Global energy demand will keep rising through 2035, but the nature of the mix and the key players will change significantly.

That's the takeaway from the analysts at Wood Mackenzie, who surveyed global energy markets from the ground up and compiled their findings in a new comprehensive report.

The maturation of China's economy has slowed growth in conventional energy demand, but India and South Asia are picking up the slack. Renewables continue to register more on the global energy share, stealing thunder from coal. Natural gas has a particularly rosy path ahead of it, seeing substantial growth throughout the world.

Here are five key charts to help breakdown the changing face of international energy consumption.

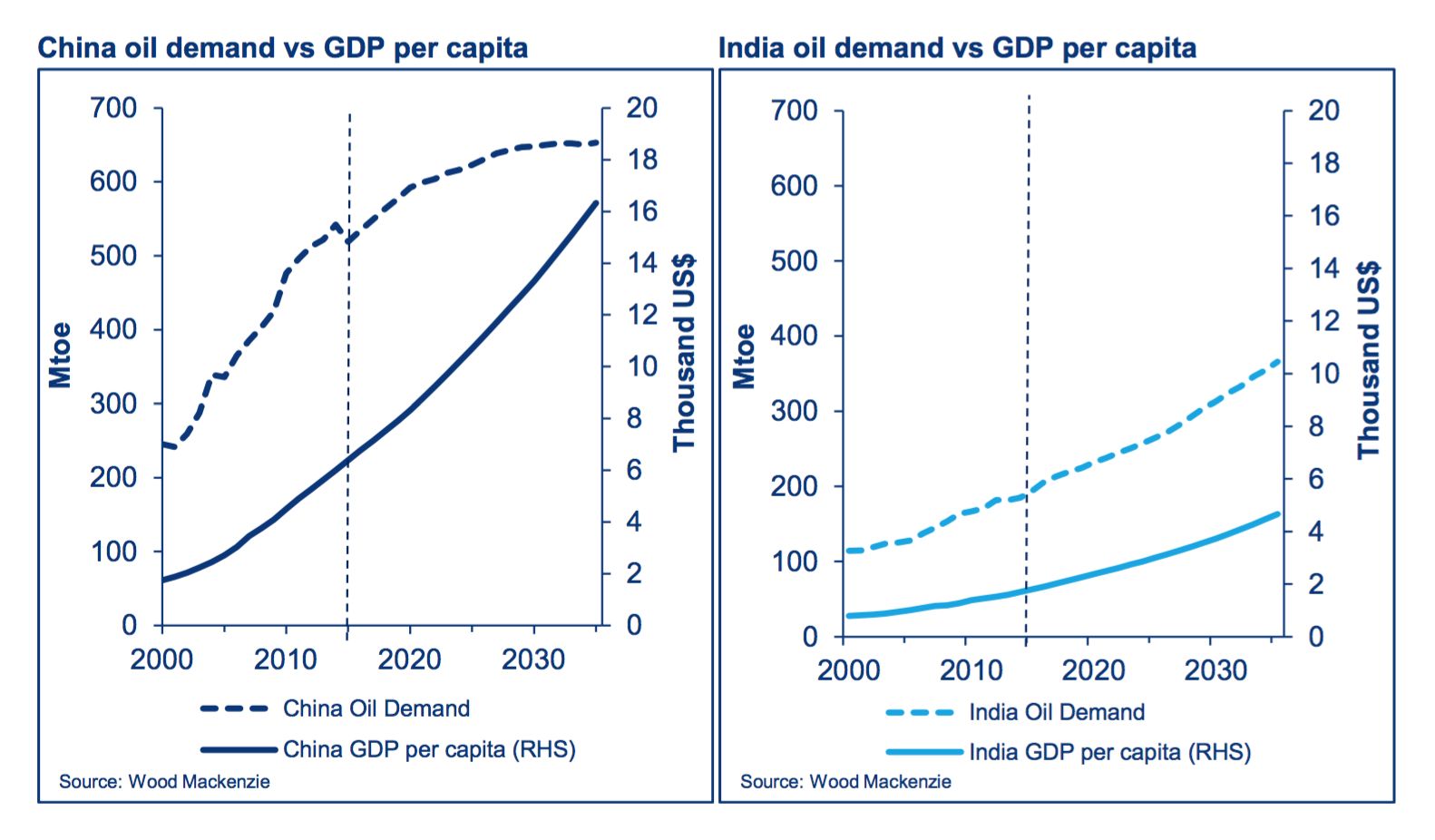

China demand fades, India grabs the baton

China has led global energy demand for the last 15 years as it fueled massive economic development. That process reoriented the economy around the service sector, which requires less energy than heavy industry. As a result, demand growth there has fallen faster than previously expected.

