After two quarters of encouraging growth, energy storage deployments fizzled in Q2.

This setback has no particular bearing on the long-term health of the storage industry, which already has a head-spinning growth trajectory baked in from contracted projects. But the blip, recorded in the latest Energy Storage Monitor report out last week from Wood Mackenzie Power & Renewables, says a lot about the occupational frustrations for those of us paying attention to the storage industry as it exists currently, while looking ahead to where it will be.

And so, at the same time that I'm rounding up a list of mega-batteries heading for the grid in the next few years — and reporting new "100-megawatt club" members, like the one Los Angeles just approved — I must tear my eyes from the brighter future to gaze upon a decidedly dull present.

Eighteen megawatts in front of the meter? What is this, Q4 2014? No, I forgot, that was actually a more fruitful quarter for large-scale batteries.

What's difficult here, at least from a narrative perspective, is that actual installations lag a few years behind the deals that initiate them. The storage industry's dealmaking is far more interesting than what it's actually doing on the ground at this moment.

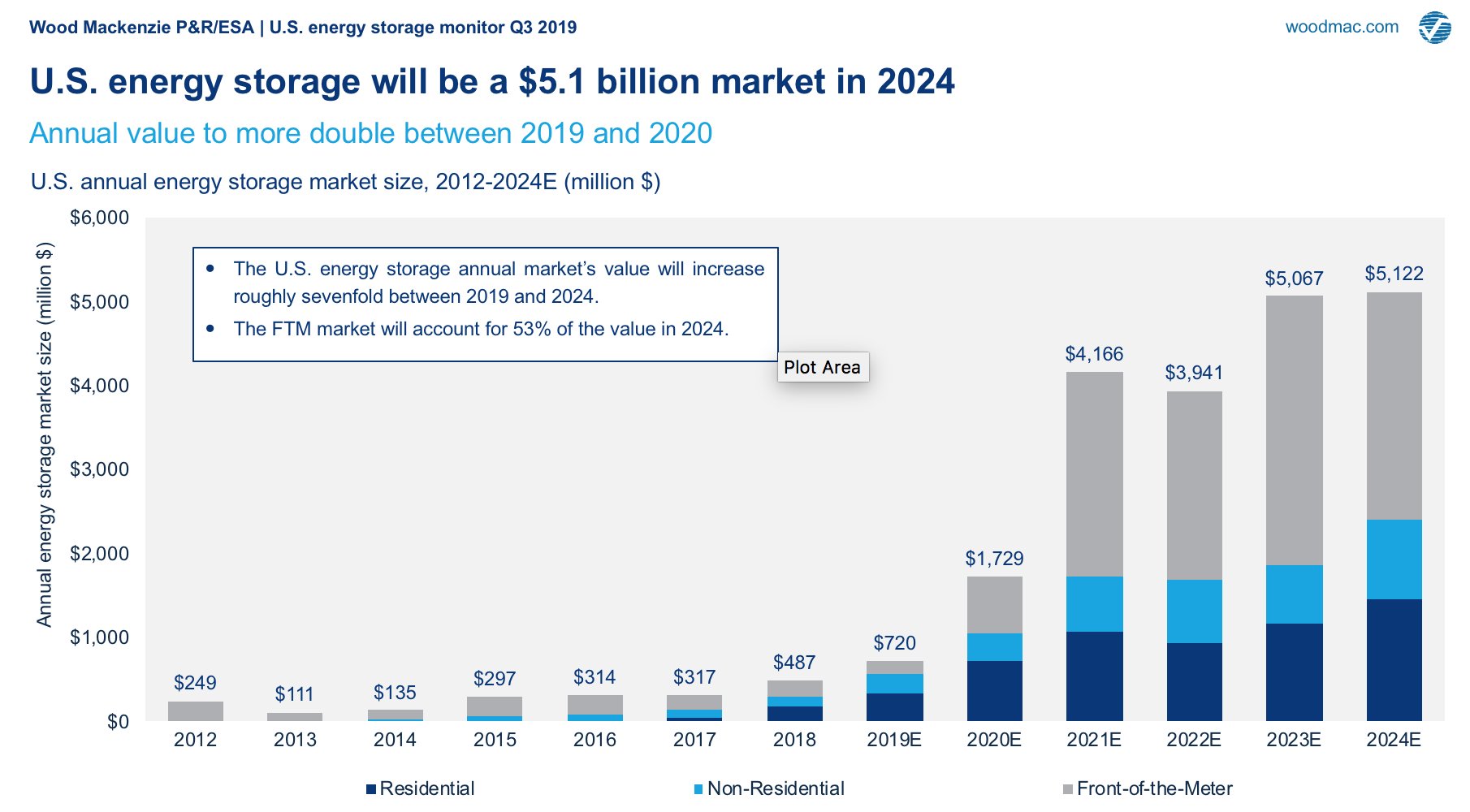

It's like one of those young characters in a Disney movie, desperately waiting for a musical montage to teleport it into adulthood. Can we just sing our way to a $1 billion annual market (circa 2020) or a $5 billion market (circa 2023)?

Evidently not, so we must wait, and entertain ourselves with flashy contracts for delivery in the early 2020s.

