It turns out Denver is a great town for a storage gathering.

GTM’s fifth iteration of the Energy Storage Summit moved from Northern California to the Mile High City. Not only did the lights stay on, but the crowd was fun and friendly and eager to participate. Even Colorado Governor Jared Polis kept things loose and lively with the help of his terrier sidekick Gia. I believe this is the first time a dog has participated in a Greentech Media keynote.

Colorado has become something of a test case for the energy transition in purple states far from the coasts. Polis won by more than 10 points last year on a platform demanding 100 percent renewable electricity. The legislature moved swiftly to pass a barrage of climate action laws this spring. The state enjoys considerable wind and solar resources, but storage will prove vital to this endeavor — and Polis knows it.

That backdrop of imminent action lent the whole event an immediacy that prior years couldn't match. Across the continent, the storage industry has been doing real things lately, which gives us more to talk about. My favorite sessions got beyond the high-level assertions we’ve heard from storage leaders in the past and drilled into the details of how they’re making those ideas happen.

This week in Storage Plus, I'll share highlights from the event, plus insights from the latest Energy Storage Monitor, the quarterly storage data treasure chest produced by Wood Mackenzie and the Energy Storage Association. And all you Squares can watch the whole thing next week when the high-definition video gets posted right here.

Strong political support for Colorado storage development

Colorado provided one of the more interesting data points for the trend of clean energy winning at the ballot box in the 2018 midterms. Here’s a purple state that elected a Democrat as governor by a wide margin, after he promised to pursue 100 percent renewable energy for the state.

The election of Jared Polis also prompted Xcel Energy, the state’s largest utility, to get out in front of the “renewables” thing, instead pledging 100 percent carbon-free power by 2050. And that action kicked off a bidding war as other major utilities sought to prove their seriousness about sustainability with deadlines several decades from now.

We brought Polis to Storage Summit to explain how he expects to fulfill his promise for a clean grid. It’s worth watching; he’s a fast-paced and engaging speaker.

Gia, left, joins Colorado Gov. Jared Polis in discussing the finer points of grid decarbonization at GTM's Energy Storage Summit. (Photo credit: Anna Conklin)

One thing that's clear: Polis really likes energy storage. He understands the intermittency problem and recognizes storage as a potential solution. He also grasps the relative potential for technological improvement. Colorado could get some new firm renewable capacity from hydro or geothermal, but Polis believes energy storage technology stands to improve faster than those older, more mature technologies.

“I'm pretty bullish on storage,” he said. “I think with storage, you have enormous opportunities for...exponential, game-changing-type technological advances.”

Polis earned membership in the small group of governors who understand what this resource can do and how it can benefit their state. He joins the likes of Massachusetts Governor Charlie Baker, New York Governor Andrew Cuomo and… well, it’s not a long list. (Jerry Brown got it, but his successor Gavin Newsom has yet to demonstrate any tangible impact on storage policy. Plenty of governors have boosted renewables without thinking ahead to what a highly intermittent grid will look like.)

The market impact of Polis’ support for storage is harder to define. The primary mechanism seems to be keeping political pressure on Xcel to follow through on its promised clean energy investments, which will lead to widespread deployment of new energy storage. But Polis also showed a detailed knowledge of the clean energy goals of his state’s municipal utilities and rural electric cooperatives, and the word of a governor could go further in pushing those organizations.

Polis continues to rally around “100 percent renewables,” as he did on the campaign trail. This makes Xcel nervous, because blocking anything that is not a renewable resource tightens the solution set and could drive up costs. Onstage, though, Polis proved to be more flexible, or pragmatic, than that slogan would suggest. He’s open to anything that does not release carbon. He just doesn’t see a likely scenario where nuclear has an economic role to play anytime soon.

A vision that allows for nuclear is not, by definition, 100 percent renewable. But that branding clearly worked for Polis, and he’d rather keep that message than hit voters with the minute differences between pre-commercial clean technologies.

Besides, the outlook for the years he’ll be in office is a continued rush of wind and solar and battery development alongside an ongoing retirement of coal capacity. In the near term, 100 percent renewable power additions is a goal that's both possible and likely. It's the end of the road that gets tricky.

Residential storage: Surging or overhyped?

Two contradictory stories about residential storage are coming into focus.

