There has been a lot of discussion lately about a manufacturing renaissance in the United States. There's also been an interesting related discussion about U.S. energy intensity.

Years of offshoring and plummeting employment have given way to a small rebound in domestic industry. Behind the scenes, more companies are relocating their manufacturing facilities back on American soil, citing increasing domestic labor productivity and rising wages in China. Adding to the debate, the recent shale gas boom may or may not play a leading role in sparking this renaissance by providing cheap fuel and feedstock to key industries.

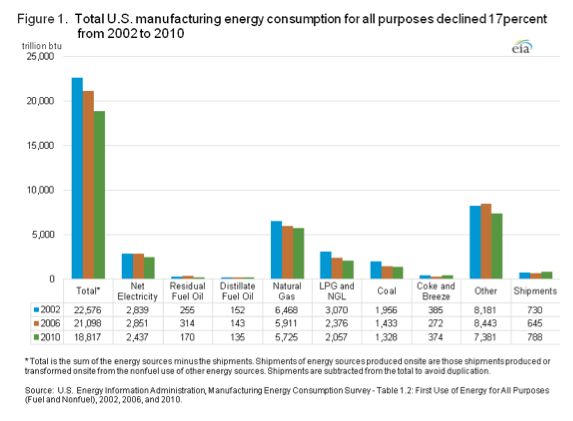

The manufacturing sector is also notoriously energy-intensive, taking in massive amounts of energy for both fuel (electricity) and feedstock. However, this may be changing, according to recent analysis from the Energy Information Agency, which indicates that the energy intensity of manufacturing has actually been steadily declining since 2002. The new Manufacturing Energy Consumption Survey shows that, while total manufacturing output has declined by 3 percent, total manufacturing energy consumption has declined by a dramatic 17 percent. This means it has taken less energy overall to create each unit of output.

Some aren't convinced that the energy intensity metric is the most appropriate measure of economic efficiency. But the data do show the manufacturing sector reduced energy consumption faster than it reduced output. So would a major increase in U.S. manufacturing undo these gains?

A Closer Look at Energy Intensity

It’s too easy to point out that more manufacturing would equate to more energy consumption. To really get a grip on the question, we have to understand what the levers in energy intensity are, since the conditions that created lower energy intensity over the last ten years may continue in the midst of a manufacturing renaissance.

The EIA points out three different drivers for lower energy intensity over the last ten years: industrial efficiency gains, changes in manufacturing output, and the net reduction of fuel consumption.

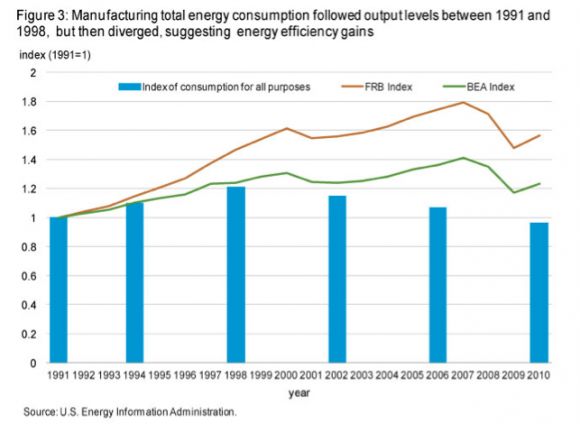

Let’s first look at industrial efficiency gains. One criticism would be that because total manufacturing output has also declined, lower energy consumption cannot be attributed to efficiency, as opposed to just making fewer things. The chart below addresses that problem, noting that energy consumption has historically tracked output, and has only recently diverged. This indicates that there is a new variable at play, namely, energy efficiency deployment.

There are a few good reasons for this. Energy-efficiency resource acquisition programs undertaken by utilities have helped. And as massive consumers of electricity with centralized controls, industrial customers are also particularly well suited to take advantage of demand response programs. Increased labor productivity (despite fewer workers) combined with the growth in output in some subsectors such as petroleum, coal, and food products, indicate that technological advances are adding to industrial efficiency. These kinds of dynamics will continue as best practices with a growth in manufacturing, albeit only offsetting a portion of increased energy consumption.

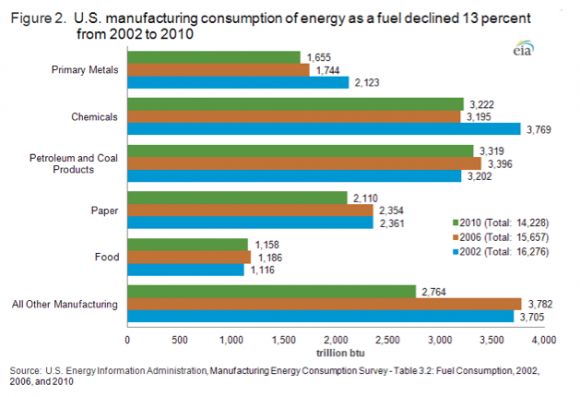

Decreased energy intensity can also be attributed to changes in manufacturing output. EIA posits that this mainly occurs when the growth of a less energy-intensive industry, like computer chip manufacturing, outpaces more energy-intensive industries, like chemical manufacturing.

This relates to EIA’s point about lower overall fuel consumption. The industries that grow during this manufacturing renaissance could influence net energy consumption. As the chart below shows, three of the four most energy-intensive subsectors -- chemicals, metal, and paper -- all saw reductions in fuel consumption since 2002. If demand rises again, it could be a different story.

The bottom line is that energy intensity is not guaranteed to stay at its current levels with a boom in manufacturing. Continued deployment of industrial efficiency and growth in low-energy subsectors could keep energy intensity relatively stable. But if cheap natural gas is fueling the resurgence, energy intensity is likely to rise.

***

Adam James is a Research Assistant for Energy Policy at the Center for American Progress and the Executive Director of the Clean Energy Leadership Institute. You can email him at [email protected] and follow him on Twitter @adam_s_james.