China will remain the number one energy consumer in 2035. The transport sector will sustain oil demand growth and China will still be the world's second largest consumer of oil, after the US, in 2035. Its rate of demand growth, though, is slowing, while others speed up.

India has the fastest growing energy demand, increasing at an annual average of 3 percent from now to 2035, by which time the country's population will outpace even China's. Renewables will surge from 22 percent to 54 percent of total installed capacity, while oil consumption rises 80 percent.

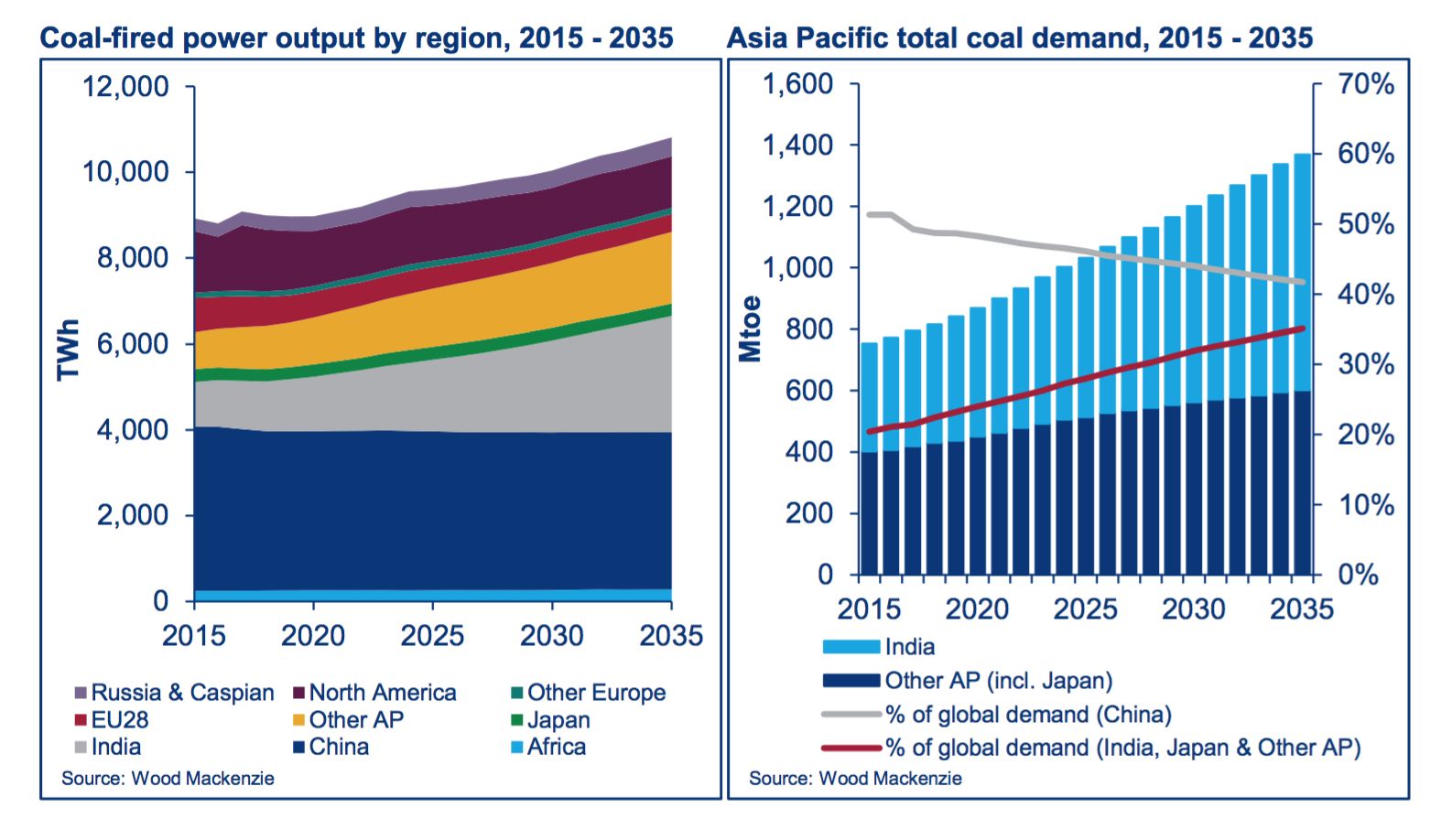

Coal's role in China's fuel mix peaked in 2013 and will continue to decline as the government pursues efforts to clean up the air and reduce contributions to climate change. India, though, will increase coal consumption as a way to power more economic activity, while mitigating exposure to oil price shocks.