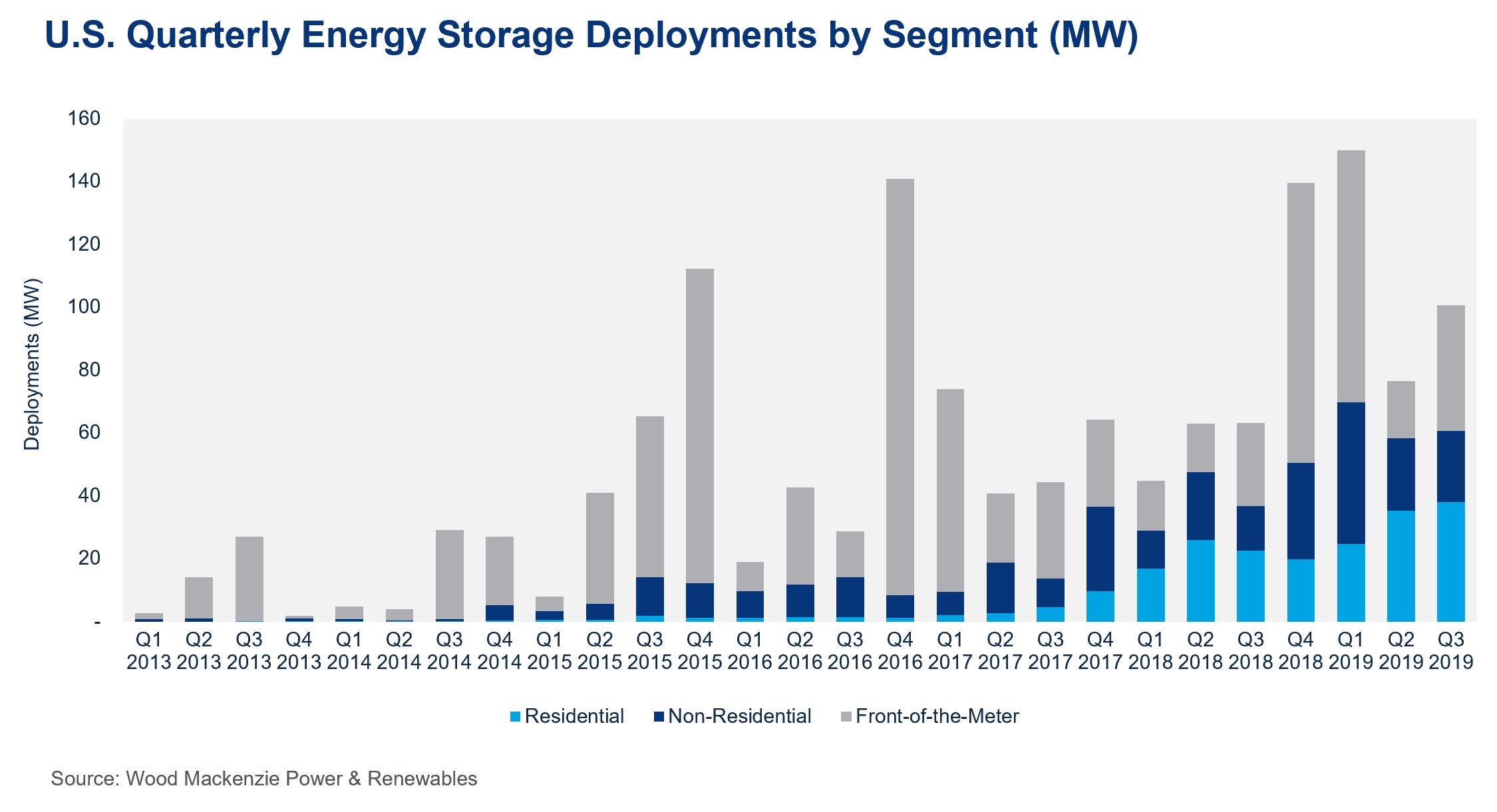

The bull case is that this segment of the market just posted two consecutive quarterly deployment records and looks poised to take off thanks to a massive assist from PG&E. Indeed, residential storage has delivered far more consistent growth than the seesawing commercial segment or the lumpy utility-scale sector.

The sales cycle for homeowners moves faster than utility procurements or the arduous wooing of commercial energy managers. Back in early 2017, the industry was installing just a few hundred home batteries per quarter. In Q3, it installed more than 6,000 units for a total of 38.1 megawatts/87.9 megawatt-hours, according to the new Energy Storage Monitor.

Note the relatively steady increase of residential storage while commercial and utility-scale fluctuate from quarter to quarter.

Residential solar leader Sunrun is telling investors that energy storage will soon become inseparable from the home solar value proposition. The company reported that, in the month of October, its share of direct customers choosing to add storage in the shutoff-plagued Bay Area jumped from 30 to 60 percent. All indications point to a record-busting fourth quarter for residential.

