First Solar, Inc. (Nasdaq: FSLR) is full of surprises lately. And Wall Street usually doesn't like surprises. Yesterday saw the sudden announcement of CEO Rob Gillette leaving the firm. The CEO transition was carried out in a surprisingly (especially for the usually predictable First Solar) sloppy manner.

Today, the leading thin film solar panel manufacturer early-announced its financial results for the third quarter of 2011.

Net sales were $1,006 million in the quarter, an increase of $473 million from the second quarter of 2011. Quarterly net sales increased from $798 million in the third quarter of 2010.

But 2011 guidance is another story.

Last quarter First Solar cut 2011 revenue guidance to $3.6 billion to $3.7 billion and expressed optimism about the second half of this year. Rob Gillette, the now-former CEO of First Solar, said in the earnings statement: “We expect stronger performance in the second half of 2011 as we build projects from our systems pipeline, develop promising new markets, execute our cost reduction roadmaps and continue to improve module efficiencies.”

But guidance for the year has now been cut to net sales of $3.0 billion to $3.3 billion. Ouch.

With respect to Rob Gillette's departure, Ahearn, First Solar founder and current CEO replacement, said, “We thank Rob for his service, but the Board of Directors believes First Solar needed a leadership change to navigate through the industry turmoil and achieve our long-term goals.”

Vishal Shah of Deutsche Bank Equity Research has a "hold" rating on the stock which is actually up 13 percent from yesterday's plummet. Shah wrote, "Although the rationale may make sense, investors are likely to still question the timing of the announcement and the way this news was handled. Besides, there is no CEO succession plan and finding a new CEO in this environment could prove to be challenging," adding that it's "still too early to buy."

Shah wonders, as does the rest of the solar world:

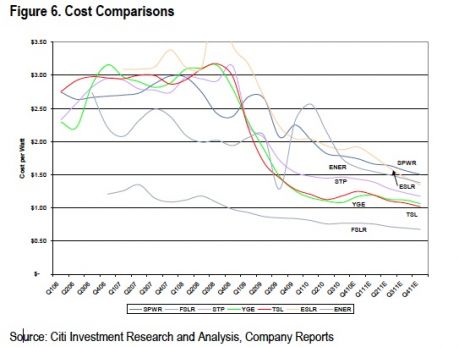

- Whether the company can achieve a $0.55 per watt cost target at a 14 percent module efficiency in order to keep ahead of Chinese crystalline silicon.

- What is the outlook of CdTe technology in a $20 to $25 per kilogram poly price environment?

****

Just last week I watched a confident Robert Gillette speak at Solar Power International in Dallas about First Solar's successes and job creation.

Today he announced that he is no longer serving as CEO of the solar industry's largest PV module company by market share, First Solar (NASDAQ: FSLR), largest by market cap for the time being.

The company's founder, Mike Ahearn, will serve as interim Chief Executive Officer.

Credit Suisse notes that "Today’s abrupt announcement is disconcerting, we have never quite seen a CEO departure announced in this manner in our universe."

Lazard Capital has downgraded the stock to "neutral" from "buy."

Deutsche Bank cites "reports indicated that negotiations of sale of Topaz project to Enbridge fell through."

Citi notes that "Mr. Gillette has been CEO since Sept. ’09 and since that time, only one of the top six corporate officers listed in the 2008 10K (the General Counsel) remains at the company, highlighting the significant management overhaul the past several years. Layoff may be coming -- our work suggests FSLR may be facing a layoff of up to 10% owing to the reality that it may have to run factories at less than full utilization during the next several quarters. This, in part, may have led to the management change."

Morgan Stanley notes, "We believe that Robert Gillette's unexpected departure is likely a troubling sign of things to come. Unfortunately, the company does not plan to give out any details about the departure until it reports Q3 results on November 3rd. This announcement is a complete surprise to us given that Gillette was upbeat at last week's Solar Power International Conference and was planning to meet with investors with all leading members of management on November 15th. We believe the uncertainty regarding the departure and the abrupt nature of the announcement will lead to negative speculation regarding the company's fundamentals. FSLR's customers may be currently struggling. A call that we had with a leading European trader today suggested that several downstream solar companies, which may include FSLR customers, have violated their bank covenants."

The news sent shares of First Solar down more than 24.5 percent on Tuesday to $43.22.

First Solar is headquartered in the U.S. with global manufacturing sites. The Walton family were investors in the company early in its existence.

Last week saw a claim by SolarWorld that Chinese module firms are dumping product in the U.S.

First Solar announces its third quarter earnings next week. It should be an interesting call.