Echelon (Nasdaq: ELON)’s third-quarter earnings call this week had plenty of good news: revenues of $43.8 million that beat out forecasts, booming utility sales, new opportunities in Brazil and China and a growing appetite in Europe for its smart grid gear.

But Echelon also had to reveal that one of its most ambitious efforts on the smart grid front has lost its only named customer. That’s Duke Energy, which canceled its $14.5 million order for Echelon’s Edge Control Nodes shortly after the close of the third quarter. Echelon shares slid Friday on the third-quarter news, with the Duke cancellation mentioned in several analysts' notes.

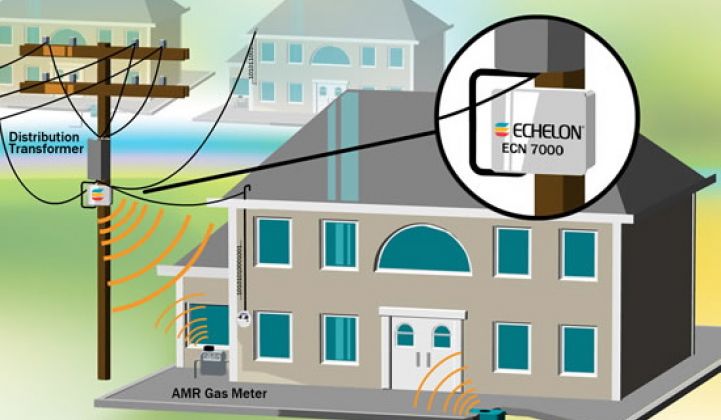

Echelon launched its Edge Control System (ECoS) platform in September 2010 with Duke as a showcase client. The idea is to extend Echelon’s abilities in smart meters to other smart grid devices via its Edge Control Nodes (the physical devices that sit in the field), and then open up the platform that manages them all (ECoS) to third-party application developers.

This kind of move from individual smart grid systems to a platform isn’t unique to Echelon -- in fact, almost every smart grid player is trying to position their technology as the foundation of a smart grid platform. Cisco and Itron are teaming up for a smart meter-grid management combo with customer BC Hydro in Canada, and other big smart meter networkers like Silver Spring Networks are delivering home energy management, demand response and plug-in vehicle management products over their networks.

One big challenge in the platform game is proving that the technology in question is robust and flexible enough to handle all the demands placed on it. In Echelon’s case, it insisted in a prepared statement that its Edge system performed well in field tests with Duke, and that performance wasn’t an issue in the cancellation.

Instead, the San Jose, Calif.-based smart grid and building controls player blamed “regulatory uncertainty” for the cancellation. To be sure, Duke has faced resistance to its smart meter and smart grid plans from regulators in several of the states it operates in, although Ohio, where Duke is continuing to roll out Echelon’s smart meters in a $15 million project, seems safe for now.

Duke’s Ohio territory is pretty much limited to Cincinnati, however, whereas its Indiana territory stretches across much of that state. But Indiana utility regulators earlier this month rejected Duke’s request to spend $22 million on initial smart meter deployment work. According to local news reports, a 2010 ethics probe that led Duke to fire its Indiana president has soured state regulators there to Duke projects, to the point where they’ve started refusing to allow Duke to recover costs for storm repairs, let alone start deploying new smart grid products.

In other words, when it comes to the Edge products, “Given the very recent regulatory decision that further delayed Duke's smart grid deployments outside of Ohio, it made sense for both companies to defer additional investment in a Duke-focused ECN until we have more visibility,” Echelon CEO Ron Sege said in Thursday’s earnings conference call. (I’d guess he was referring to the Indiana situation, though he didn’t specify that.)

While Echelon continues to seek North American clients for its Edge products, particularly for distribution automation purposes, that might not be its most promising market -- Echelon’s smart meters are popular in Europe, but Duke is its only U.S. customer right now.

Instead, Sege said Echelon would be focusing on “Europe and Latin American regions where we see more solid demands.” Echelon recently got its platform certified with Brazilian metering heavyweight ELO, which could offer it entrée into that country’s future 65-million-unit smart meter upgrade. Echelon’s also working with Chinese smart meter maker Holley Metering in an attempt to break into the murky yet potentially massive Chinese smart meter market.

Baird Equity Research lowered its price target for Echelon from $13 to $11 after the conference call, noting that the Duke cancellation, as well as higher-than-expected costs from two European smart meter deployments, were “near-term headwinds” for the stock. Still, it and other analysts reported that they saw potential in Echelon’s long-term growth in emerging markets, based on its technology and its current strategy of working with local partners to get that technology into the field.