Just how much would your electricity bill go up if the Department of Energy’s plan to give coal and nuclear power plants cost recovery in capacity markets turns into a reality? It depends on where you live, and how much cost-uncompetitive coal and nuclear power you’re going to be supporting past its natural lifespan.

But it also depends on a web of suppositions and predictions about what the Federal Energy Regulatory Commission (FERC) might do with the vague DOE notice of public rule making, or NOPR. The options range from rejecting it entirely, to passing it as written -- or issuing a notice of inquiry, convening a technical conference, or another such, more traditional option.

Monday was the deadline for filing opening comments with FERC on Energy Secretary Rick Perry’s controversial proposal to consider generators with 90 days of fuel on-site -- a characteristic shared only by nuclear power plants and coal plants with coal piles nearby -- as a critical grid reliability and resilience asset.

The proposal has drawn a backlash from major sectors of the energy industry, and the critique of two of three seated FERC commissioners at present, based on the potentially dire impacts it could have on the country’s relatively well-run and low-cost electricity markets. It’s also been decried as a blatant attempt to fulfill President Donald Trump’s promise to support the coal industry through political interference with FERC’s traditionally nonpartisan, free-market-oriented approach to regulating interstate electricity and gas networks.

Opposition to the proposal hardened over the weekend, with the country’s largest grid operators joining the growing roster of energy industry groups that have pointed out the NOPR’s flaws and highlighted the increased costs to support plants that would otherwise retire and be replaced with more efficient alternatives.

The figures on this front range from $800 million to $3.8 billion annually through 2030, according to a study from research firm ICF -- a small but significant addition for a country that spent about $280 billion on energy in 2015, according to the International Energy Agency. The range in costs comes from a series of assumptions about how FERC might interpret DOE’s suggestion. The highest costs represent FERC implementing the rule as written -- something that opponents have said would be a nearly impossible task, given the document’s legal and procedural flaws.

Late last week, The Brattle Group came out with another report that dove into more regional detail, and concluded that supporting the coal plants that the plan would save from retirement would cost “several billion” dollars per year, largely limited to one grid operator -- PJM, the country’s largest, serving power to about 65 million customers in 12 states stretching from Chicago’s Gold Coast to the Jersey Shore.

Despite having the most coal and nuclear retirements since 2002, PJM still has the highest proportion of coal and nuclear capacity, Brattle Group principal Marc Chupka wrote. It also contains most of the 50 gigawatts of merchant coal that would be guaranteed cost recovery under the NOPR, he noted.

The opposition mounts

These facts have pushed PJM to take some relatively extreme measures, compared to its top executives' more typical opacity. CEO Andy Ott told reporters during a Monday press call, ”I don’t know how this proposal could be implemented without a detrimental impact on the market," calling it "discriminatory" and inconsistent with federal law.

PJM was joined by the rest of the country’s grid operators, in the form of the ISO/RTO Council, in filing comments that said the rule would “would degrade the efficiency and effectiveness of existing organized wholesale markets, would provide improper incentives and disincentives to current and future market participants, would not promote the goals stated in the NOPR and would reverse the progress made in developing robust and reliable competitive electricity markets.”

Meanwhile, the Energy Storage Association has added its name to the list of energy industry groups officially opposed to DOE’s proposal. The unusual combination of solar, wind, oil, natural gas, industrial energy consumers and clean energy groups has already asked FERC to slow down the proceeding from its 60-day timeline -- a plea that was rejected earlier this month.

Now the slightly expanded group has filed comments attacking the NOPR on legal, technical and procedural grounds, and providing commissioners some options for considering the issue of reliability and “resilience” -- an otherwise undefined term in ISO/RTO parlance. And while the DOE proposal hinges on the need to ensure grid resilience, opponents have pointed out that the agency does not even attempt to offer a definition of the term.

