Duke Energy, one of the largest electric power holding companies in the United States, has been steadily diversifying its energy resources and cleaning up its act over the past decade.

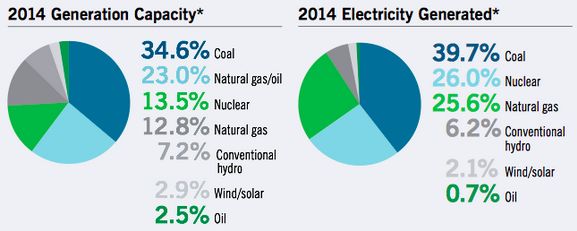

According to the Duke’s 2014 sustainability report -- which tracked performance across the company's regulated utilities, commercial business and international arm -- nearly a quarter of Duke's generation capacity came from carbon-free resources, including nuclear, hydropower, wind and solar.

Renewables alone made up 10.1 percent of generation capacity, and ultimately produced 8.3 percent of the electricity generated by Duke-owned facilities in 2014.

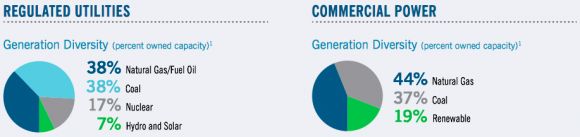

On the regulated side of the business, solar and hydropower together made up 7 percent of the utility’s generation capacity in 2014. On the unregulated side, renewables made up 19 percent of generation capacity. And in Duke’s International Energy business, which targets projects in Latin America, power generation capacity was more than two-thirds hydropower. These figures represent a slight overall increase in the amount of renewable energy in Duke's portfolio compared to last year.

Solar alone saw a small but significant capacity increase from 121 megawatts in 2013 to 168 megawatts in 2014. But, arguably, this is only the beginning.

In an unprecedented move, Duke's regulated arm announced plans to invest $500 million in 278 megawatts of utility-scale solar, for which it received approval in December. This year, Duke announced it plans to add up to 500 megawatts of utility-scale solar in Florida by 2024 and has proposed owning 110 megawatts of solar in South Carolina by 2021.

Meanwhile, Duke Energy Renewables, the company's unregulated arm, recently purchased a major stake in California-based commercial solar installer REC Solar.

Duke claims it has invested a total of more than $4 billion in wind and solar to date. The company currently owns and purchases more than 3,000 megawatts of wind, solar and biomass (more than 1,800 of which is in its unregulated branch), and has set a goal to reach 6,000 megawatts by 2020. Generating capacity across all three arms of Duke Energy totals nearly 62,000 megawatts.

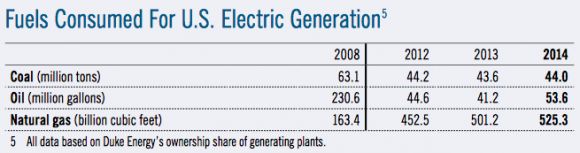

As Duke has adopted more renewables, it has also boosted its use of natural gas and phased out heavily polluting coal plants.

“For the past decade, Duke Energy has been on a $9 billion modernization effort that resulted in new coal, natural gas and renewables," said Randy Wheeless, spokesperson for Duke Energy. "We believe our energy mix is becoming more balanced, which should help meet our customers’ future energy needs.”

“We cannot depend on one energy source alone," he added. "Like investing, a balanced mix makes more sense to us.”

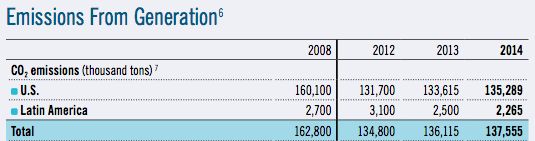

But while Duke's overall portfolio has become more diverse, carbon emissions across Duke Energy’s operations in the U.S. actually saw an increase over the last three years. This is largely due to load growth and greater use of oil and gas. However, Duke boasts that its carbon dioxide emissions have fallen by 19 percent since 2005, thanks to new pollution control equipment, increased natural gas generation, and the retirement of 40 coal-fired generating units.

Duke is also tackling emissions though avoided energy use. In recent years, the company has given customers nearly 61 million energy-efficient light bulbs, which have saved enough energy to power nearly 192,000 homes.

But pollution is still a looming issue for Duke.

Last February, a pipe that burst at a retired Duke coal plant in Eden, North Carolina caused an estimated 39,000 tons of coal ash and up to 27 million gallons of wastewater to flow into the Dan River. The event is considered the third worst coal ash spill in U.S. history. Duke launched a clean-up effort in response, and later created a $10 million fund to protect waterways in the Carolinas and downstream from Duke Energy’s Carolinas operations.

Earlier this month, Duke agreed to pay a $2.5 million settlement for the spill.

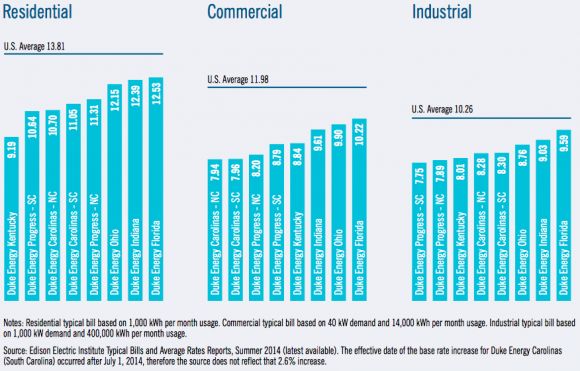

Finally, amid all of the change that took place under Duke Energy's roof last year, Duke's regulated business in the U.S. kept electricity rates below the national average for its roughly 7.3 million customers in the six states it serves.

Duke Energy reported its first quarter 2015 earnings today at $1.24 per share, up from $1.17 for the first quarter 2014.

Duke Energy's Regulated Rates (July 1, 2014)