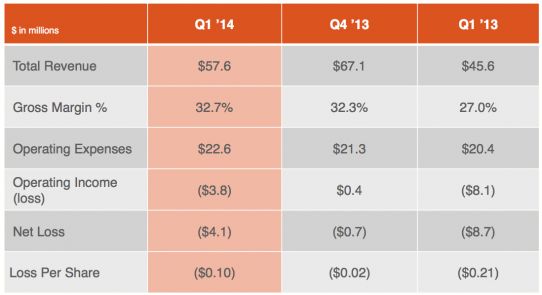

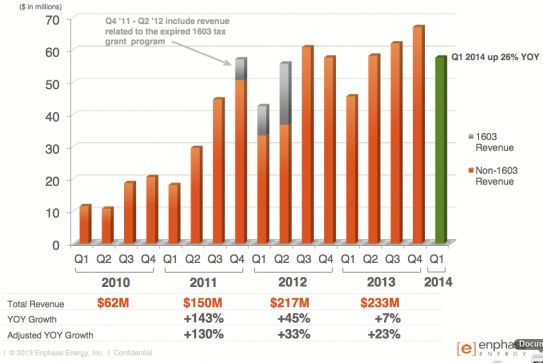

Microinverter maker Enphase Energy posted its first quarter results with revenue of $57.6M, up 26 percent year-over-year, having shipped 423,000 units for a gross margin of 32.4 percent. It was the best first quarter revenue in the firm's history. GAAP net loss was $6.2 million for the Q1. Enphase's CFO noted that a switch to Fair Value accounting for warranty obligations accounted for "approximately one point of gross margin improvement."

Fourth-generation microinverters comprised 70 percent of this quarter's shipments for the firm.

The company is expanding into Australia and had some strong growth in the U.K. The U.K. installed 1.1 gigawatts of solar in the first quarter, according to PV-Tech. Adam James, analyst at GTM Research notes that the U.K. market has been driven by a step-down in the renewable obligation certificates, or ROCs. The analyst believes that though the U.K. does not have ideal conditions for building solar, in a solar-fatigued EU, the U.K. is the place to be in 2014.

For the full year of 2013, Enphase's total revenues were $232.8 million representing 355 megawatts (AC) or 1.6 million microinverters. GAAP gross margin for the year was 29.0 percent and GAAP net loss for the year totaled $25.9 million.

Enphase noted that it had filed a shelf registration for "a secondary offering of up to 5 million shares held by our current stockholders" in order to provide liquidity to its early stage equity investors. Enphase will not sell any shares and will receive none of the proceeds, according to the CFO. Here's the S3 form.

Nahi noted that the firm had a close relationship with HECO, Hawaii's utility, and was working with the utility to understand how to mitigate the grid impacts of renewables.

Guidance for Q2 2014

Guidance for the second quarter:

- Revenues for the second quarter within a range of $69 million to $73 million.

- Gross margin within a range of 30 percent to 33 percent.

Where is the microinverter competition?

When asked the quarterly, "Where is your competition?" question, the CEO said that the real competition was primarily from string inverters. Within the microinverter segment, however, Nahi said that competitors have not gotten "any sign of traction."

Enphase Q1 2014 financial results:

Record revenue for a first quarter at the firm:

GTM Research notes that over half of U.S. home solar systems used microinverters or DC optimizers in 2013. Learn more in the latest GTM Research microinverter and DC optimizer report. Within the greater module-level panel electronics market, Enphase and SolarEdge (SolarCity is a customer) are the dominant players, with Tigo ranking third, according to GTM Research's MJ Shiao.