“I would say in fact, FERC has been using the market approach to ensure that we have reliability and resilience,” Todd Foley, senior vice president of policy for the American Council on Renewable Energy (ACORE), said in a Tuesday press conference. “FERC already has a number of tools to address market concerns. It’s actually competition and market forces that will make sure that our system is prepared to deal with the future, and making sure we have reliable and affordable power going forward.”

DOE’s proposal has been slammed for its lack of data showing that today’s market structure is “unjust or unreasonable,” or that its proposed remedy is “just and reasonable,” Natural Gas Supply Association CEO Dena Wiggins noted. “In our view, that threshold hasn’t been met.”

The data to support that view mounted with new comments from research firm Rhodium Group that expand on an analysis it released earlier this month. Using federal data, it found that 96 percent of the 3.4 billion customer-hours of power lost between 2012 and 2016 were caused by weather, indicating that maintaining and restoring distribution and transmission circuits might be the logical focus of federal efforts to prioritize grid reliability. By contrast, the outages caused by “emergencies or deficiencies at power plants,” a category that includes fuel supply disruptions, made up 0.00007 percent of the total.

Notably, this period included the 2014 polar vortex, claimed by DOE’s NOPR as the justification for its rule. "During Hurricane Harvey, the coal piles were soaked and weren’t able to be used. During the [2014] polar vortex, the coal piles were frozen," Malcolm Woolf, senior vice president of policy for Advanced Energy Economy, noted on Tuesday's call. "To get the reliability and resilience that we all want, there's an array of technologies we should look at. Demand response performed very well during the polar vortex."

A policy that's moving against the tide

Meanwhile, the verifiable drivers of coal and nuclear power plant retirements -- flat energy demand, cheap and plentiful natural gas, and increasingly cost-competitive renewable energy -- remain in place. Brattle Group’s analysis included some of the uncertainties around how DOE’s NOPR would alter that environment for its chosen generators, along with the fact that “necessary subsidy and the resulting coal generation output depend on level of future natural gas price.”

But the market forces battering the coal and nuclear industries won’t be changed by a rule that extends cost-recovery protection to a selected, geographically limited set of power plants, according to a report released last week by Wood Mackenzie, which owns Greentech Media.

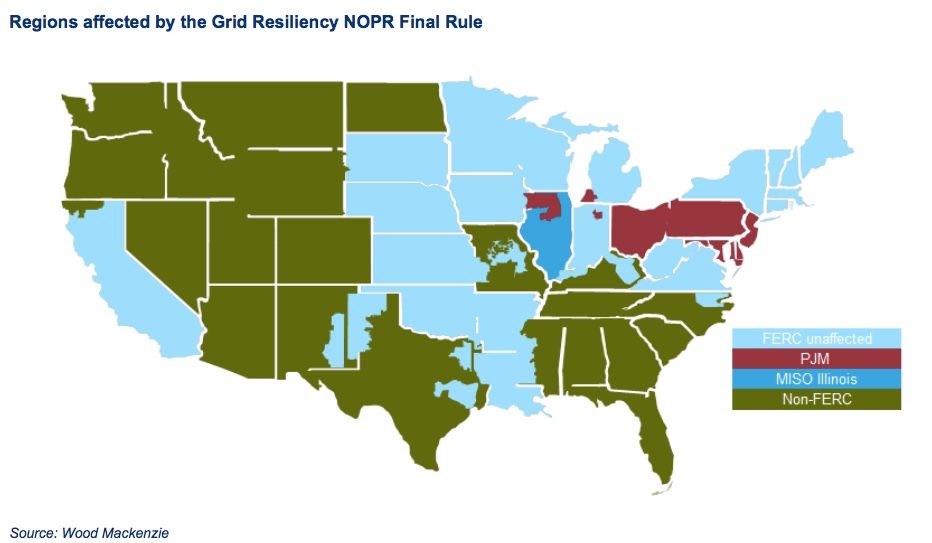

“Although many aspects of how the rule would be implemented are unknown, Wood Mackenzie's high-level analysis suggests the proposed rule would impact a relatively limited area,” -- specifically, parts of PJM and MISO. Actual day-to-day grid operations would change very little, and have a “negligible” impact on wholesale electric, coal and natural gas markets.

