Consolidation amidst the shakeout in the solar industry has a number of looks.

There's the attrition we've seen from Q-Cells, Solon, Odersun, and ECD as firms fall to bankruptcy, victims of their high cost structures and intense competition. There's the manufacturing restructuring path, with announcements of shuttered production lines at First Solar and SunPower. There's the massive collapse of companies in China's polysilicon industry.

Last week we saw Canadian Solar (Nasdaq:CSIQ), a gigawatt-scale solar module manufacturer, announce that it will acquire majority ownership in 16 solar power projects in a JV with SkyPower Ltd. in a $185 million deal. The JV between Canadian and SkyPower will look to build solar power plants in emerging markets. That's another way to deal with this market: move some of your efforts downstream to project development, where low-priced panels are actually a good thing.

This regular update will track the consolidation-related upheaval in the 2012 solar industry.

Plant shutdowns at REC

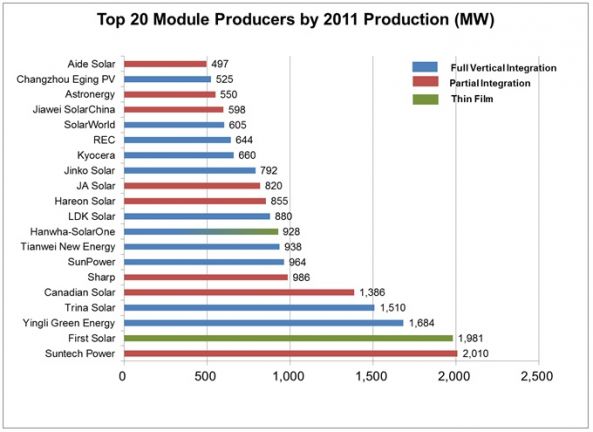

Norway's solar energy firm Renewable Energy Corp. (REC) builds crystalline silicon wafers and PV modules in Singapore and silicon materials in the U.S. But the firm is shutting down its 650-megawatt wafer production facility in Herøya, Norway. According to a release from the firm, 460 employees will be affected by the shutdown, which is attributed to overcapacity and "extreme competition, especially from China." REC's quarterly financial results will be presented today, April 25. Few are expecting great news. REC shipped 644 megawatts of solar modules in 2011. (See chart below.)

Global Solar looks to sell its portable solar products division

Global Solar Energy (GSE) of Tucson, Arizona is aiming to sell its portable solar products business and has engaged FTI Capital Advisors for the asset sale. Global Solar is looking to "grow other key business units serving the building integrated photovoltaic (BIPV) market," according to a release. GSE's portable PV products are sold to military, mobile professionals, and campers.

GSE's CEO Dr. Jeffrey Britt was quoted as saying, “The Portable Solar Business is positioned to recognize a fourth straight year of strong revenue and profitability. The time has come for Global Solar to realize value from the business and identify a buyer who will take the product line to the next level." He also said, “Additionally, the sale of the portable solar business enables Global Solar to increase focus on our core product lines, namely, copper indium gallium diselenide (CIGS) solar cells for OEMs such as Dow Solar and the company’s commercial-scale flexible modules ideal for building integrated applications.”

Global Solar has never publicly divulged its production costs.

GSE is competing with SoloPower in the flexible rooftop solar industry. Note that one of GSE's main financial backers, Solon, went bankrupt at the end of last year.

Several parties interested in Q-Cells' assets

An administrator for insolvent solar module manufacturer Q-Cells said that several parties had shown interest in the German solar cell and module maker, according to Bloomberg. Q-Cells was Germany's -- and once the globe's -- largest solar manufacturer. Q-Cells has resumed some cell and module production.

Q-Cells also has a CIGS manufacturing unit, Solibro, which shipped 66 megawatts of CIGS solar in 2011, "more than any other CIGS manufacturer not named Solar Frontier," in the words of MJ Shiao of GTM Research, who adds that the company had a relatively long history and a "fairly mature" coevaporation technology. Shiao sees that unit as ripe for acquisition.

Chart from GTM Research. Meet the solar analysts who've gathered and parsed this data at the GTM Solar Summit.