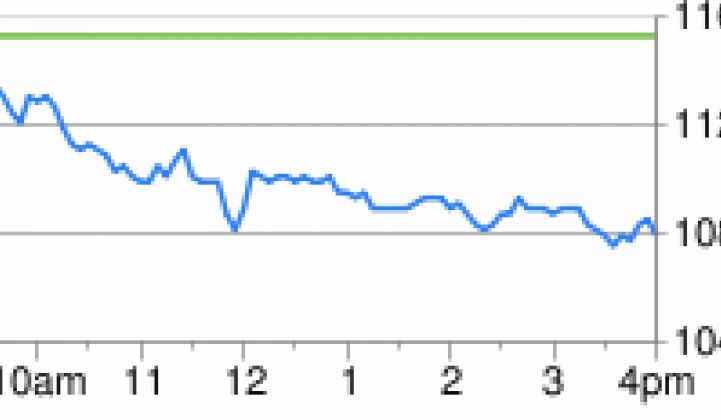

First Solar stock is down $3.01, or 2.8 percent in after-hours trading to $104.93; following a drop of $7.31, or 6.3 percent, to $107.94 in the regular trading day.

Trina Solar, operating in another technology (c-Si) and another country (China) revised its second-quarter guidance downward: Trina expects second-quarter shipments to range from 395 to 397 megawatts and predicts gross margins of 17.0 percent to 17.5 percent. Prior guidance was for 430 megawatts to 450 megawatts in shipments and low-20-percent overall gross margin. Shipment guidance for full-year 2011 was maintained at 1.75 gigawatts to 1.80 gigawatts, according to a release from the firm.

On the other hand, Yingli (NYSE: YGE) expects its solar module shipments for the second quarter of 2011 to increase by the range of 35 percent to 37 percent quarter-over-quarter, compared to its previously provided guidance of a more than 30 percent.