Even within PJM and MISO territories, many coal power plants are owned and operated by regulated utilities, and thus fall outside the scope of DOE's rule, the report noted. “Most of Virginia and West Virginia are regulated and would be excluded, along with all of SPP and most of MISO. In MISO, only southern Illinois is not covered by state-level regulation,” the report notes.

Wood Mackenzie also hasn’t changed its projections for coal and nuclear retirements in CAISO, ISONE and NYISO, since these are “assumed to be driven by environmental considerations rather than the potential impact of the Final Rule.” California is closing its last nuclear power plant, and New York and New England are planning to retire nuclear reactors as well.

A last-minute change to the text of the NOPR filed with the Federal Registry has also led observers to exclude California ISO and MISO, since they don’t manage their long-term, last-resort energy and power needs via capacity auctions like those held by PJM, ISO New England and New York ISO.

For the affected areas, Wood Mackenzie projected two scenarios. In the first, “we expect that FERC would seek to treat 'resiliency' in a manner similar to other ancillary services,” a relatively minor share of any grid operator’s market compared to its capacity and energy needs.

The second scenario “also assumes that capacity market signals will be disrupted,” as coal and nuclear plants pricing signals would likely be very low. "A low-capacity price would postpone or slow the rate of build-out of gas combined-cycle plants assumed in our base case. The second scenario assumes no new gas plants are added to the impacted systems after 2021.”

Both projections also assume that the chosen power plants, known as eligible generating reliability and resiliency resources (EGRRRs), would be “dispatched normally according to their variable operating costs,” which would limit the impact of their continued presence in the market by translating their higher operating costs into market signals.

This assumption is based on a political assessment of what might happen if FERC takes up the possibility that EGRRRs could be considered "must-run" or “otherwise operate without regard to traditional variable operating cost principles." Wood Mackenzie chose not to model a "must-run" case, because the economic implications for ratepayers of such a case would incentivize states to re-regulate EGRRRs to control costs.

What FERC can do?

More logical steps for FERC to take might include an effort to define resilience, consider eligibility requirements and assess how much of the resource, whatever it is, is needed for long-term grid support. Next steps might be to solicit bids from potential eligible resources, in search of a price signal that can define the cost and return on equity to come from, the report noted.

FERC Acting Chairman Neil Chatterjee, who said that he generally believes coal and nuclear should be "properly compensated," recently laid out a panoply of options to examine DOE's proposal.

"We could do an advanced notice of proposed rulemaking; we could do a notice of proposed rulemaking superseding the DOE NOPR; we could issue a final rule or an extension of the comment period and a solicitation of further comments," he said. "We could convene technical conferences; we could do a notice of inquiry; we could initiate Federal Power Act Section 206 review proceedings -- so there are many tools available to the commission to act within 60 days.”

Tuesday’s press conference with the energy industry groups opposed to DOE’s proposal expressed confidence that FERC’s commissioners would make good decisions.

“The hallmark of FERC over the years has been their independence -- I have a hard time remembering who is the ‘D’ and who is the ‘R’,” Natural Gas Supply Association CEO Dena Wiggins said. “I think they will carefully look at the record; they will look at the law. […] They can’t just go off and do anything they want to do. I have confidence they will come up with a good result.”

***

Come join us for GTM's first annual U.S. Power & Renewables Conference, November 7-8. You'll get an in-depth look at how the renewable energy market will interact with the U.S. power market, and how those interactions can impact overall industry development and market growth. Curated by GTM Research, MAKE, and Wood Mackenzie energy analysts, we’ll take an expansive view of key issues and timely topics, bringing together a diverse group of energy experts and stakeholders to discuss demand dynamics, economics and business model shifts, and policy and regulatory implications. Learn more here.