Utility Dominion Energy is planning a major shift toward renewable energy and batteries as it looks to comply with Virginia's ambitious new clean energy law.

Dominion Virginia’s new integrated resource plan (IRP), announced Friday, represents a potentially historic shift for the state’s largest utility, which has seen previous plans rejected by Virginia regulators for their over-reliance on fossil fuel power plants and infrastructure to be paid for by ratepayers.

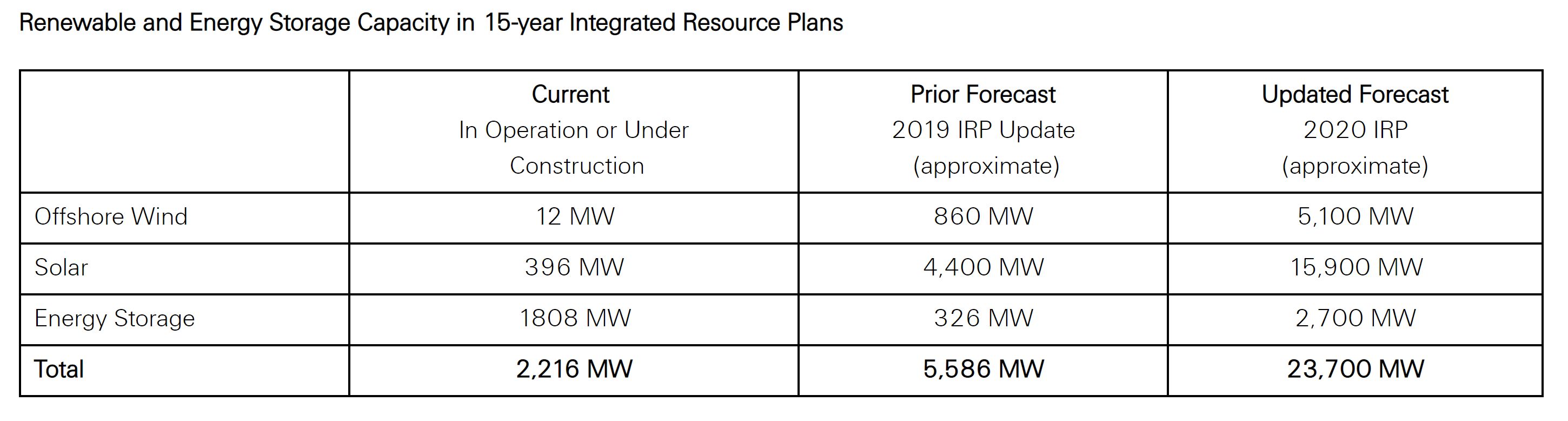

The new plan, by contrast, sets out a goal of nearly 16 gigawatts of solar, more than 5 gigawatts of offshore wind, and 2.7 gigawatts of energy storage over the next 15 years. That’s nearly quadruple the targets laid out in Dominion’s 2019 IRP, and a major shift from a 2018 IRP that was rejected by Virginia’s regulator, the State Corporation Commission (SCC).

Dominion's plan would see it starting with a near-term solicitation for up to 1 gigawatt of onshore wind and solar and 250 megawatts of energy storage for delivery over the next three years, itself a significant development in a market that has not been overly friendly to renewables companies.

Dominion's before and (proposed) after. (Credit: Dominion Energy)

Dominion’s new IRP is driven by Virginia's Clean Economy Act passed earlier this year, which calls for 100 percent carbon-free electricity by 2045 and sets targets for energy efficiency, energy storage, and in-state solar and wind power. Under the law, Dominion Virginia must supply 41 percent of its power from renewables by 2030 and close all carbon-emitting power plants by 2045, while the smaller Appalachian Power Co. must reach 30 percent renewables by 2030 and 100 percent carbon-free energy by 2050.*

Dominion’s Virginia generation portfolio today is roughly one-third natural gas, one-third nuclear and one-quarter coal, with just over 5 percent ascribed to renewable energy, much of it hydropower and biomass. While its new IRP intends to keep its four nuclear power plants running, that still leaves a massive gap to be filled by renewable energy, as well as energy storage to integrate those intermittent resources into its power grid.

