Yesterday, the final ruling on solar panel trade tariffs came down from the Department of Commerce.

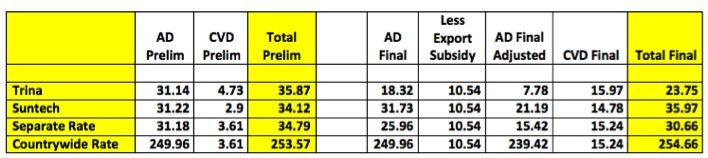

Subject to ITC approval in November, the final determination kept the same scope, lowered the tariffs for some vendors and raised the tariff slightly for Suntech. Trina's number went down compared to the preliminary numbers. CASE did the math and shared the following table.

Barclays, an investment bank, agreeing with the findings of GTM Research, noted:

- "Overall, we view the broad affirmation of the preliminary ruling by the U.S. DOC as in-line with expectations."

- "Despite the fact that the DOC's ruling is now finalized, we believe the 'trade war' cloud will continue to linger over the sector as both the EU / China investigation as well as China's response (i.e., its own investigation into U.S. / EU polysilicon suppliers) have yet to be completed."

- "Given that rates stayed broadly in-line (adjusting for rate changes and cash deposit requirements, both Trina Solar and Yingli are expected to pay less than what was originally stipulated) and the DOC did not agree to broaden the scope of the investigation (i.e., the rates only apply to solar cells manufactured in China), we see limited changes to various company strategies. Specifically, most companies in our coverage universe have begun to accrue costs associated with AD/CVD tariffs as well pursued means to circumvent the tariffs (i.e., cell assembly outside of China). Thus we believe the lack of an incrementally negative outcome will likely be viewed as a near-term positive for Chinese Solar names."

The Coalition for American Solar Manufacturing (CASM) "welcomed" parts of the U.S. Department of Commerce announcement, "but was very disappointed with other parts." The disappointment stems from Commerce "not altering its preliminary determination on the product scope, which covered PV cells produced or assembled into panels in China but not panels made from cells produced in third countries. SolarWorld’s initial, broader scope had covered all cells and panels produced in China. This decision, according to CASM, leaves a significant loophole in the final ruling as it allows Chinese manufacturers to potentially avoid the duties by using non-Chinese cells in its solar panels." SolarWorld has signaled that it intends to block the "evasive" measures taken by the Chinese, according to Bloomberg.

According to Platts, "eight members of Congress on Thursday urged the U.S. Department of Commerce to close a loophole in its tariffs on Chinese solar panels that allows Chinese manufacturers to skirt the penalties by simply outsourcing the production of photovoltaic cells." Sen. Jeff Merkley, a Democrat from Oregon, where SolarWorld is based, said, "I fear that the action does not go far enough in addressing the loophole allowing Chinese companies to duck the tariff by moving a small part of the operation overseas," adding, "We need to close that loophole and ensure that American workers and businesses are playing on a level field," as quoted in the Portland Tribune.

Yingli Green Energy (NYSE: YGE) would be subject to an anti-dumping tariff of 15.42% (after the required reduction in the rate to avoid double counting of anti-subsidy tariffs), and an anti-subsidy tariff of 15.24%. These rates are lower than what was proposed in the preliminary decision. "Throughout this entire proceeding, we have defended ourselves and the U.S. solar industry and we are grateful to our loyal customers, suppliers, partners and their employees who have united in our defense," said Robert Petrina, Managing Director of Yingli Green Energy Americas. "We are looking forward to getting back to our daily business, focusing on innovation and outstanding customer support."

Tom Gutierrez, CEO of GT Advanced Technologies, said, "We are concerned this ruling will have a negative effect on the U.S. solar industry. In our view, the tariffs do nothing but threaten to spark a solar trade war with China, a key U.S. economic partner. These sanctions will only make it more difficult for U.S. entrepreneurial companies like GT to export solar products abroad and will ultimately result in a loss of American jobs."

Trina Solar Limited (NYSE: TSL) received a combined effective net rate tariff of 23.75 percent, comprised of AD duties of 18.32 percent and CVD duties of 15.97 percent, of which an export subsidy of 10.54 percent is subtracted from the AD duties calculation to avoid double application. Trina Solar continues to actively defend its position before the International Trade Commission ("ITC"), which in November of 2012 is expected to make separate determinations of economic injury as well as critical circumstances before the AD/CVD duties can be imposed. "While we disagree with the Department of Commerce's conclusions in this case, we will abide by their decision and look forward to the ITC's final ruling on this issue in November," said Jifan Gao, Chairman and Chief Executive Officer of Trina Solar.

Canadian Solar (Nasdaq: CSIQ), received a ruling of anti-dumping duties (AD) of 15.42% and countervailing duties (CVD) of 15.24% on c-Si PV cells made by Canadian Solar in China. The DOC also confirmed the scope of the trade investigation was limited to silicon photovoltaic cells made in China whether or not they are assembled into modules, and upheld its opinion on critical circumstances which imposes retroactive CVD/AD up to 90 days from the date of the preliminary determinations. "While we are disappointed with the DOC final determination, we will continue to defend our position with the ITC ahead of its final determination in November. We will also remain committed to the U.S. solar energy market, leveraging our global supply-chain to provide fairly priced solar energy solutions, to support our employees, partners and customer base," said Canadian Solar CEO Dr. Shawn Qu.

We've written on some of the collateral damage and unintended consequences caused by the ruling and critical circumstances to vendors building products such as small PV-powered lamps for the third world. It appears from the following passage that Commerce excepted those types of products:

"Also excluded from the scope of these investigations are crystalline silicon photovoltaic cells, not exceeding 10,000 mm2 in surface area, that are permanently integrated into a consumer good whose function is other than power generation and that consumes the electricity generated by the integrated crystalline silicon photovoltaic cell. Where more than one cell is permanently integrated into a consumer good, the surface area for purposes of this exclusion shall be the total combined surface area of all cells that are integrated into the consumer good."

And finally, Shayle Kann, the VP of Research at GTM Research, notes, "The ITC still has to make its final determination in November on the issue of injury. If the ITC determines that there was no injury, the whole case is thrown out. So whatever DOC determines today should still be considered somewhat preliminary until then."