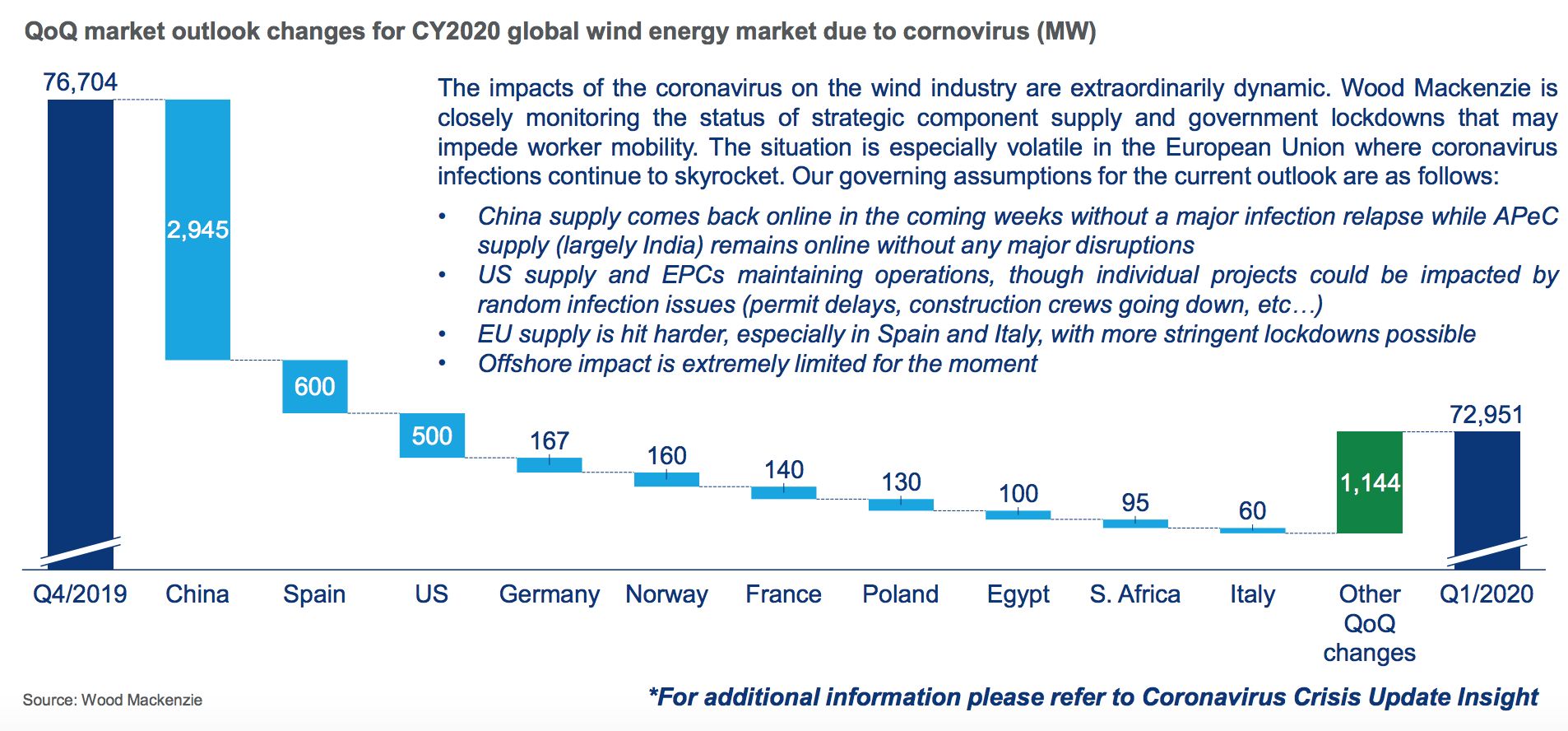

Market researcher Wood Mackenzie has trimmed its forecast for global wind installations in 2020 by 6.5 percent, or 4.9 gigawatts, as the industry grapples with the impact and implications of the coronavirus outbreak.

Shuttered manufacturing capacity, closed borders and the threat of canceled or postponed tenders all play a part in the downgrade, which could hit major European markets hardest. WoodMac now expects the world to add 73 gigawatts of new wind capacity in 2020, still a solid jump from the 62 gigawatts built in 2019.

"The impact of the coronavirus is top of mind for the global wind industry and embodies a crisis unlike anything the market has ever seen,” wrote Dan Shreve, Wood Mackenzie’s head of global wind energy research and lead author of the latest report.

“The state of the pandemic is evolving on an hourly basis, resulting in a highly reactionary environment. Industry stakeholders are continually adapting business operations to balance worker safety with the needs of their clients, all while complying with dynamic government containment measures,” added Shreve.

Supportive policy moves were likely to enable the shifting of projects into 2021 without penalty, rather than offering new routes to market. Germany, for one, has confirmed it will waive penalties for delayed projects.

“In the months to come, there may be a more concerted effort to weave renewables policies into more sweeping omnibus bills aimed at providing fiscal stimulus in the countries hit hardest by the pandemic,” said Shreve.

Europe may be hit hardest

Driven by booming demand in China and the U.S., where developers face declining subsidies, wind developers placed a record 100 gigawatts' worth of turbine orders last year. Yet while the world's top two wind markets may take the biggest hit in terms of megawatts, in percentage terms there could be greater pain in Italy, France and Spain, with aggressive lockdown measures now in place.

Shreve noted that factory closures in those top European markets are also beginning to have an effect. The most severe impacts of that are likely be felt in Europe and potentially the U.S.

The global nature of the wind supply chain is likely to limit the impact. Indeed, U.S. engineering, procurement and construction firms have told Wood Mackenzie that they have not seen any supply chain problems thus far.

The blade factories of Siemens Gamesa and LM Wind Power in Spain are both closed for cleaning after identifying positive cases of COVID-19 among workers. WoodMac warned that the current predictions for downtime could be measured in months, not weeks, if the virus continues to accelerate its spread.

Shashi Barla, Wood Mackenzie’s principal analyst for global wind supply chain and technology, told GTM that China had lost between six and eight weeks of production.

“Most companies will be running one or two eight-hour shifts per day. One option could be to increase this, to work two shifts instead of one or even 24 hours per day, if necessary, to compensate for the volume that's been jeopardized,” Barla said.

Workforce shortages outside the major wind markets

Outside the established markets, there is a greater reliance on overseas expertise. That means markets such as Norway, with a strong project pipeline for 2020, are vulnerable to skills shortages as borders close.

“Norwegian officials have already rung the alarm bell due to an inability for foreign project teams to enter the country,” said Shreve.

“This same issue is being flagged for concern in African nations, though the build volumes in most countries are so small as to allow for time to get projects completed before year-end if coronavirus containment measures are successful,” added Shreve.

A greater challenge in Africa could be the delay or cancellation of tenders. South Africa was scheduled to hold a renewables tender in Q2, with onshore wind and solar among the technologies vying for 1,800 megawatts of capacity.

***

Wood Mackenzie's Q1 2020 Global wind power market outlook presents an analysis of global and regional wind power installation forecasts through 2029. The coronavirus update, an addendum to the report, explains changes related to COVID-19. Download the report brochure and view purchasing information here.

Join WoodMac head of wind research Dan Shreve on April 28 for a research webinar on the offshore wind market in North America.