Major boosts for solar, offshore wind and energy storage

The first step toward meeting these goals will come through its renewable energy and energy storage request for proposals. Dominion is seeking up to 1 gigawatt of onshore wind and solar power, either through bids for new projects to be acquired through asset purchase agreements or power-purchase agreements.

This would significantly boost opportunities for solar and wind power in a state that ranks 18th in installed solar capacity, according to the Solar Energy Industries Association, and has no wind farms within its borders. Developer sPower last month secured tax equity financing for a 620-megawatt solar farm in Virginia and has plans for doubling that capacity in the state.

Dominion’s new IRP ups its already massive offshore wind plans, a central plank in its renewable targets. By 2026, Dominion plans to finance, build and own up to 2.6 gigawatts of offshore wind, a move enabled by its ownership of exclusive rights to a development zone in federal waters off the state’s coast, but which has drawn some criticism for its costs to ratepayers, already higher than industry averages for its $300 million, 12-megawatt pilot project.

Dominion's new IRP would expand its offshore wind capacity to 5.1 gigawatts by 2035, in line with the Clean Economy Act’s 5.2-gigawatt target, and bolster the state’s hopes of becoming a center of U.S. manufacturing for the growing industry.

Dominion Virginia is also seeking bids for up to 250 megawatts of energy storage projects, either paired with renewable projects or stand-alone, for delivery by 2023. That’s a big boost from previous plans to build four pilot battery projects this year and study them for the next five years before committing to a broader build-out.

Dominion's new IRP will need to be approved by the SCC, which has rejected many of the utility's plans in recent years, including its previous IRPs and a multibillion-dollar grid modernization plan that it said wouldn't deliver clear customer benefits to outweigh its cost to ratepayers.

Retreat from natural gas not enough for environmental advocates

Dominion’s new IRP includes plans to close its Clover coal plant in 2025 and eliminates previous plans to build at least 3,664 megawatts of natural-gas-fired combustion turbine capacity by 2033, since that is “not viable” under the new law, according to a March filing with the SCC.

Still, the utility’s planning scenarios include at least 970 megawatts of new natural-gas peaking facilities over the next five years. In an email, Dominion spokesperson Samantha Moore acknowledged that the new plan will not get the utility all the way to 100 percent clean energy.

"Based on limitations, such as existing battery storage technology and the variable nature of renewables, natural-gas-fired generation will continue to play a critical, low-emission role in our system for decades to come," Moore said, adding that the utility is conducting an analysis on how it can continue expanding its renewables fleet while maintaining reliability.

Dominion Energy, which has operations in 18 states and a major stake in natural-gas infrastructure, also plans to continue work on building the Atlantic Coast Pipeline to supply its Virginia power plants and those of Duke Energy in North Carolina and South Carolina, despite significant public opposition and legal challenges that have halted construction in recent months.

Analysts at Morgan Stanley, among others, have expressed doubts that the Atlantic Coast Pipeline will ever get built.

Clean energy advocates including Clean Virginia and the Sierra Club have pointed out that Dominion's plans would still rely on natural gas obtained from fracking operations that are now facing significant financial challenges.

Clean Virginia also questioned the plan's potential to raise customer rates by about 37 percent over the next 10 years and called for state lawmakers to reconsider the utility's current ratemaking authority under laws passed in 2015 and 2018 that limit regulatory oversight of large capital projects.

Dominion noted in its Friday release that its residential rates are 10 percent below national averages and the lowest of any state participating in the Regional Greenhouse Gas Initiative, of which it is a member.

* Correction: an earlier version of this story misstated the 2030 clean energy target for Dominion Energy.