Some of the first companies in the U.S. to commit to buying clean energy were internet giants, including Google and Apple, which were worried about the massive energy needs of their data centers in coal country. But today, more and more companies across a number of sectors are opting to buy renewables and are increasingly doing smaller deals.

This week, Goldman Sachs announced its first clean energy procurement deal from a 68-megawatt wind project that will be built in Pennsylvania through a power-purchase agreement with a subsidiary of NextEra Energy Resources. When it commences operation in 2019, the wind project will cover all of Goldman Sachs' energy needs (including offices and data centers) in the U.S.

Goldman Sachs' global head of the environmental, social and governance team, Cindy Quan, said the bank chose the deal as its first clean energy PPA because of the location, close to its energy footprint on the East Coast, and because of the size of the project, which is similar in scope to its energy footprint. Goldman Sachs, which has played a significant role in financing the clean energy sector, also wanted to invest in a project that's new and would put more clean energy on the grid.

Goldman Sachs isn’t the only one. Food giant General Mills announced last week that it’s inked a deal for a virtual PPA for 100 megawatts of clean power from a wind farm that will be built by RES in Texas.

A major part of the momentum behind these clean energy procurement deals has been the dropping cost of solar and wind over the past few years. A report from Bloomberg New Energy Finance released on Thursday says that solar energy costs will drop another 66 percent by 2040, while onshore wind costs will decline by another 47 percent by 2040.

Often, the location of the clean energy project determines how cheap the clean energy it produces will be. Wind in general is cheaper than solar in many places in the U.S. Researchers at the Rocky Mountain Institute just released a software tool on Thursday that helps companies idnetify the lowest-cost and best places to buy clean energy.

The other motivating factor behind these deals is companies’ sustainability goals. Goldman Sachs has committed to have 100 percent clean energy through the RE 100 pledge. The Rocky Mountain Institute says 96 companies have made the RE 100 commitment, and 66 percent of the Fortune 100 have public sustainability goals. Fifty percent of the Fortune 500 have public sustainability goals.

Goldman Sachs' Quan said that its first clean energy deal was motivated by both sound economics and the company's sustainability commitments. “The decisions we make have to be commercial to the firm,” said Quan.

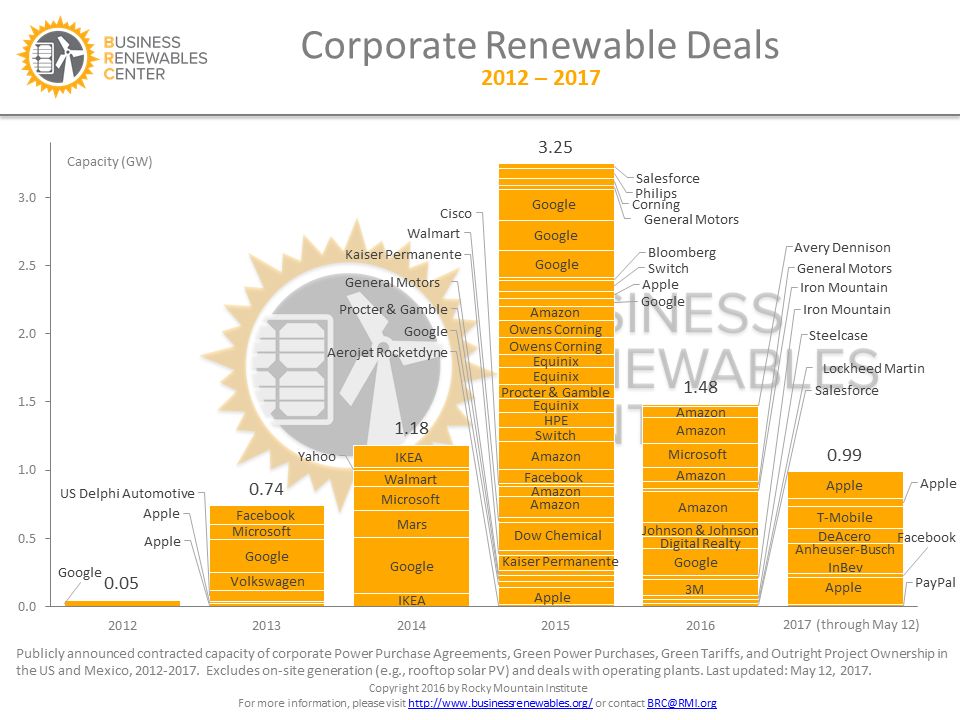

“Corporate procurements have really scaled up over the past few years. It’s not just tech companies,” said Rob Rains, an analyst with Washington Analysis. A recent newsletter from Washington Analysis listed 33 companies that have completed clean energy deals over the past year or so. There are likely to be more clean energy corporate deals done in 2017 in the U.S. than were done in 2016, according to the firm, looking at the pace of deals done in 2017 compared to the year before.

The Rocky Mountain Institute, which will host a conference track on commercial and industrial energy deals at GTM's Grid Edge World Forum later this month, has tracked nearly 1 gigawatt of corporate renewable energy procurements from the beginning of January through May 12 of this year.

Because tech companies have such large energy footprints, hefty balance sheets, well-known consumer brands and aggressive sustainability goals, many of the firms have had an outsized influence on pushing these types of clean energy deals over the years. Washington Analysis noted that states with the highest concentration of tech companies and data centers have tended to get better energy deals.

Data centers can be lucrative and stable clients for utilities, so utilities can often be more willing to negotiate and offer them clean energy options. Washington Analysis noted that an example is a deal between power company Dominion and Microsoft for 20 megawatts of clean energy that will come on-line in late 2017.

If companies don’t get what they want, utilities are increasingly facing the reality that some firms might choose to defect from the grid. In Nevada, casinos such as the Peppermill, MGM Resorts and Wynn Resorts are leaving the grid to buy clean energy from outside suppliers.

The big tech firms are still pushing the envelope when it comes to clean energy, however. This week Apple announced another $1 billion bond dedicated to financing clean energy and environmental projects. Apple said the green bond -- its second issued, and the first issued since President Trump walked away from the Paris accord -- is meant to send a message that many U.S. businesses are still committed to the Paris deal.

With the federal government moving away from support for initiatives to fight climate change, businesses (as well as cities and states) will now have to assume the role of leaders on clean energy in the U.S.

Join us at Grid Edge World Forum June 27-29, where we'll have three days of sessions that address virtually all facets of the grid edge, including corporate clean energy procurements. We'll also have the most influential executives, entrepreneurs and analysts from across the energy sector to meet with during unparalleled networking opportunities and exhibitions. Learn more here.