[pagebreak: page one]

The PV industry spends countless hours debating the merits, weaknesses, and prospects of the firms that occupy the competitive landscape. Aside from the ever-important yardsticks of cost-per-watt and conversion efficiency, however, the conversation to date has lacked definitive metrics with which to gauge the competitive positioning of companies in the space. We spend a lot of our time at GTM Research thinking about the metrics that matter and quantifying the relationships between them: the seven discussed below represent our best attempt thus far. To put it succinctly, if you’re not doing at least one of these things, chances are your days in the PV industry are numbered. Of course, none of this is rocket science, but this discussion should provide a useful framework for assessing the positioning of individual producers and charting the course of industry dynamics in the days ahead.

Low Manufacturing Cost per Watt: We all know this one. Now as much as ever, cost per watt remains the most important source of competitive advantage in PV manufacturing, as well as the easiest (though not necessarily easy) metric to discern and value. It’s a number, which means it can be compared, and many companies currently report it. The reason that it is important is also easily understood: electrons are a commodity, and consequently any grid-connected energy-generating technology will be valued primarily on the (levelized) cost of electricity it drives, questions of reliability and generation risk aside (which is where technology and balance-sheet bankability can distort the equation).

For markets and applications constrained by finance, however, upfront cost is more front-of-mind -- especially with a capital-intensive technology like PV -- meaning that the buyers of the technology (developers), despite attempts to shift the onus of the discussion, are still very much focused on the per-watt installed cost, of which the module remains a key part of the equation. This, of course, is why the Chinese crystalline silicon giants (JA Solar, Yingli, Trina) and First Solar have grown into the behemoths they are today -- their industry-leading manufacturing costs. Scale, technology, value chain participation, and location are the primary drivers of manufacturing cost at a high level.

Efficiency: After manufacturing cost, this is perhaps the most closely examined and easy available competitive metric. Module conversion efficiency is inversely proportional to area-related balance-of-system costs, such as land, substructure, racks, labor, and cables. Industry leaders in this regard are SunPower’s all-back contact cell (19.5% module efficiency) and Sanyo’s HIT technology (17.7%), and a number of established Chinese players have vying for the number three spot with their own high-efficiency technologies (Yingli’s PANDA, Suntech’s Pluto, and JA Solar’s SECIUM cells). A separate point on high-efficiency technology is that it provides a crucial advantage in markets and applications where space is severely constrained (the Japanese residential market, for example), and where buyers are willing to pay a premium for the higher power density of the technology in order to maximally exploit available area.

The importance of high efficiency can sometimes be overstated, though: only technologies that drive a substantial efficiency differential can really command a price premium. On the flip side, though, having lower-than-average efficiency in your technology bracket can be problematic, as it implies a lower power rating for a standard-area module than one’s competitors (currently, 230 watts is the norm for 1.6 m2 c-Si modules). For thin film technologies like amorphous silicon in the 7% to 9% range, the required module price discount can be substantial, which must be compensated for with either a lower manufacturing cost or the addition of value through other means (see below).

Bankability: The term ‘bankability’ when applied to module producers refers to the availability of financing for projects employing that firm’s modules. Capital today is both scarce and expensive, which has forced lenders to be much more risk-averse with respect to which projects they choose to finance. As such, the projects that receive capital are those with the lowest risk profiles. This has placed the module manufacturers under special scrutiny from banks, in two important respects: first, since module warranties last for 20- to 25-year periods, it is essential that the module manufacturer be around during that entire span of time in order to honor its warranty. The long-term financial health of the company and the strength of its balance sheet come under the microscope here, which lends a significant advantage to well-capitalized public companies (First Solar, SunPower) and firms with large, established corporate parents (Sharp, BP Solar).

Second is the aspect of technology and process risk. Combining questions of risk with scarce, expensive capital means that banks have begun to exert their desire to control the technology. The long-term durability and performance (i.e., energy output) of the module in the field and the robustness of process flow of the manufacturer (to ensure consistent module quality) are of greatest concern in this respect. This works very much in the favor of crystalline silicon, as CdTe, CIGS, and tandem-junction a-Si modules have not been deployed in the field for the full 20- to 25-year operating lifetime; in the case of CIGS, widespread operating data do not exist even for five- or ten- year periods. The situation is compounded further when considering flexible substrates, which is why Dow will face challenges deploying its CIGS solar shingles despite being eminently bankable from a balance sheet perspective.