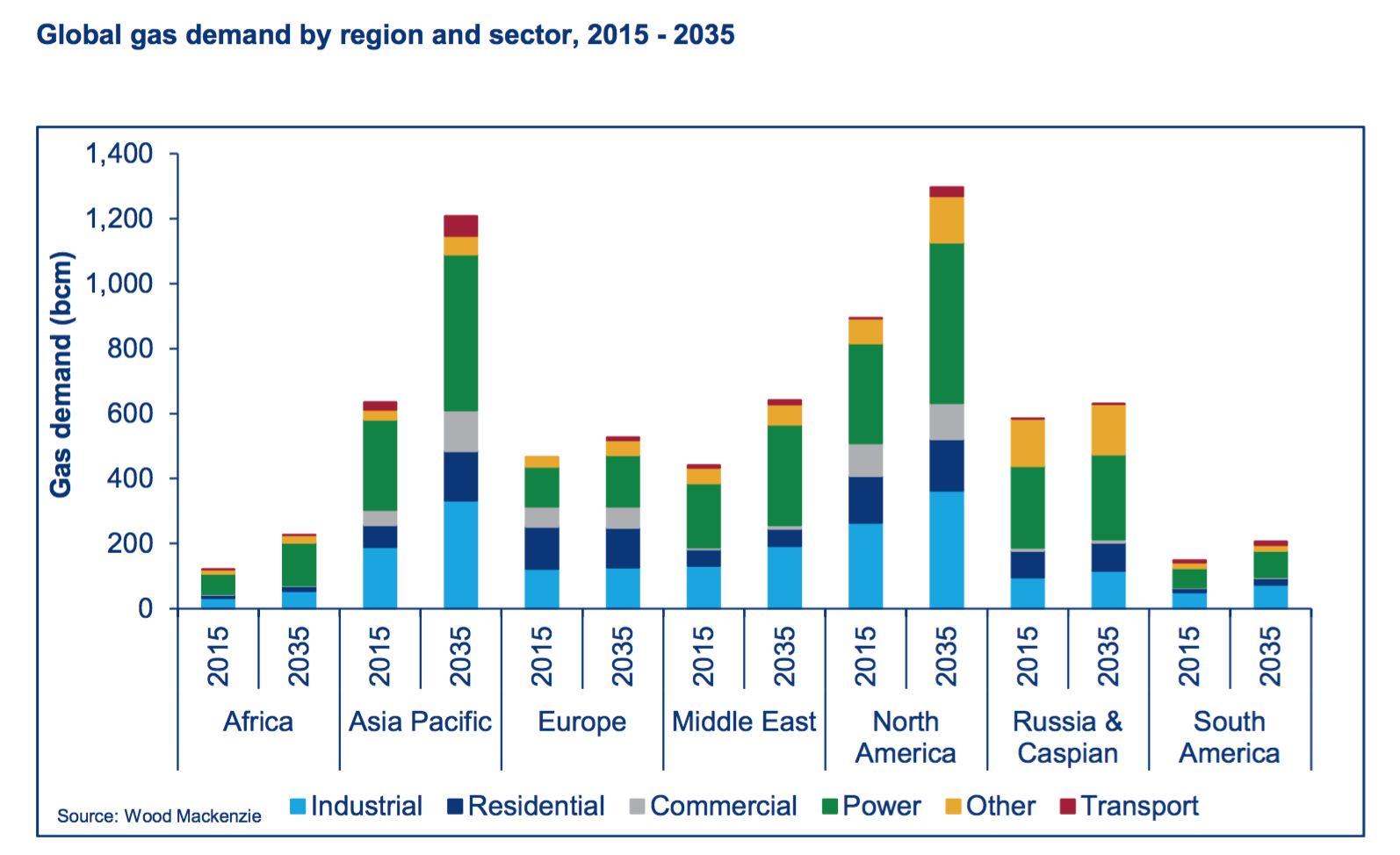

Gas expands to fill the space

The award for most improved market share in absolute terms goes to gas. While oil and coal will see a small bump, global gas gas demand will grow 41 percent and claim coal's trophy for second most popular energy source.

Much of that success derives from the expanding role for gas in the power sector. In the U.S., gas in the power generation mix will grow 60 percent for that period, working alongside renewables to outcompete coal. Chinese gas demand for power is expected to grow 366 percent by 2035, and India's by 156 percent. The Middle East will also be turning more to gas for electricity in an effort to conserve oil for exports.

On home soil, the American fracking boom will lead to some striking geopolitical implications.

For one thing, Wood Mackenzie expects the U.S. will ride the wave of cheap gas to become a net energy exporter by 2021, achieving the elusive dream of energy independence pursued by many a president. "Although vocal, the effect of the Trump administration on the markets may be negligible. The markets are ultimately controlled by demand and price," the analysts note.

The interconnectedness of global energy markets nullifies much of what it means to be "independent," but the reduced reliance on overseas imports and the enhanced ability to export could change the way America conducts foreign policy.

More than half of U.S. LNG exports will go to Europe, supplying a fifth of Europe's gas need by 2035. Currently, Russia supplies 35 percent of Europe's gas. Russia is unlikely to sit idly by as the U.S. challenges a key source of leverage over its neighbors.

