Utility customers are hungry for green energy -- and more of them are willing to buy it from their utility than to generate it on their own.

That’s a piece of data out from Swiss Re this week, and it offers a glimpse of how utilities, under threat from a rising number of solar-powered, energy-bill-independent customers, might counter that trend by providing competitively priced renewable energy on their own. Consider it a snapshot of an opportunity for utilities struggling to establish their stakes in the disruptive energy landscape emerging on the grid edge.

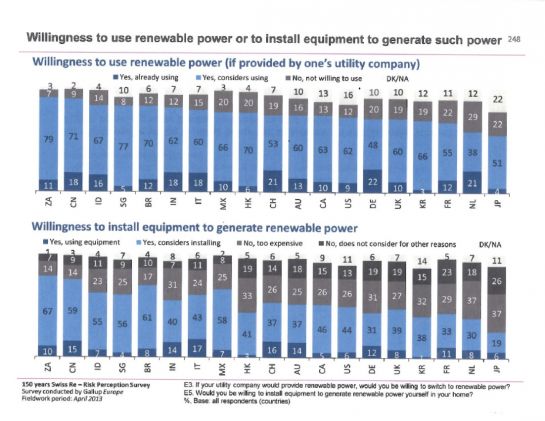

Here are the pertinent graphs from the reinsurance giant’s risk perception survey, which polled nearly 22,000 people in April and May of 2013 in nineteen countries, from the U.S. and Europe to India, East Asia and Oceania. The first shows responses to two questions: One, would you be willing to switch to buying renewable power if your utility provided it, and two, would you be willing to install renewable generation equipment in your home?

As we can see, the number of respondents willing to buy utility-provided green energy is greater than the number willing to install it on their own. So is the number of respondents actually buying green-branded utility power today, compared to those already generating it at home -- the portion represented by the dark blue sections at the bottom of each of the charts.

While the question didn’t ask what type of equipment was being considered, rooftop solar PV is pretty much the sole source of mass-scale residential green power available today. Notably, Swiss RE doesn’t indicate whether respondents thought that installing equipment in their own homes would cost them directly, or whether it could be attained via third-party solar providers like SolarCity, Vivint, Sunrun, Sungevity, Clean Power Finance and the growing number of rooftop PV providers that offer low- to no-cost deals for individual homeowners.

There’s also a lot of variation from country to country in terms of willingness to own one’s own green power systems. For example, only 9 percent of U.S. respondents said they’re using renewable power in their homes today, compared to 22 percent in Germany and 21 percent in both Switzerland and the Netherlands, where feed-in tariffs offer more lucrative paybacks for self-generated power.

For the majority of people who haven’t taken the plunge into green power purchasing or self-generation, the opportunity for utilities to provide renewable power is clearly there, however -- but only if it comes at a competitive price.

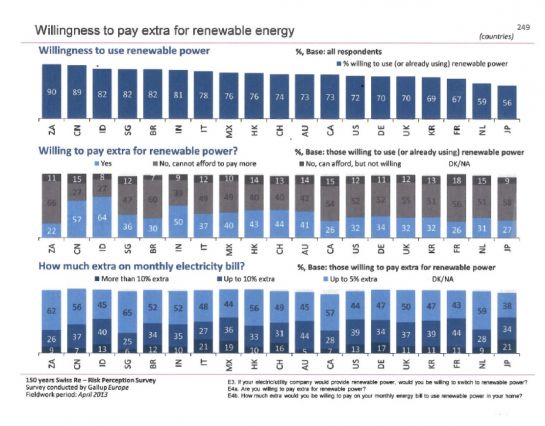

That fact is laid out in the following graph, which asks a tiered series of questions. First, it asks how many people are willing to use renewable power. From that subset, it asks how many are willing to pay extra for it. Finally, it takes that even smaller subset of people, and asks them just how much more they would be willing to pay.

Clearly, the key barrier to broader utility green power sales lies in the cost of that power. While a majority of people in all markets are willing to switch to renewables in theory, most countries have only a minority willing to pay anything extra for the privilege. And of that minority, most aren’t willing to pay more than 5 percent more per month for it.

How can utilities capture the opportunities presented here? We’ve covered several ways energy companies can compete for a greater share of the solar market, whether it’s investing in solar generation assets outside of their regulated markets or going directly to consumers in deregulated, competitive markets. Other options that would require significant changes to regulatory models are also on the table, and utilities around the world are certainly aware of the fact that their traditional business models need to change to adapt to the distributed, renewable energy challenge.

As Mark Way, Swiss Re’s head of sustainability Americas, said in a Thursday statement, "The level of adoption of renewable energy sources will be determined, in part, by striking the right balance of providing easy access to these technologies at an affordable cost.”