Technology Differentiation (Performance-Related): At the first order, this risks being a redundant discussion. What else is technology differentiation good for, other than driving down the cost of solar electricity, either through cost-per-watt or by driving higher efficiencies? But aside from the installed system cost, technology differentiation can also play a role in influencing the numerator of the LCOE equation, i.e., in enabling higher energy yield relative to existing technologies. Simply put, you get more kilowatt-hours for the same number of kilowatts of rated capacity (in other words, the capacity factor is higher). This is another area where Solyndra claims to have an advantage over the competition: the company's cylindrical modules capture sunlight across a 360-degree surface and can employ direct, diffuse, and reflected light. If a technology was commercialized that had a substantially lower temperature coefficient (lower efficiency loss at high temperature) or ultra-low annual degradation rate, this is where it would fit in, as well. At the end of the day, though, it’s harder to sell LCOE over $/Wp, so remaining within an arm’s length of Chinese c-Si manufacturing costs is still key -- only then do other factors help to tilt the equation to give you a meaningful competitive advantage. This is the challenge that Solyndra faces today.

[pagebreak: page two]

Technology Differentiation (Product-related): This can pertain to technology innovation that does not directly impact costs. To do this, though, you have to be selling something other than dollars per watt or cents per kilowatt-hour, and in a market where something other than just the electricity is valued. This “other” could be an aesthetically appealing building envelope, as in the case of façade-integrable CIS modules sold by Germany-based CIGS producers Soltecture (formerly known as Sulfurcell), Avancis, and Wurth Solar. The addressable market for BIPV applications (and thus the competitive advantage) is advanced even further if the modules can be manufactured without frames, on a flexible substrate, and can be customized in terms of shape and color, given the lack of standardization in such applications: indeed, these features are exactly what Odersun (another German CIS firm) brings to the table.

Of course, the market for such products is currently but a fraction of that for the “standard” grid-connected market; Wurth, for example, has been operating at close to full utilization since 2007, but has expanded capacity minimally to only 30 MW today. But these firms have proven that demand does exist if the right products can be engineered, and the end-market is growing, albeit steadily; as proof of this, Avancis announced that it would be expanding capacity from 20 MW to 120 MW in 2011. The advantage of such an approach is that one is playing in a fundamentally different market than the one that commoditized Chinese c-Si is engaged in, where cost plays a much smaller role and some degree of insulation exists on account of the technological requirements of the market. A similar argument exists for U.S.-based Global Solar’s flexible CIGS chargers, aimed at the consumer and military market, as well as products incorporating dye-sensitized and organic cells, such as bags and clothing, but the technology is far from mature, and the existing market is smaller still.

Business Model Differentiation: Currently, the PV manufacturing landscape is dominated by firms that occupy a well-defined position in the value chain, namely, wafer-cell-module manufacturing. This is what Suntech, Yingli, Trina, Canadian, and LDK do, meaning that their advantage stems mostly from their processing costs. It is possible to offset this advantage by branching out into other aspects of the value chain. One approach would be to own the polysilicon step, as REC, MEMC and AU Optronics currently do (through its 90% stake in polysilicon firm M. Setek). The disadvantage in processing costs, be it because of scale or a higher-cost location, can be at least partially offset by a lower feedstock cost per watt (currently, REC makes poly for roughly $30/kg, while Yingli buys it for over $70/kg, which translates into a $/Wp cost advantage of around 25 cents per watt -- if REC Silicon is willing to give up those fat silicon margins to its solar division, that is). If commoditized c-Si newcomers Samsung and LG want to compete with the Chinese, this is something they need to think seriously about.