And it’s not just Sunrun anymore: The ranks of companies chasing this market swelled this year to include Panasonic, SunPower, backup generator titan Generac and a slew of lesser-known but ambitious contenders. More investors than ever see a future in this product.

But then there’s the flipside view, which holds that home batteries only really make sense in a few very limited geographies and otherwise amount to little more than a sales pitch in search of a customer need.

Even storage boosters must concede that almost nowhere do time-based rates justify home storage as an economic asset. Outside of Hawaii’s export limitations, the grid does a very good job of storing excess solar production for free. Thus, companies selling batteries talk up the resilience value, highlighting the various disasters that may cut out the lights and positing a battery as the best solution.

In Northern California and other areas marked for preemptive safety shutoffs, this argument really works, as Sunrun’s recent surge attests. The problem is that storage companies don’t confine their pitch to places where it makes sense.

Take Arizona, a sunny state where customers have been adding solar for years. At an Energy Storage Summit panel on residential resilience, David Peterson from utility Arizona Public Service described the tactics he’s seen as someone charged with tracking emerging technology for his employer.

“We have a very resilient grid,” Peterson said. “But that doesn’t prevent folks from selling when it’s monsoon season and we have wind storms and occasionally the power goes out briefly. [...] Whatever they’re marketing to, they’ll market to.”

Similarly, sonnen pitched its Soleil Lofts project, which installed batteries inside 600 new apartment units south of Salt Lake City, in part as a resilience play. The customers host the batteries in their homes, but don’t get any daily use out of them; if the lights go out, though, they’ll kick on backup power. The problem is, the project’s utility partner, Rocky Mountain Power, reports that the local grid is new and highly reliable and that outages really haven’t been an issue.

Even where backup power is needed, batteries offer a limited solution because the capacity of products on the market falls short of the typical American household’s consumption patterns.

On the resilience panel, Vivint Solar CCO Thomas Plagemann admitted that he would not recommend relying on a solar-plus-battery system to operate critical life-support devices. APS' Peterson said he’d seen homes stack up to five Powerwalls to cover whole-home backup in air-conditioning-dependent Arizona.

Separately, veteran installer Barry Cinnamon has demystified for GTM's readers what he calls "the myth of whole-home battery backup." The hard numbers of appliance usage versus battery product capabilities ensure that homeowners can't maintain a typical lifestyle in backup mode. Battery backup power requires paring down to a small number of low-intensity, critical loads.

We noted recently that Vivint lags its national solar installer peers in going to market with storage. That is evident in how little the company talks about storage and how few places it sells it (just Hawaii and California).

But Plagemann made clear that he’s not ignorant of the value; if anything, Vivint is waiting for the actual value of storage to justify the marketing effort. His company now offers storage as a roughly $30 per month add-on to solar power-purchase agreements in California, and Plagemann thinks that’s a fair price to pay. He just doesn’t see the need to offer it everywhere until the costs come down and the value becomes more apparent.

The workaround that long-duration startups need

We closed the conference with a conversation on how storage safety plays into project financing. I got to speak with Jay Goldin, vice president of Green Tech Solutions at reinsurance giant Munich Re, about an insurance product he put together for the iron flow battery system developed by the company ESS.

Munich Re’s bread and butter is insuring insurance companies so big disasters don’t send them into bankruptcy. But this new product is actually a direct insurance offering. Goldin’s team spent time vetting the technology and identifying the risks of failure. The product requires Munich Re to pay up if a storage system underperforms and imposes replacement costs above an agreed upon threshold. Crucially, this shifts responsibility for system performance from the technology startup to a global financial powerhouse.

We’ve written extensively about the contenders building unconventional technologies to succeed where lithium-ion falls short, especially for long-duration storage of renewable electricity. Assuming they can make something that works, the next hurdle is convincing risk-averse financiers to trust them, knowing how many such companies have gone bankrupt on the path to commercialization.

Munich Re’s insurance could be the missing piece that could ferry these companies across the choppy waters of initial commercial deployments. ESS was the first recipient announced, but Goldin is open to more, provided his teams feels confident in its ability to assess them.

A good insurance product is not sufficient for unconventional storage to take off, however.

Flow battery maker Vionx secured a similar product in 2017 from New Energy Risk, part of larger insurance company XL Catlin. Two years later, Vionx still only has two kilowatt-scale pilots operating in the field; they were up and running before the insurance product was announced. Another kilowatt-scale system is in commissioning this quarter, with the help of a $875,000 grant from the state of Massachusetts to cover half the cost.

ViZn Energy also told GTM it had developed an insurance product for its flow technology — prior to running out of money and laying off its staff.

After pushing performance risk onto a bankable partner, then, the long-duration startup still has to close its own deals and stay alive.