Rob Gillette, the CEO of First Solar, just announced the following in their Q4 earnings call.

- Q4 net sales of $610M

- 2010 net sales $2.564 billion, up 24 percent year-on-year

- Net income of $664 million for 2010

- Q4 production was 395 megawatts and 1.4 gigawatts in 2010

- Module manufacturing cost of $0.75 per watt in Q4

- Fourth quarter gross margin was 48.7 percent

- 11.6 percent conversion efficiency, up half a percentage point versus a year ago

- "2010 was a good year."

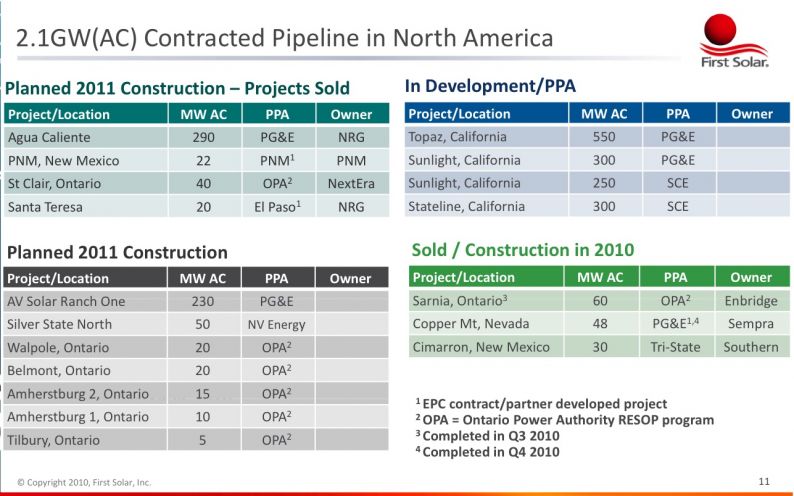

Q4 Performance Summary -- completed 138 megawatts AC of projects

- 80-megawatt Sarnia

- 48-megawatt Copper Mountain

- 30-megawatt Cimarron

2011 Guidance

- Net sales: $3.7 billion to $3.9 billion

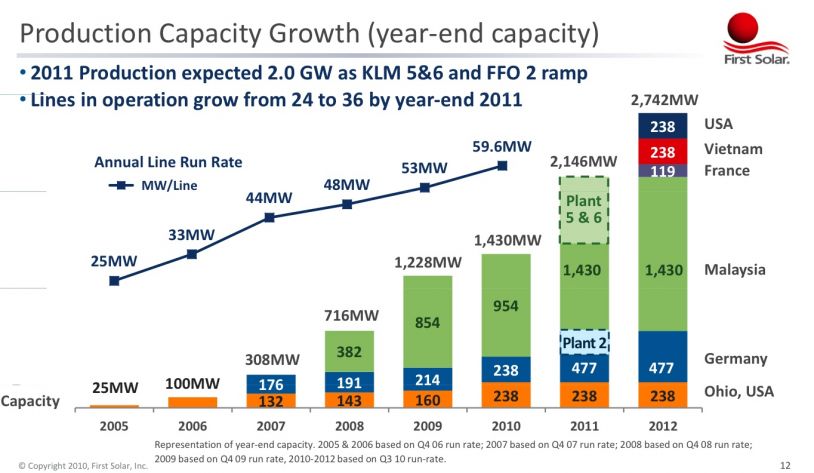

- 2.0 gigawatts of module production

- Consensus analyst market forecast of 17.6 gigawatts in 2011 with 2.4 gigawatts in North America

- 2.9 gigawatts of capacity by end of 2012

- Expects to grow efficiency 0.5 percent per year

Market overview

- Europe: Active discussions by several governments on accelerated FIT digression and potential caps

- US: ITC extended 1 year and DOE project funding beginning

- US: PPA prices declining toward peak grid parity

- Canada: local content requirements eliminate future market viability

- China: 20-gigawatt goal by 2020 but challenging economics impact project realization

- India: 22-gigawatt goal by 2022 -- high cost of capital constrains growth and drives price pressure

Questions on the minds of equity analysts

- Can the growing North American market offset the slowdown in European growth? What will be the impact of fading European policy support for large ground mount project? What about the impact of local content requirements in new growth markets such as Canada and India.

- Is the profitability level of the systems business sustainable in the longer term? (U.S. utility economics are currently better than European economics because of attractive PPAs and low-cost DOE financing.)

- Can project economics remain attractive in a low PPA/high financing cost environment?

- What is the likelihood of EDF Energies Nouvelles getting approval to build a 261-megawatt project in France (near Beaucaire in the Provence region) using FSLR modules. This would be a module sale (rather than a system sale) for First Solar and could translate into $260 million to $400 million in revenue between 4Q11 and 2013.

First Solar stock is currently trading at $165.42, up 1.5 percent. The firm has a market cap of $14.18 billion.

Representatives of First Solar will be speaking at Greentech Media's Solar Summit next month. More details here.

_797_616_80.jpg)