DataRaker doesn’t like the terms 'smart meter,' 'smart grid' or 'big data.'

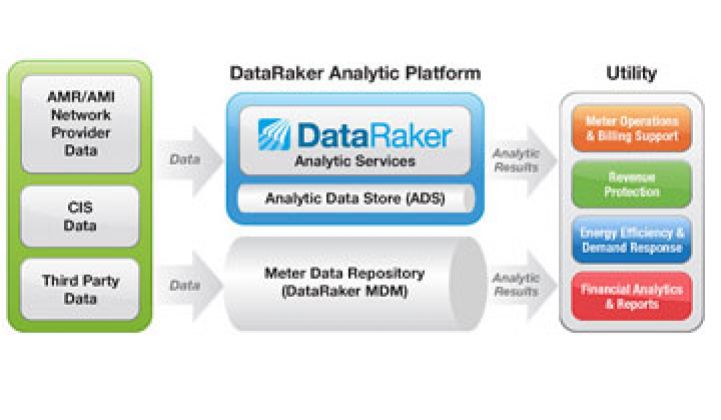

The company, which has been around since 2007, is also careful to note that it is not strictly a meter data management company. Instead, DataRaker describes itself as a software-as-a-service company providing data analytics for utilities, primarily crunching data from smart meters (the firm prefers the term 'fixed meter').

“Our MDM was always around analytics and not around billing or transactional data,” said Rick Brakken, CEO of DataRaker. “Data analytics is a lot more than a software system.”

The Sausalito-based company works with various large utilities, including PPL, PECO, Kansas City Power & Light and Puget Sound Energy. Many of DataRaker’s customers already have MDM systems and are using DataRaker to provide deeper analytics than current systems provide.

The cloud-based system takes the raw meter data, which Brakken described as extremely noisy, and is used to drive cost savings or operational efficiencies in different areas, including meter-to-cash, diversion and theft, customer service, distribution optimization planning, and recently, AMI deployment support.

“It’s become one of our recent biggest business areas,” said Brakken. As deployments come under more scrutiny, some utilities are trying to minimize negative press by ensuring that all of the hardware and software in the meter deployment is working as it’s meant to. Currently, DataRaker has 24 million meters under contract, 18 million of which are installed. He said that while some of the applications sound like what other MDM systems do, DataRaker can find more anomalies and identify trends that other systems miss.

Brakken said that, at this time, his company does not see any direct competitors. While some utilities are bulking up their IT departments, he argued that the business side of the utility is not looking toward its internal IT department for deep analytics. “We see a lot of software people pushing tools on the IT department,” he said. “It’s like basically selling [scientific] calculators to people who aren’t going to use all of the buttons.” Instead of waiting for utilities to decide they need sophisticated analytics, Brakken said the company goes in and generates demand for its product, which can be a multi-year process.

Every utility sees itself as unique, but DataRaker sees itself as being in the business of knowledge sharing. “We don’t believe the utilities want to build redundant analytical knowledge when they can share it,” said Brakken.

Although Brakken doesn’t see other MDM companies as competitors, firms large and small are adding increasing analytical capabilities to their platforms.

“Early MDMS had very limited functionality, mostly providing data collection, validation, and ties to the billing system,” said Emma Ritch, senior smart grid analyst with Greentech Media. “Now we're seeing more MDM systems offer features such as rate impact analysis, outage and event analysis, load monitoring, and AMI system health analysis.”

Large MDM providers such as eMeter and MeterSense have started touting increased analytics. Computing giants like IBM are also beefing up their analytics offerings.

Utilities need it. A recent survey by Oracle, another player not to be ignored in the space, found that many of the utilities with smart meters weren’t actually doing anything with the data. And while many MDM companies and DataRaker would like to sell advanced analytics to those utilities, Oracle also found that less than half of the utilities they surveyed even had an MDM for their meters.

For municipal and cooperative utilities, it usually comes down to cost, which is why cloud-based solutions could be more attractive. DataRaker, however, has mostly worked with large investor-owned utilities and, since business is mostly word-of-mouth, there has not been a focus on expanding to serve smaller utilities.

Rather than being just one more vendor to a utility, DataRaker sees itself as “an extension of the utility's data analytics team,” said Brakken. “We’re not just about delivering software, but also pushing them to do different things with their data.”