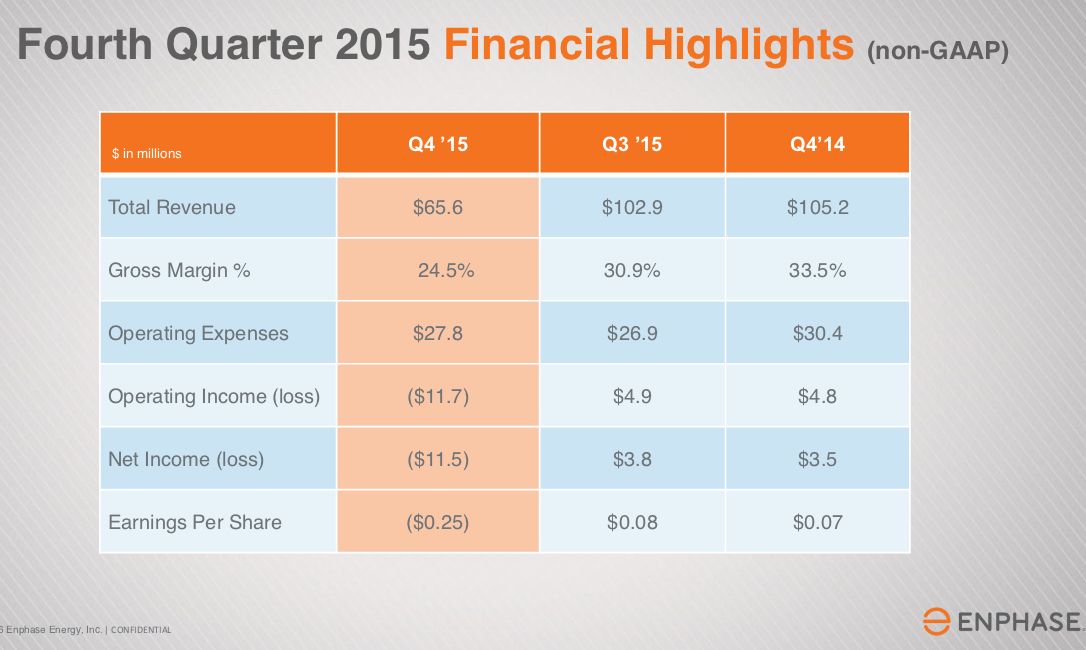

Microinverter pioneer Enphase reported its fourth-quarter and 2015 financial results. The company's revenue of $65.6 million was in line with a soft outlook of $62 million to $70 million.

CEO Paul Nahi remarked in a release: “2015 was a challenging year for Enphase. However, we continued to grow our revenue and megawatts shipped on a year-over-year basis."

It's a transitional time for the company as it looks to move from being a microinverter specialist that must furiously cut costs to a multi-product energy company (that must furiously cut costs).

Q4 and 2015 results

-

Revenue of $65.6 million for the quarter, $357.2 million for the year.

-

16 percent of Enphase business for the year was international, driven by Australia.

-

The company shipped 129 megawatts (AC), representing 547,000 microinverters in Q4. It shipped 3.1 million microinverters in 2015 for a total of 706 megawatts.

-

Gross margin for 2015 was 30.6 percent; gross margin for the quarter was 23.9 percent.

-

GAAP operating loss for the fourth quarter of 2015 was $15.2 million. GAAP net loss for 2015 totaled $22.1 million.

-

The 10-millionth microinverter shipped, representing more than 2.5 gigawatts of Enphase systems. (Competitor SolarEdge just shipped its 10-millionth optimizer.)

“Revenue for the fourth quarter of 2015 was impacted by the reduction of inventory levels in our channel, which have now returned to normalized levels,” said Kris Sennesael, CFO of Enphase. “We also reduced our operating expenses in the second half of 2015 to accommodate our lower gross margin profile.”

Enphase's new fifth-generation bidirectional microinverter with "advanced grid functions" has started shipping.

Q1 2016 Guidance

The company expects first-quarter 2016 revenue in the range of $63 million to $69 million with a gross margin of 18 percent to 21 percent.

Oppenheimer Equity Research notes, "As ENPH works toward its Gen 5 product introduction, it is clear the company’s share loss is putting increasing pressure on the platform. Management notes its use of price as a lever to drive sales and its intent to continue to do so after seeing some regain of share in 4Q:15 and first part of 1Q:16. We would expect this dynamic to create increased working capital challenges despite its revolving line of credit still being intact. With ongoing losses and a commitment to maintaining share, we are stepping to the sidelines as price pressure has the potential to create difficulties with the balance sheet. We remain bullish on the technology potential and would look for margin stabilization before upgrading."

Solar analyst Scott Moskowitz of GTM Research said, "Enphase's fourth-quarter results show commitment to its cost reduction strategy. Going forward, Enphase cannot miss on its cost targets, and even if it stays the course, winning market share back will not be easy. Inverter pricing in the residential market remains aggressive and will continue to fall in 2016 as many of Enphase's competitors also bring lower-cost products to market."