Reliability and resilience became buzz words this year following three successive hurricanes in the Gulf of Mexico and the Southeastern United States, and the release of the Department of Energy’s high-profile grid study that named reliability and resilience as priorities in the face of extreme weather.

Following the hurricanes, stories emerged of microgrids enabling buildings to keep their power on. Many of these were basic microgrids, noted Colleen Metelitsa, grid edge analyst and lead author of a new report from GTM Research, U.S. Microgrids 2017: Market Drivers, Analysis and Forecast.

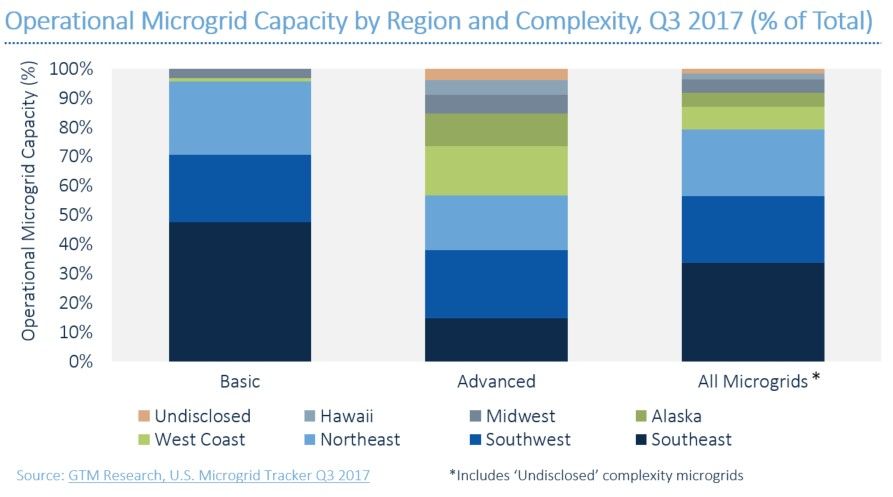

Basic microgrids -- differentiated from advanced microgrid systems because they have only one distributed energy resource (DER) technology, typically a gas or diesel generator -- make up the majority of the microgrid market in Florida and Texas.

Like an advanced microgrid, basic microgrid generators and controls must be able to provide both power and energy services when in grid-connected or island mode, and be able to island for at least 24 hours.

This year, GTM Research expanded its data collection effort and microgrid definition to capture a wider group of resilient distributed energy systems. This led to the addition of over 1,500 basic microgrids to its microgrid tracker. (The data is part of the GTM Research Grid Edge Data Hub.)

Basic microgrids represent 64 percent, or 224 megawatts, of the total installed and planned U.S. microgrid capacity for 2017. They also contributed 204 megawatts of capacity to a growing commercial market this year.

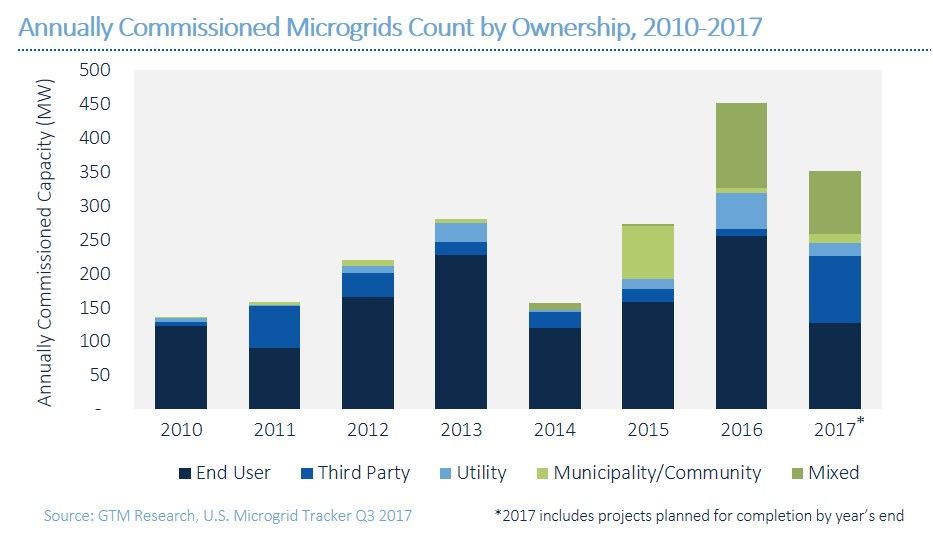

Overall, commercial microgrids have experienced 102 percent growth since 2016, buffering overall commissioned capacity for the year, given that the military and university microgrid markets nearly vanished following a banner 2016.

Basic microgrids have been a foundational aspect of the microgrid market going back to the mid-2000s.

“Basic commercial microgrids will remain an important component of the market, but they will face increasing competition from more advanced solutions that provide fuel diversity and more energy and demand management controls,” said Metelitsa. Commercial microgrids are positioned for growth as business models are refined and declining costs improve project economics, according to the report.

Research and development, state funds, and renewable energy mandates in the Northeast and on the West Coast are creating a fertile ground for more advanced systems. State-level action has been particularly influential. Since 2012, approximately $275 million has been announced and/or awarded by states to conduct feasibility studies, design or build microgrids.

“State-level microgrid funds tend to focus on community-based solutions, which often involve more advanced systems and multiple technology types," said Metelitsa. "With many of these microgrids expected to come on-line in the 2018 through 2020 timeframe, their impact on the market will continue to evolve."

***

GTM Research’s annual report on the U.S. microgrid market pulls from its database of over 1,900 operational and planned microgrids; the report provides an analysis of multiple dimensions of the market landscape, such as fuel supply, ownership and end-user type, and location. Learn more about the report here.