When fossil fuel divestment is discussed in the press, there often two foregone conclusions.

First, it's assumed that the campaign is being run by a bunch of activist college "kids" who know nothing about investing. (Fox News host Greg Gutfeld once charmingly hoped that "the kids and their idiotic professors freeze their Marxist asses off next winter.")

And second, it's assumed that the strategy will never work. It seems impossible to imagine Very Serious People in finance really considering removing fossil fuels -- the resources that make up the backbone of the global economy -- from their investment portfolios.

Indeed, there are some truths to both of these perceptions.

Taking a page from the apartheid divestment campaign in the 1980s, Bill McKibben and the other founders of the fossil fuel divestment movement explicitly targeted colleges and universities, where it hoped students could put pressure on administrators to remove coal, oil and gas investments from their endowments. As a result, a significant part of the campaign is being leveraged by college students.

But the campaign is spreading, with ten U.S. cities have now pursuing divestment strategies. Even more powerfully, large organizations like the International Energy Agency and the financial services firm HSBC are looking seriously at the risk of a "carbon bubble" that may leave fossil fuel investments stranded.

Of course, there's still lots of debate about whether the strategy will have any material impact to the bottom line of fossil fuel companies.

On the other side of the equation, renewable energy stocks have taken a battering in recent years due to shaky global market conditions and a reliance on fickle subsidy programs. The industry continues to grow, even while subsidies get pulled back -- but the poor performance of many companies in the public markets has left some investors skeptical.

So these dynamics should lead us to believe that abandoning fossil fuels can only be a loser for investors, right?

A new analysis from Impax Asset Management, an investment firm that manages a $3.5 billion portfolio of environmentally focused equity funds, disputes that conclusion.

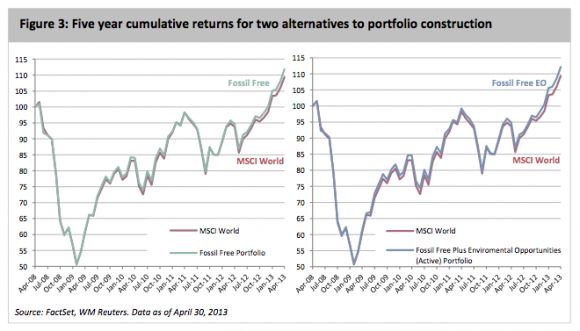

The firm looked at four different performance scenarios from 2008 until 2013 in the MSCI Index, which tracks 500 exchange traded funds globally. The first scenario was a removal of all fossil fuel stocks in the index; the second was a replacement of those stocks with a passive allocation of renewable energy and efficiency stocks; the third scenario used an active portfolio of renewable energy and efficiency stocks; and the fourth focused on replacing fossil fuels with a diverse set of environmentally focused stocks.

The result was that each fossil-free strategy offered equal -- if not slightly better -- returns for investors.

Removing fossil fuel stocks from the index resulted in a 0.5 percent improvement on returns. Adding a passive allocation of 243 renewable energy and energy efficiency companies through FTSE’s Environmental Opportunities index brought no material change to returns. And an active allocation of renewable energy and efficiency stocks offered 2.2 percent in annual returns, with a tracking error of 2 percent.

"The results show that removing the fossil fuel sector in its entirety and replacing it with ‘fossil-free’ portfolios of energy efficiency, renewable energy, and other alternative energy stocks, either on a passively managed or actively managed basis, would have improved returns with limited tracking error," concluded the firm.

This report backs up one from MSCI itself, which found that removing 247 companies tied to fossil fuels in its All-Country World Index improved yearly performance by 1.2 percent -- with a tracking error of 1.9 percent.

Ken Locklin, a managing director with Impax and one of the authors of the report, said in an email he believes these analyses can help quell concerns among investors.

"Whatever one may think about the merits of such an approach -- and that is certainly a thorny question -- the 'divestment risk' topic clearly causes considerable fiduciary anxiety," he said. "I find it very encouraging that our paper, a similar one last month from MSCI, and a private analysis done recently by Advisor Partners all came up with comparable results. Hopefully, such efforts will go some way to reducing the anxiety that fiduciaries currently feel when they contemplate going fossil-free."

People are still figuring out what to think about the fossil fuel divestment movement. Is it just a bunch of activists who don't understand the world of finance? Or is it a real strategy for investors? This latest report shows that, yes, more major investors are taking divestment seriously as an option.