The full value of aggregating distributed energy resources on the grid is still unknown in the U.S.

Distributed resources have the potential to be an affordable and reliable grid player. But market, regulatory and infrastructure challenges remain. These challenges make it difficult to know the full impact of these resources to both consumers and operators. Even so, a patchwork of programs managed by independent system operators (ISOs) and regional transmission organizations (RTOs) can be found across the U.S. that indicate how future opportunities and benefits may materialize.

In GTM Research’s U.S. Wholesale DER Aggregation, Q2 2016 report, a summary of recent programs illustrates the value of wholesale distributed energy resource (DER) aggregation. Some of the highlights include:

- California Independent System Operator is leading the pack in regulatory and market transformation. “At the grid edge, DER aggregation creates an increasingly complex operational environment for the distribution grid, and in turn for the management of the bulk power system. With regulatory and market design change, the CAISO is using DERs to innovate across the value chain,” said Elta Kolo, a GTM Research grid edge analyst and author of the report.

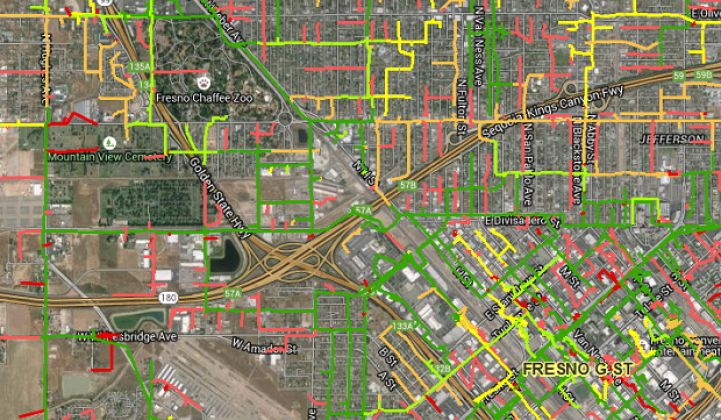

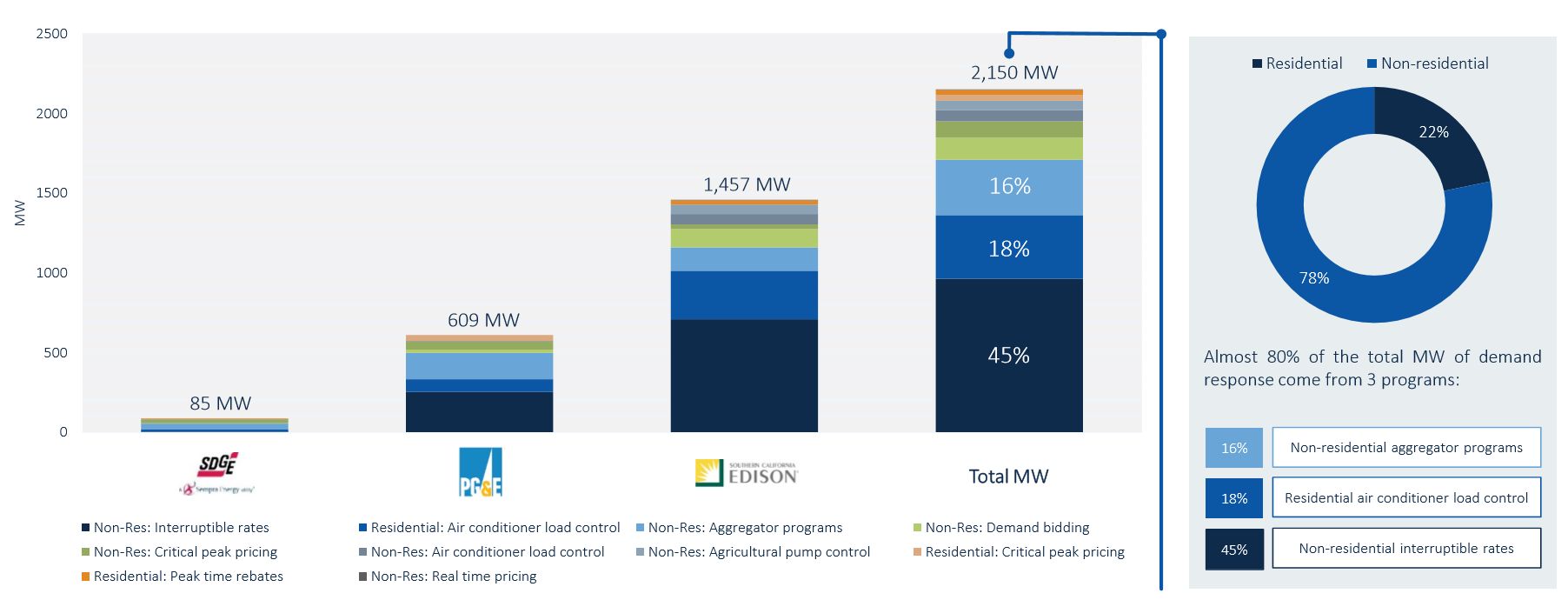

FIGURE: CAISO 2015 Demand Response Capacity by Program Type

Source: California Public Utilities Commission

CAISO is unique in its attempt to make demand response load-modifying resources and supply-side resources available in the wholesale market by 2018. Thus far, it has succeeded in integrating almost 70 percent of the total investor-owned utility (IOU) demand response that was available and utilized in 2015 at a wholesale level. The recent FERC approval of the Open Access Transmission Tariff to facilitate participation of aggregated DERs represents a crucial step toward redesigning power market rules to accommodate ongoing changes on the distribution grid.

-

As the current leader in market development, PJM has made headway in integrating stringent capacity performance rules that mandate demand response resources be available year-round. This push toward a single, year-round capacity performance product has made a clear impact on the capacity market. In late May 2016, the capacity auction cleared the lowest demand response capacity of the last five auctions, totaling approximately 10.4 gigawatts. Despite the impact to the capacity market, the rules are a step forward for enhanced integration of demand response.

-

Texas' ERCOT hosts the most competitive retail environment in the country, making it an attractive market for third-party aggregators to provide service flexibility to customers of all sectors. The recent dismantling of the Distributed Resource Energy and Ancillaries Market (DREAM) task force signaled the RTO’s transition from evaluation of high-level concepts to technical details of distributed resource integration.

- Due to regulatory barriers across the majority of states in its territory, the Midwest's MISO lags in demand response aggregation of distributed resources. When compared to the previous year, demand resource availability dropped by nearly 50 megawatts and behind-the-meter generation dropped by 250 megawatts in the most recent capacity auction. Small steps are underway in MISO with the approval of the first-ever battery storage connection and the redesign of the capacity auction mechanism in competitive retail areas.

Each quarter, GTM Research’s Wholesale DER Aggregation report provides an update on ISO and RTO programs, capacity markets and regulatory initiatives. For more information on the report, please click here.