Alternatively, a firm could also differentiate its business model by integrating downstream. One option is to enter into system design and sales and work directly with residential and commercial end-customers. This approach allows a firm to capture the value that was hitherto assumed by the distributor and integrator, and it has been pulled off by companies such as tandem-junction producer Inventux (an Oerlikon customer), which produced around 40 MW in 2010. Another amorphous silicon firm, Trony Solar, produced 145 MW of off-grid systems for sale into the grid-deprived markets of China and Southeast Asia, which have so far received scant attention from the majors. The key question with this model, however, is how well it scales.

For utility-scale markets, downstream involvement can be extended further into project development and EPC services, with the option to sell the project at conclusion, or to sell the power to the off-taker through a PPA. The most successful representatives of this model have been First Solar and SunPower, but as my colleague Shayle Kann has pointed out numerous times, 2010 saw a buying spree in terms of downstream acquisitions of U.S. pure-play developers by till-then pure-play manufacturers such as SunEdison (MEMC), Sharp (Recurrent), Cornerstone (OCI), and Korean conglomerate Hanwha (they that took the “fun” out of Solarfun) is reported to be shopping around as well. While downstream integration gives you greater a dedicated sales channel for your product, it is much easier said than done: just ask Suntech, which has all but abandoned its joint venture with Fotowatio Renewable Ventures (Gemini Solar). Moreover, project sales are a lumpy business, and the margins in non-feed-in-tariff markets remain low: for a manufacturer, this is not a business you want to get into unless you absolutely have to, and it will not pay immediate dividends. But the success of First Solar and SunPower in the utility-scale market in the U.S. has shown that a downstream-integrated model can be the key to opening up emerging markets, and the importance of a first-mover advantage when it comes to project development cannot be overstated, as the learning curve can be steep and customers weight prior experience heavily.

Historical Local Presence in an Emerging Market: History has shown a very close relationship between the growth in local manufacturing and demand in PV markets as they first begin to take off. The rise of Japanese producers in the early 2000s was closely linked to the growth of the domestic market there, and the same holds true for German firms in the years from 2003 to 2008. Even though the successes of SunPower and First Solar in the U.S. do not stem from a domestic manufacturing presence, both firms are headquartered here and were well-positioned to capitalize on opportunities when the time was right. The same is likely to be the case for emerging PV markets: producers with a local presence will have a definite advantage during those first few years as demand ramps up. The increasing popularity of domestic content requirements, as has been witnessed in Canada and India, would only further benefit local producers. But history has also shown that while a local manufacturing presence might reap rich rewards initially, these can evaporate easily when low-cost manufacturers turn their eyes toward the market. Crystalline silicon manufacturing especially has a low barrier to entry, meaning that a first-mover advantage won’t count for a lot in the long term. Suntech and Yingli have made huge share gains in the U.S. residential and commercial market since 2008; Suntech has set up a module plant in Arizona that is more than competitive with established U.S. producers; Ontario will be home to at least five new module facilities in 2011. To cement one’s position, a local producer needs to exploit their knowledge of the “ropes” in that market -- which really comes into play on the downstream end of things.

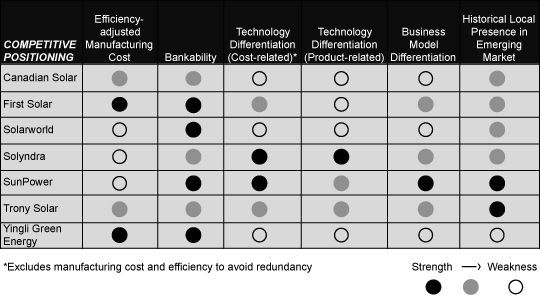

The table below assesses some of the world’s leading PV producers based on these principles. While a detailed examination is a matter for another day, it’s interesting to note that the large Chinese c-Si players like Yingli have succeeded almost entirely on the back of their industry-leading processing costs, while higher-cost players like SunPower and Solyndra have had to check almost every other box to compete with the Chinese. This reflects just how commoditized PV is today, and just how difficult it is to compete with vertically integrated, low-cost Chinese c-Si in such a market.

A final thought: if you were to include every single category of PV manufacturer in this assessment, rows (firms) where the black dots match up with white (i.e., where strengths and weaknesses are complementary) might point to strong synergies, and therefore, a case for assimilation. The question is, who might these be? More when we return.