For years, demand response has been increasing its role on the grid, starting out as a method for emergency load relief and evolving into an always-available ancillary services resource.

It's well known that the use of load shifting can often be more efficient than power plants when it comes to providing grid balancing services. But few detailed studies exist examining the effect that demand response resources, from industrial to residential loads, have on operational costs for utilities or independent system operators.

A recent study from the National Renewable Energy Laboratory and Lawrence Berkeley National Laboratory specifically addresses this question by putting demand response resources into a commercial production cost model.

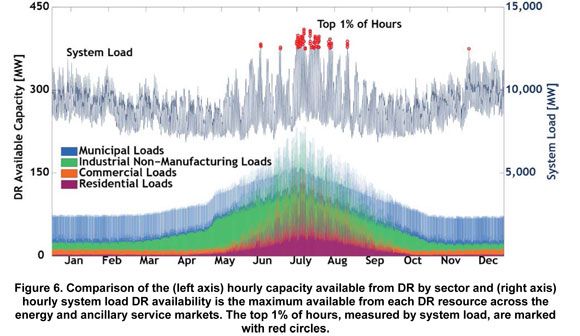

Production cost models are commonly used by utilities to plan for renewable energy integration. For the study, Berkeley Lab used the Colorado test system to model demand response options. The Colorado system has a summer peak of 13.7 gigawatts and an annual demand of 79 terawatt-hours with about 16 percent wind and solar resources.

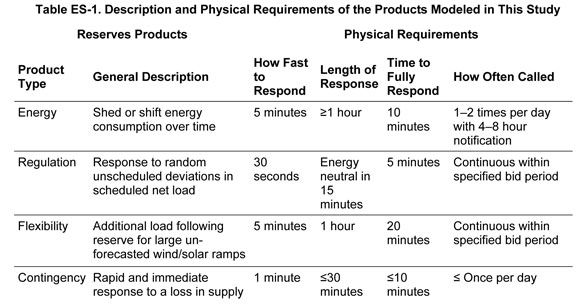

For the top twenty load hours of the year, demand response can provide about 113 megawatts of capacity and shift 135 gigawatt-hours of energy, according to the Colorado model. The model looked at DR for energy, regulation, flexibility and contingency.

Overall, demand response can meet about one-third of frequency regulation needs, 19 percent of spinning contingency reserves and 85 percent of flexibility. The figures are an annual average response and do not include co-optimization. In other words, that could just be the beginning.

By using a variety of demand response resources, from data centers and agricultural pumps to home water heating and outdoor lighting, the system could save $7.9 million in operations. The savings are greater than the total revenue of $5.4 million that the study found the resources could earn in a market setting.

Most of the operational value of demand response comes from reducing the highest-cost generation units and reducing the use of less efficient, partially loaded thermal generators. Although demand response assets have both operational and capacity value, the production cost model only takes into account the operational value.

The process to properly value demand response has been changing for both utilities and market operators. FERC ordered the system operators under its jurisdiction to raise payments for demand response for economic DR with Order 745, and then upped payments for faster-responding frequency regulation services, such as demand response.

ERCOT, Texas’ grid operator, which is not under FERC’s jurisdiction, is reconsidering its entire ancillary services market. And it’s not just the large system operators that are taking this approach. Consolidated Edison just doubled its demand response payments to lure more customers to its program, which focuses on easing distribution congestion in New York City.

Much of the emphasis so far has been on achieving compliance with FERC’s orders, but are more changes coming in terms of the ways that demand response is valued at individual utilities and by the larger grid operators.