The one bright spot of storage activity is the residential sector. Though not as liquid as most consumer goods, these batteries can move relatively quickly once a customer signs a contract. Move quickly they did in Q2, notching an all-time quarterly win. This puts hard numbers behind the qualitative sense that has been building lately that residential battery networks are finally making some money.

The big batteries are filling out deals signed a few years ago; the home batteries are building momentum in the current moment. In the absence of much to talk about in the second quarter, I'll use this week's Storage Plus to focus on potential upside and downside to the growth trajectory that analysts expect. These factors will have more lasting influence on the market than whatever did — or didn't — happen in the last few months.

Potential upside: How good is a tax credit?

You've heard talk of a standalone federal tax credit for energy storage. This has been a topic of discussion for many years. It has yet to enter reality, but there's some chance it could this year.

The conservative tack would be to assume this effort fails, and that the only way for storage to access that sweet, sweet tax equity is to pair with solar for whatever remains of its soon-to-decline Investment Tax Credit. However, WoodMac analysts modeled what would happen if a standalone storage credit passed, and the outcome is not trivial.

If Congress adopts a storage ITC, it could boost installations by 16 percent over the next five years, the analysts found. In hard numbers, that adds 2.9 gigawatts/8.8 gigawatt-hours to a base-case forecast of 18.1 gigawatts/56.3 gigawatt-hours from 2019 to 2024.

Though small as a percentage of future business, that gigawatt capacity equates almost exactly to all the batteries installed from 2012 through WoodMac's projected 2020 deployments. It's risky to bank on, but that kind of reward easily justifies lobbying expenses in the next few months.

On an individual project level, commercial storage could gain a 6 percent boost to internal rates of return from a 30 percent standalone ITC. Front-of-the-meter batteries stand to gain 4 percent in IRR from the same. Those improvements are enough to make borderline projects attractive to financiers, and make attractive projects look even shinier.

As for the pathway to getting it done, that runs though Capitol Hill. The likeliest route would be as part of the larger budget package toward the end of the year, rather than as standalone legislation, said Energy Storage Association CEO Kelly Speakes-Backman. The storage ITC enjoys bipartisan support, she added, with several Republicans backing it in both the House and the Senate.

Indeed, storage has managed to avoid the kind of political notoriety that other forms of energy have attracted. The key question is whether it garners enough interest to make it into whatever budget deal comes together.

"There is a path to getting this done this year," Speakes-Backman noted. "The issue is, if there’s no controversy around it, maybe people won't be paying as much attention to it as they need to."

Potential downside: Unexpected regulatory hurdles

Part of the reason for the minimal output in Q2 relates to logistical friction slowing down installations that were supposed to be wrapping up. As WoodMac storage lead Daniel Finn-Foley told me, some of this is to be expected when revving up an industry rooted in infrastructure and the complex regulatory environment surrounding the electrical grid.

"As you go from inception to building up to scale, you’re going to go through the same realities any energy market faces," he said.

Then again, some challenges are more storage-specific.

The big surprise of the second quarter came in the April explosion at a Fluence-supplied battery plant owned by Arizona Public Service. Investigators have not released the official cause of the event, so it is not known how much the fault lies with the storage technology itself. Still, the fact that a dramatic safety failure could occur at a facility supplied by one of the most experienced companies in the industry, and overseen by one of the most enthusiastic utility adopters of storage, sent shockwaves around the country.

That incident also prompted APS to shut down its other grid batteries, although it reaffirmed its commitment to keep building this technology. There and elsewhere, additional safety measures may become crucial to getting regulatory and customer buy-in for future deployments.

Massachusetts faced a new bureaucratic hurdle just as its storage industry was starting to accelerate.

Utility National Grid, faced with the rush of distributed solar predictably triggered by state laws that encourage a rush of distributed solar, decided to pump the brakes. It launched what it termed a "cluster study," which will scrutinize nearly 1 gigawatt of solar projects larger than 1 megawatt each to determine their collective impact on the transmission system.

In practical terms, that freezes those hundreds of megawatts until the study wraps up, supposedly in early 2020. In the words of one developer, “This is a disaster.” Since grid storage in Massachusetts almost always comes alongside solar, this freeze locks up battery deployment too.

Over in California, the storage outlook took a hit from stricter greenhouse gas emission rules applied to the Self-Generation Incentive Program, also known as the lifeblood of the largest commercial storage market. WoodMac analysts expect that will shrink the state's commercial storage market by 7 percent between 2021 and 2023.

All told, these and other impediments reduced the projected deployments for 2019 by 557 megawatt-hours compared to last quarter's outlook. The demand disappearance for 2020 is even more stark: Projected deployments dropped from 5,635 megawatt-hours to 3,363.

Lest our readers see that and frantically tweak their resumes for shale gas employment, let me stress that the industry will more than make up the loss in subsequent years. The five-year cumulative forecast actually rose 5 percent, in spite of the short-term troubles.

Of course, that shift only reinforces the frustrating gap between the industry's present-day achievements and its future potential. For us storage watchers, the lesson here may be to cultivate long-duration patience, the mental equivalent of a large underground compressed-air facility or whatever wizardry the folks at Form Energy are building.

As APS would surely attest, battery storage is best when it isn't exciting.