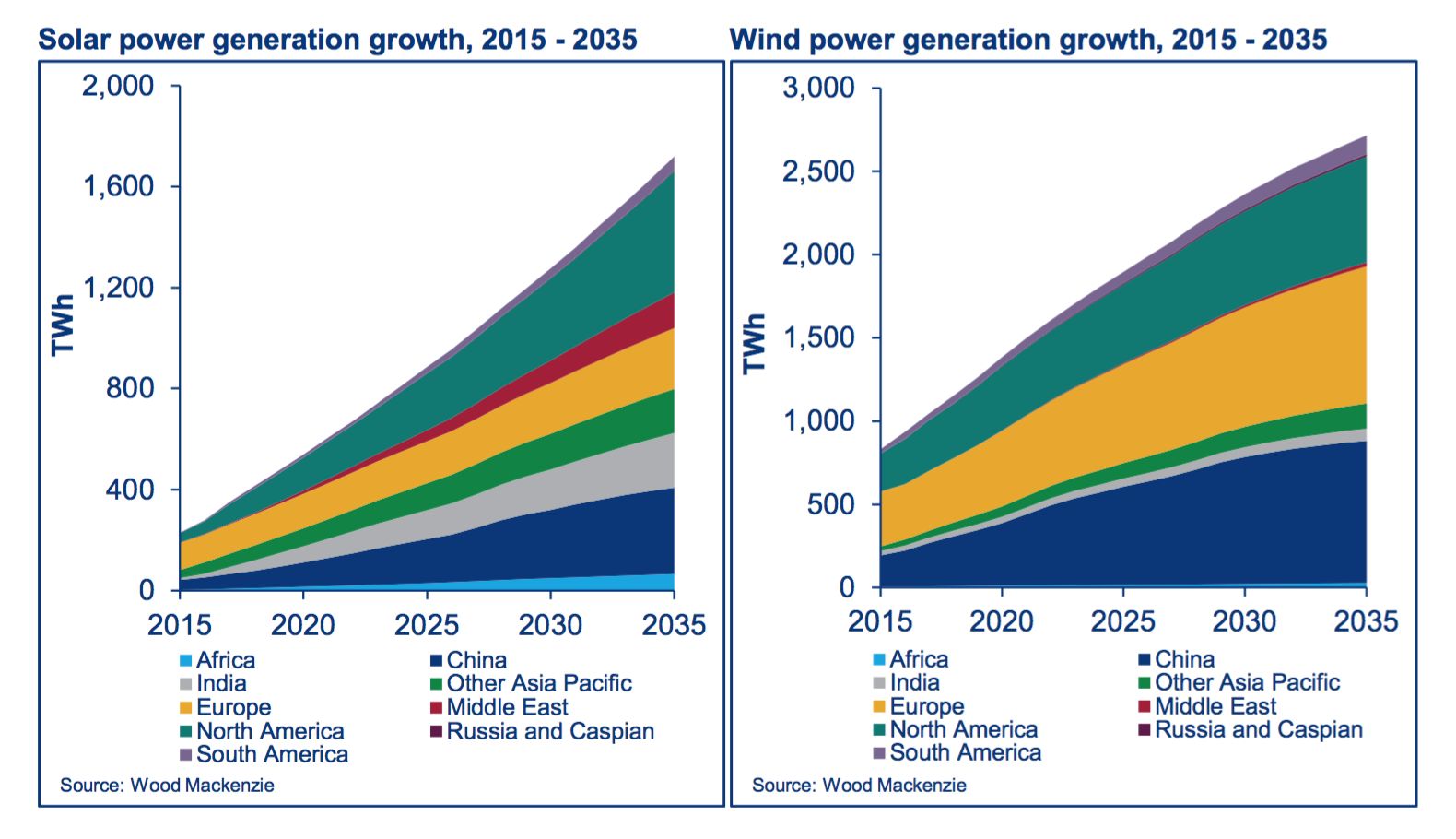

Renewables rising faster

Wind and solar are beating all of the other fuels on speed of entry into the energy mix, but starting from a much smaller base.

Wind will grow 7 percent a year on average, and solar will rise 11 percent. That still only gets them to 13 percent of electricity generation in 2035, up from 4.5 percent in 2015, according to Wood Mackenzie's analytics. The authors note that clean energy technology has already beat expectations several times, though, and this trend could continue.

"Technology is continually improving and is tending to push renewables from their previous role of more expensive green options requiring important government subsidies, to one of serious competitors," the report states. "Renewables are in a strong position to force the market to reshape."

The report also identifies grid-scale energy storage as a "significant risk to our outlook." If the storage industry delivers on its promise of cheap, widely deployed storage in the next few decades, it could boost the renewables market share by making wind and solar power dispatchable and by displacing natural gas for peaking capacity.

That's salient, because 13 percent market share for wind and solar would make achieving the carbon reduction goals of the Paris treaty nearly impossible. A recent report from the Energy Transitions Commission called for wind and solar to power 45 percent of the world's electricity by 2040 to avoid catastrophic temperature rise.

