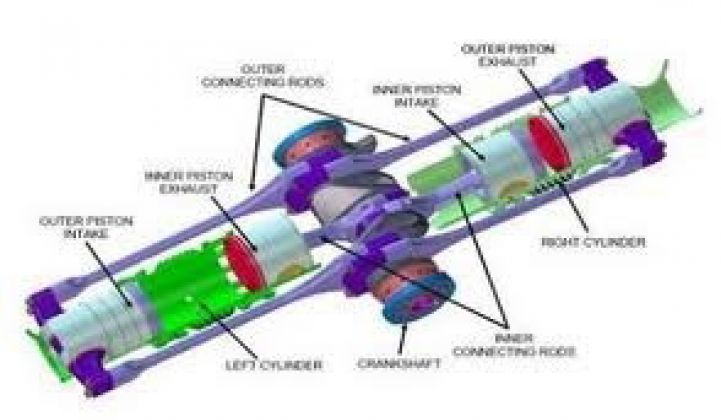

EcoMotors, a VC-funded engine startup based in Allen Park, Michigan, builds the "opoc" engine, so named for its opposed-piston, opposed-cylinder architecture. The firm just signed a deal in China for production of its engine, which aims to be "15 percent to 50 percent more efficient, smaller, lighter, and less expensive" than today's diesel engines.

We spoke with Andrew Chung, a partner at Khosla Ventures and Director at EcoMotors this morning. He emphasizes that what EcoMotors has accomplished in this deal with First Auto Works was not easy or without risk, but in many ways was "cleantech done right." EcoMotors has managed to enter a joint venture with First Auto Works (FAW) Jingye Engine to develop, build and sell the opoc engine technology in China. Here's the surprise: FAW is committing in excess of $200 million to the project, and EcoMotors is on the hook for zero. Yet EcoMotors owns 49 percent of the JV.

“Partnering with an affiliate of one of the largest automotive original equipment manufacturers in China is a remarkable milestone for EM and gives credence to the potential of our engine technology,” said Amit Soman, EcoMotors’ president, in a release.

Andrew Chung saw this deal as "transformative" for the firm and "a nice progression" from last year's deal with Zhongding Power. The deal with Zhongding was a licensing arrangement with a royalty and share of plant capacity. According to Chung, there is already "steel in the ground" for the factory, with production slated for the end of 2014 or early 2015.

"Fast forward to a year later," said Chung, "and that deal [attracted] attention from the large automotive OEMs that could potentially implement the engine in their vehicles. This technology has the potential to bring big advancements in reducing fuel consumption and emissions that will ultimately scale and have widespread impact in China and beyond." This new deal is "fully funded" by a subsidiary of FAW that controls substantial market share in China's large truck and passenger car market. Again, Chung notes that "zero capex" was required from EcoMotors.

FAW will be going after medium- to large-sized commercial diesel vehicles and then looking at other applications with alternate fuels such as CNG and methanol.

According to EcoMotors, "The opoc architecture comprises 50 percent fewer components and far less mass than conventional internal combustion engines. The reduced mass and weight also allows automakers to fundamentally rethink the way they design vehicles, which holds the potential for further efficiencies through improved aerodynamics." Chung has said in earlier interviews that the design can challenge "conventions about the size, efficiency and versatility of the internal combustion engine." The startup is also developing a “multi-fuel family” of engines for both automotive and non-automotive markets, as well as diesel-fueled gensets for on-site power.

EcoMotors has competition from startups and incumbents. Startup Achates Power is designing its own opposed-piston diesel engine that it says can improve fuel economy by up to 15 percent at a cost that is 10 percent to 15 percent lower than the standard. Pinnacle Engines is using regular gasoline for its own high-powered opposed-piston engine design, known as a Cleeves cycle engine, and claims a potential 25 percent to 50 percent fuel efficiency improvement over today's models. Ford is working on its EcoBoost engine, a diesel-like gas engine that can boost fuel economy by 10 percent to 15 percent.

Diesel is the fuel of choice for commercial fleets, and also powers about half of Europe’s personal cars. It could be a major fuel for new mass automotive markets in China, India and other developing economies as well.

We spoke with Chung about the threat of IP loss when a small U.S. startup works with an enormous Chinese entity. It's well-explored territory for the investor, as Khosla Ventures has a number of companies negotiating similar partnership deals in China such as LanzaTech, Great Point Energy, and NanoH2O. Chung said that these companies and others "are making great inroads in commercializing in China," adding that "Chinese partners are working with us because our technologies have the ability to address major environmental issues strategic to them and could be critical to the country’s survival.”

Chung points out that the EcoMotors engine design is actually simpler and more elegant than a standard engine with fewer moving parts -- but part of its complexity and innovation is in the software control and timing algorithms. And those, he said, are harder to replicate.

He concluded, "At the end of the day, we are absolutely taking some risk, but the advantages of being able to commercialize groundbreaking technologies with great partners in an otherwise difficult funding environment outweighs that risk. It’s an important first step in taking these technologies to the world."

EcoMotors has raised more than $65 million from Khosla Ventures, Bill Gates and Braemar Energy Ventures.