Huge savings could come with the just-agreed-on plan from PacifiCorp and the California Independent System Operator Corporation (the ISO) to work together on a new energy sharing market.

The new Energy Imbalance Market (EIM) is designed to increase power delivery reliability and put more renewables into both systems’ energy mixes.

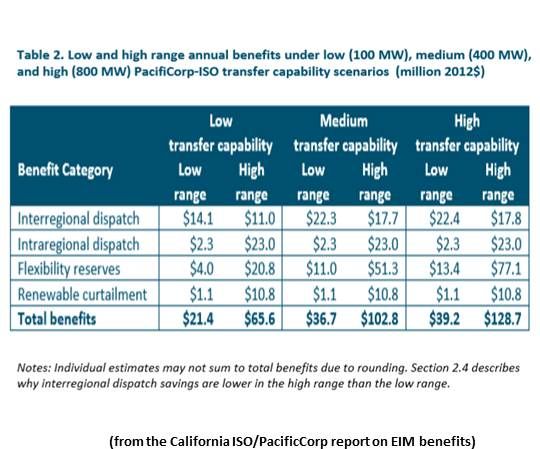

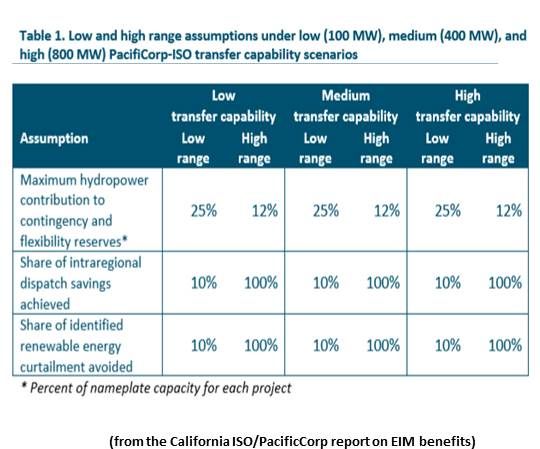

The range of estimated benefits for the year 2017 from the PacifiCorp-California ISO Energy Imbalance Market, according to a study by the Energy and Environmental Economics (E3) research group, “is $21 million to $129 million.” The range of costs for setting up the EIM, E3 reported, is “$3 million to $6 million, with an estimated annual cost of $2 million to $5 million.”

PacifiCorp (PINK:PPWRP) is owned by renewables investor MidAmerican Energy, which is a utility subsidiary of Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A). The firm controls two balancing authorities covering portions of six Western states.

California’s ISO operates the only advanced energy market in the Western Interconnect region. Like much of the Northeast, Midwest and Canada, the ISO’s real-time, IT-optimized market automatically balances electricity deviations every five minutes by choosing the least-cost resources available.

The two system operators just signed a memorandum of understanding (MOU) “to work toward creating an energy imbalance market by October 2014,” according to MidAmerican Energy Holding Company VP Jonathan Weisgall.

This EIM “would allow both parties to improve dispatch efficiency and take advantage of the diversity in loads and generation resources between the two systems,” the E3 study reported. This would reduce production costs, operating reserve requirements, and renewable generation curtailment.

A PacifiCorp-California ISO EIM’s four main benefits, according to E3, would be:

- Five-minute interregional dispatch would reduce transmission charges and ease present impediments to energy trading between the two systems;

- PacifiCorp could cut its generators’ dispatch costs by allowing them to work through California’s automated nodal system, making their use of transmission more efficient;

- Aggregating the two systems’ load, wind, and solar variability and forecasting would cut their need for costly flexibility reserves;

- More system speed and flexibility would reduce curtailment of renewables by allowing operators to dial down fossil sources or export excess renewable generation.

“EIMs combine the ability to have a large balancing area and get the benefits of geographic diversity with fast dispatch. Those are individually the two most effective grid operating practices,” explained American Wind Energy Association Transmission Policy Manager Michael Goggin. “Combining them in an EIM is the single most effective way to reduce integration issues with wind and make the grid work more efficiently.”

The fundamental issues are likely more or less the same with integrating solar, Goggin added. “Grid operators who use efficient operating methods are finding it is no more of a challenge or cost than wind.”

The 39+ electricity delivery systems in the West outside California, including PacifiCorp, presently manage deviations with manual dispatches and a system of reserves.

Some veterans of grid operations have suggested EIMs are too expensive and too difficult to implement, but Goggin said the California ISO-PacifiCorp EIM can easily be in operation on schedule. “There is no need for new infrastructure that doesn’t exist. There is some startup and operational cost, some investment in software and hardware upgrades, but, relative to the benefits, it is minimal.”

Xcel Energy (NYSE:XEL), which serves 3.4 million electricity customers in eight states from Texas to Wisconsin and North Dakota and has had more than 50 percent wind on parts of its grid at times, is working on similar energy sharing markets with its neighbors, according to its Director for Market Operations Stephen Beuning. Achieving their goal of reaching a definitive agreement by April will be “challenging for the California ISO and PacifiCorp," he said, but “their EIM is a positive development for improved generation dispatch efficiency, integration of renewables and grid reliability management.”

Some two-thirds of the U.S. energy supply in the East and Midwest is already optimized by EIMs, he added, adding that “we think the use of joint dispatch optimization will expand in the West.”

“When other balancing areas’ operators see the benefits, they will want to join,” Goggin said, “and the ISO and PacifiCorp have created provisions so that other entities can join at very low cost relative to the benefits.”

“If you have wider geographic areas sharing different plants, you can smooth variability,” Interwest Energy Alliance Southwest Representative Amanda Ormond recently told GTM. “An energy imbalance market allows dispatch of the lowest-cost resource to address energy imbalance when a load turns on unexpectedly.”

The West’s many balancing areas are presently relatively inflexible, Ormond said, “because they keep large amounts of energy in reserve to meet potential contingencies. And the last generators you turn on are typically the most expensive.” Without an EIM solution, Ormond said, more renewables will increase variability and the inefficiencies will become more costly. With an EIM, there is more flexibility.

The areas of the country that have efficient grid operating practices have integrated significant portions of renewables “very reliably at virtually zero incremental cost,” Goggin said. But in the West outside California, he added, many “are still not using efficient grid operating practices and they are seeing increased costs and challenges.”