SunEdison wrote the first U.S. power purchase agreement (PPA) in solar in 2004. It built the first U.S. and Canadian utility-scale solar projects and the biggest (72 megawatts) European installation. And, in 2010, its deal with First Reserve was the first solar development investment fund to top $1 billion.

SunEdison Distributed Generation General Manager Attila Toth says the next big thing in solar will be distributed generation (DG).

“For us, distributed generation means the commercial and industrial (C&I) sector and the public sector -- everything on the customer side of the meter,” Toth said. It also includes residential rooftops. “Everything that includes dealing with a customer, as opposed to dealing with a utility, is distributed generation.”

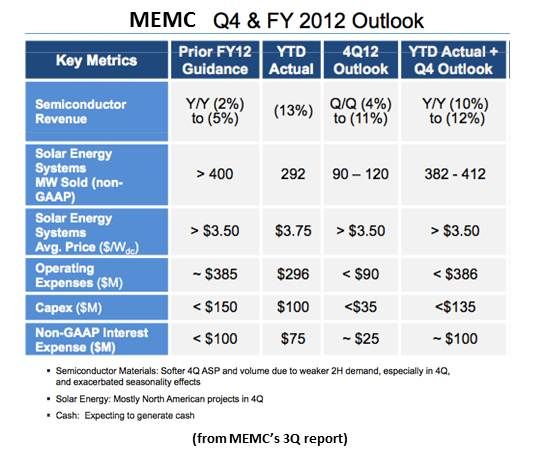

Wholly owned by MEMC (NYSE:WFR) since 2009, SunEdison believes, Toth said, “the solar business on the customer side of the meter will grow very quickly over the next few years, in the U.S. and internationally, because the economics make sense."

SunEdison operates and maintains solar on all the viable space at five California prisons. That's 18.4 megawatts of ground-mounted solar, progressively developed since 2006 for the California Department of Corrections and Rehabilitation (CDCR).

“If our solution didn’t make sense, the prisons would not sign with us,” Toth said. “And Kohl's and Wal-Mart would not sign with us.”

In its nearly one-gigawatt portfolio, SunEdison boasts an impressive array of national retailer’s roofs. “We have longstanding relationships with companies like Koh'ls, Wal-Mart, Whole Foods, and Staples. They provide us with their rooftop assets and we build solar systems,” Toth said. “The companies get the advantageous economics and the profile of an environmentally responsible corporate citizen.”

Toth said there are three things driving the emerging DG trend. “The first is grid parity. When I joined SunEdison in 2008, we paid close to $4 per watt for modules. We are now well below $1 per watt. That cost reduction has enabled solar to become very competitive with traditional generation sources.”

Island states like Hawaii and Puerto Rico, where imported electricity generation sources are expensive, are at grid parity now, Toth said. Solar-rich states will be there soon. “Grid parity doesn’t happen at the same time everywhere in a state. It happens in a normal distribution. When parts of California are there, towards the end of 2014, Californians will rely less on Governor Brown and more on the pure economics of solar."

The second driver is the fact that the renewable portfolio standards (RPSs) and financial subsidies on which utility-scale solar has depended are somewhat played out.

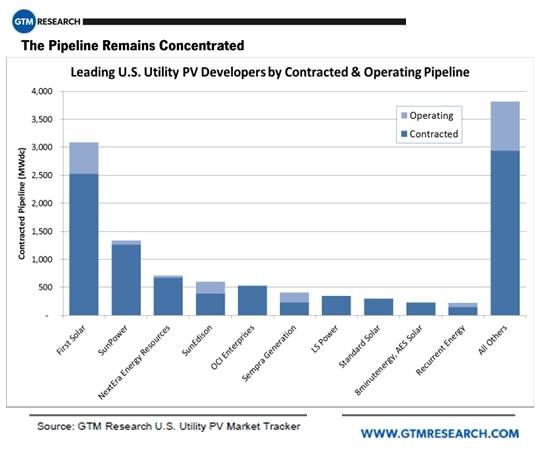

“Many utilities -- California is an example -- have met their RPS commitments for many years ahead," Toth said. SunEdison, he explained, will focus entirely on building the utility-scale projects in its own pipeline that already have PPAs and on acquiring companies with pipelines of projects that already have PPAs.

“On the utility side, our strategy is M&A-driven,” Toth said. “We made two big acquisitions over the past eighteen months, Fotowatio and AxioPower.” Both came with “significant existing pipelines” of utility contracted projects.

Source: GTM Research’s Q3 2012 U.S. Solar Market report

In DG, on the customer side of the meter, he said, “we have big opportunities for uncontracted megawatts of volume.” The company is gearing up for “an aggressive pursuit of government institutions, retailers and other commercial and industrial customers.”

The residential segment, Toth said, “is a hard nut to crack. I don’t think anybody in the United States has truly cracked it. What we are seeing is just an early start.” But SunEdison is “absolutely” thinking about expanding there against competitors like SolarCity, Sunrun and Clean Power Finance.

“We are working with partners to aggregate demand,” Toth said. “Having proven ourselves in the other segments, investors are coming to us, offering to raise funds with us and attack the residential segment.”

SunEdison is moving cautiously. “We want to make sure we approach the residential sector with a strategy that is truly scalable.”

Free choice, Toth said, is the third driver. “Customers no longer have to depend on incentives or pay high upfront costs. With third-party financing, very soon, on the customer side of the meter, it will be economically equivalent if they buy energy from a conventional source or from renewables such as solar. That free choice can have a big psychological impact. It will drive the trend toward distributed generation.”

Other benefits of DG, Toth noted, are that “you are producing energy where it is being consumed, so you don’t have to invest in transmission and distribution; you balance the grid; and you don’t have the ten percent energy loss that happens with electricity transmitted through the grid.”

Since the Solyndra bankruptcy, solar has been getting highly politicized “bad press,” Toth said. “But the economics, from the end user’s point of view, now make sense. It is not what it used to be twenty years ago. Solar is growing 25 percent to 30 percent, year over year, even in very hard economic conditions. Customers want distributed generation,” he added. “Now that the economics make sense, it will be a thriving business.”

***

Emerging Solar Strategies, Part 1: Centrosolar America; “The entire sales cycle for residential solar is 26 steps.”

Emerging Solar Strategies, Part 2: SOLON; “We are prepared to deal with whatever we need to deal with to play in the market.”

Emerging Solar Strategies, Part 3: DuPont’s Push for Quality Standards; In today’s market, “you have to rely on what you’re buying, not who you’re buying it from.”