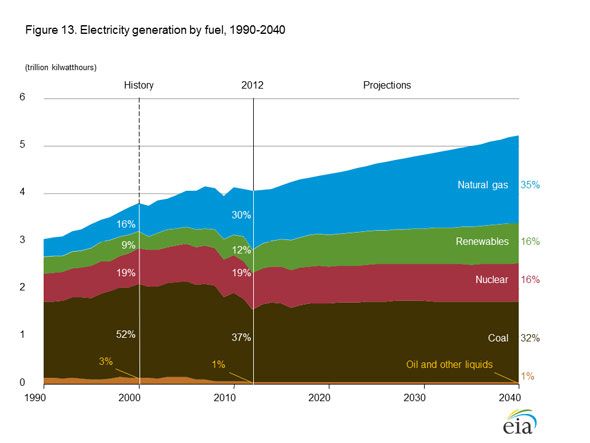

Electricity generation from renewable energy, not including hydropower, will tick up from 12 percent to 16 percent, according to the U.S. Energy Information Administration’s 2014 Annual Energy Outlook reference case.

The upward trend seems reasonable until the timeframe is taken into account. The increase of 4 percent is forecasted to occur from 2012 to 2040.

In that timespan, renewables excluding hydropower will account for about 28 percent of the growth in electricity generation. But other government figures would suggest that, at least in coming years, renewables could be a much larger part of the picture.

In October of this year, FERC found renewable energy accounted for nearly 100 percent of all new generation capacity. A 2012 market report from FERC found that wind, and to a lesser extent solar, made up nearly half of the new generation capacity that year.

Earlier this year, the International Energy Agency forecasted that renewables will surpass natural gas for electricity generation globally by 2016. Although natural gas will likely take the top spot from coal eventually in the U.S., it shows that the renewable outlooks generated by other fairly conservative agencies are still far more bullish on renewables than the EIA's.

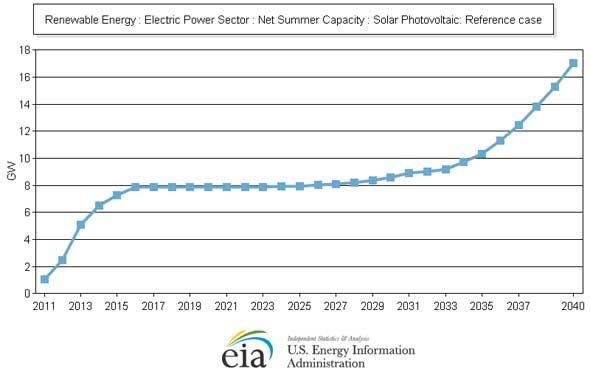

The EIA’s reference case for 2014 estimates that there will be a total of 6.5 gigawatts of net summer solar PV capacity in 2014. GTM Research, however, reported nearly 1 gigawatt of solar installation in the third quarter of 2013 alone. The Q3 figure from GTM Research was 20 percent higher than Q2 of this year.

The EIA raises its estimate for installed PV as part of summer capacity up to 7.9 gigawatts by 2016 -- but from there, it essentially flat-lines for about a decade before creeping back up. Wind capacity is also flat-lined in many of EIA’s estimates.

For 2014, the EIA estimates about 8 gigawatts of planned additions for all renewable generation capacity. If solar continues at its current pace in the U.S., it would easily be at least half of that. Texas alone installed more than 12 gigawatts of wind in 2012.

The inconsistent and fragmented clean energy policy in the U.S. ensures that even the most accurate of forecasts will be adjusted as circumstances change. But factors such as falling prices for some renewable technology, financial innovation in the solar market, and increasing customer acceptance of (and demand for) renewables mean that EIA’s projections of wind and solar flat-lining will likely prove to be more than a little off in coming years.