EVs slowly enter the fleet

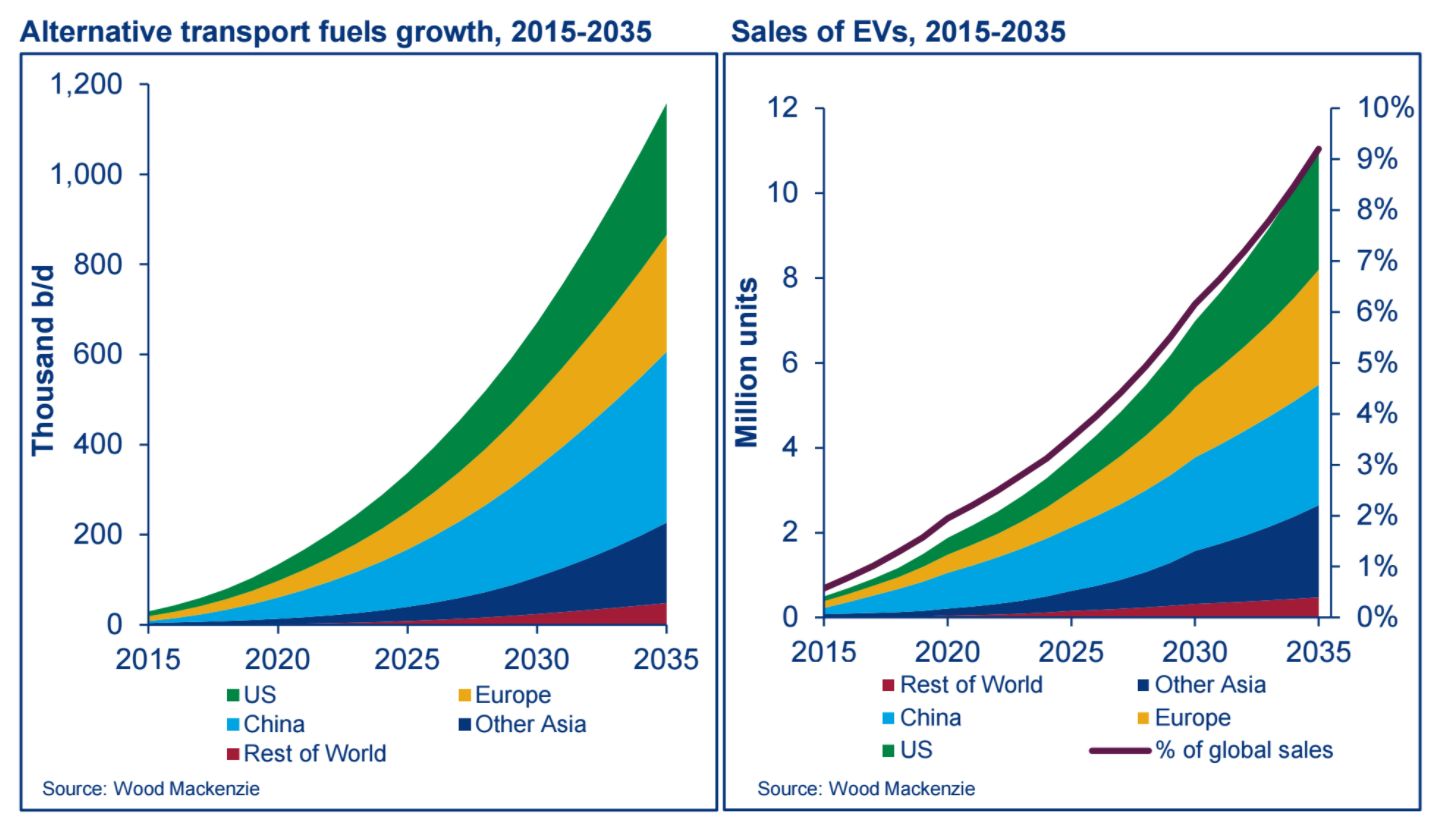

The electrification of transport is also relevant to decarbonization. The report predicts a cumulative electric vehicle deployment of almost 100 million by 2035, displacing 1 to 2 million barrels a day of oil demand.

Faster-than-anticipated battery improvements have helped EV sales grow exponentially, outpacing expectations. "But given the average lifespan of a car is over 10 years, it will take decades for EVs to significantly penetrate the global car fleet," the report states. EVs currently account for 1 percent of the worldwide vehicle fleet. By 2035, Wood Mackenzie projects EVs could grow to 9 percent of all vehicles.

The level of EV penetration will ultimately depend on additional technology advancements and government policies, since vehicle sales and infrastructure still rely heavily on subsidies.

Overall, these changing dynamics in the global energy landscape show carbon emissions on the decline.

Overall, these changing dynamics in the global energy landscape show carbon emissions on the decline.

"Globally, carbon and energy intensity have peaked and will trend downwards towards 2035," the Wood Mackenzie report states. "Even fast-developing, emerging economies such as India show a reduction of greater than 30 percent in both energy and carbon intensity over the forecast."

The trends are moving in the right direction for the international climate change goals. But given the relatively modest pace of clean energy adoption, the current trajectory may not be sufficient to meet them.