What is the right way to gauge the shakeout's impact on the PV industry? The optimist points to module average selling prices, which we forecast will fall below $2.50 per Watt in 2009, as a sign that grid parity is imminent. The pessimist points to company balance sheets, noting – as we do – that even the most successful European and American multicrystalline manufacturers will have profit margins of only 5 percent in 2009. Underlying these effects is producible module supply growth, which will increase from 3.2 gigawatts in 2007 to 11.2 gigawtts in 2009. But module oversupply is only half – maybe only one quarter – of the story. If it were the complete story, as many have argued previously, elastic demand in policy-supported markets would absorb most module supply without meaningful changes in price. This is simply not the case.

The shakeout is demand-driven. In the past eight years, module prices have fallen at an average of 2 percent annually, while average demand has increased 51 percent per annum. In 2007 and 2008, module prices fell 7 percent and 12 percent, while demand rose 46 percent and 69 percent over the same period. If historical trends are any indication of future outcomes, the 25 percent decrease in global average module prices we forecast for 2009 would drive another year of outsized demand growth, the loss of the Spanish market notwithstanding. Instead, we forecast global PV demand growing 13 percent from 2008 to around 5 gigawatts this year. Even with meaningful price changes the markets are not growing. Something else is going on here.

Most previous demand analyses were able to explain market movements because the markets always moved in one direction: up. Germany and Spain absorbed most modules produced in the supply-constrained market from 2005 to 2008. Feed-in tariffs in these markets let project developers outbid competitors in unsupported markets who were unable to afford the high prices German and Spanish project developers could pay while enjoying more-than-adequate returns. With some combination of Germany and Spain comprising more than 50 percent of incremental demand from 2004 onward, analyzing the dynamics underlying market demand didn't really matter. Demand forecasts were pegged to program sizes, adjusted using some historical growth rate, and rounded out to meet that year's supply expectation. Unfortunately, this is still happening.

A real analysis of market demand for PV begins with the economics of individual projects. Market demand for any product is really just a function of individual demand for that product. Adding up individual demand functions tells you both market demand, and the forces underlying market demand. This is precisely how we approached demand analysis and estimation in our recently released demand report.

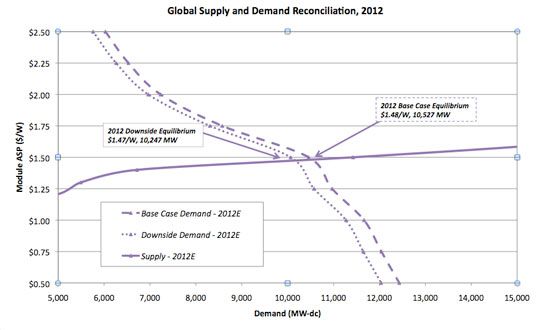

The true source of module pricing pressure is the internal rates of return PV project developers need to build projects. Faced with limited access to costly capital and waning incentive programs in major markets, PV project developers are demanding higher returns from fewer projects. They are passing these pressures on to overbuilt module manufacturers, forcing them to cut prices rapidly and drastically to move inventory and clear markets.

High-cost and undifferentiated manufacturers that were able to compete in the supply-constrained markets merely because they had access polysilicon are the first victims of this new pricing pressure. In today's market, low-cost or high-performance manufacturers able to withstand margin compression and source modules at lower prices will survive. This dynamic is paving the way for a much different, much more competitive PV industry.

Module oversupply is not the big story here. Just because producible module production in 2009 is 11.2 gigawatts doesn't mean 11.2 gigawatts of modules will be produced. In short, module manufacturers won't produce what they can't sell. Most uncompetitive manufacturers will idle their production lines and attempt to sell off as much net inventory as possible in the cost-plus market environment. Some will survive by the skin of their teeth, others will exit the market, or fall victim to consolidation or acquisition by larger players.

The right way to gauge the shakeout's impact on the PV industry is to look at the new market the shakeout is creating. A new downstream focus will define the types of manufacturers able to compete successfully in this evolving market. We are beginning to see levelized costs of energy falling fast, driven down by falling module and system prices, with grid parity emerging in the most price-sensitive markets as early as this year. With electricity sales becoming an important factor, delivered $/kWh is replacing $/W as the guiding metric of a manufacturer's competitiveness. Not only will this force some manufacturers to cut costs or exit, but it will also help to expand the market into countries unable to install modules at yesterday's prices. The optimist's view predominates, though merely having the right answer isn't as important as how you got there.