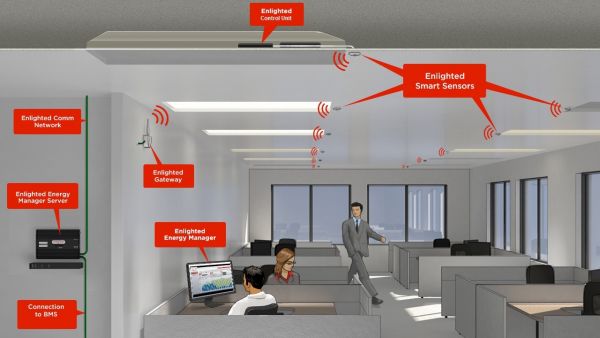

LED lighting fixtures could well become the nodes of ubiquitous wireless connectivity for the office buildings, warehouses, parking lots and other spaces they’re being installed in around the world. At least, this describes the internet-of-things plans of most of the companies in the networked LED business today, including Sunnyvale, Calif.-based Enlighted.

Last week, Enlighted announced it has raised a $25 million Series D round to help bolster those plans. New investor Tao Capital joined previous investors Kleiner Perkins, RockPort Capital Partners, and Draper Fisher Jurvetson in the round, which brings the startup’s total venture financing to about $80 million.

Enlighted also announced a new $20 million line of credit from Square 1 Bank, a division of Pacific Western Bank. The credit line is meant to provide capital to bridge the gaps between bank financing and customers for Enlighted’s Global Energy Optimization (GEO) program, which offers low-upfront-cost installations to its corporate customers.

“We’ve been homing in on that strategy -- in my opinion, that's the only way we’re going to scale this portfolio,” CEO Joe Costello said in a Friday interview. “Going a building at a time is too slow.”

While LEDs tend to provide high and predictable energy savings for most buildings, ranging from 50 percent to as high as 90 percent, payback times on LED projects can range widely, from about two years to as many as 10 years, he said. But bundling multiple buildings into a portfolio through its GEO program can allow Enlighted to get its LED nodes into more real estate, according to Costello.

That, in turn, can expand the range of buildings that can afford Enlighted’s sensor nodes, he said. Since late 2014, the company has grown the share of built space using its LED-connected sensor and control nodes from about 45 million square feet to more than 100 million square feet today.

“It’s a fortunate happenstance that the money you save allows the sensors to be installed,” Costello said, because it brings the opportunity to bring new applications to bear across a wider array of customer building space. In October, Enlighted launched the first two non-lighting apps to run over its networks -- Aire, to provide its ceiling sensor data for building HVAC optimization, and Space, to track and plan better building utilization.

Using Enlighted’s sensors to track where people are in a building throughout the course of the day can help building facility managers fine-tune their HVAC operations, he said. The energy savings aren’t as great as they are for lighting, he added -- “You can probably save, on average, over time -- about 30 percent. But you use two to three times more energy on HVAC than you do on lighting, so the net energy savings will probably be similar.”

At least, that’s the theory. So far, Enlighted’s Aire application has primarily provided data to building owners, who may or may not act on the insight it delivers. “The truth is, most people don’t know what to do with the data, so we’re actually building more of that” capability in-house, he said.

Many companies are using this kind of data to improve heating and cooling energy use, whether through sensors embedded in lighting fixtures or other locations, or by allowing employees themselves to provide data on where they are and how comfortable the temperature is. Oakland, Calif.-based startup Building Robotics has actually taken that initial approach with its Comfy app, and expanded it to include lighting data in partnership with CommScope’s Redwood Systems, Intel, Lutron and View.

Enlighted’s second application, Space, is centered on using the same building occupancy and usage data and applying it to planning for its most efficient use. “This is the first time that people have had real-time data that accurately tells them how their buildings are being used,” he said. The applications for this data could range from tracking workflow in a warehouse, to better planning the use of flex-work facilities, he added.

“We’re got a few more apps that are in beta right now,” aiming for release in the second quarter of 2016, according to Costello. One is asset tracking, using Bluetooth sensors in key pieces of equipment to find misplaced hospital equipment or shipping containers, for example, he said.

Others in the networked LED business are also pursuing these kinds of opportunities. Digital Lumens, which networks LEDs primarily for warehouses, food processing facilities and other large-format spaces, is looking at using its sensors for building security and asset tracking, Kaynam Hedayat, the company’s vice president of product management, said in a recent interview.

Boston-based Digital Lumens, which has raised about $65 million in venture financing, has also introduced an automated safety testing application, to allow for remote testing of emergency lights and other critical systems, and has built an app to allow different employees to have different levels of control over building LEDs through their smartphones, he said.

About half of Digital Lumens’ business is outside the United States. Enlighted, which has about 75 percent of its lighting systems in office buildings, is also targeting international markets with its new financing, primarily Europe. While it hasn’t named any customers yet, Costello said it has some significant projects underway in the U.K. accounting for about 1 million square feet, a few hundred thousand square feet of projects in France, and a smaller pilot project in Germany.