Out of this year’s collapse of German wind turbine manufacturer Senvion comes a major development in the wind turbine service industry.

Earlier this week, Siemens Gamesa Renewable Energy confirmed the purchase of Senvion’s European service fleet for €200 million ($222 million). The acquisition is expected to fully close by March 2020, and it will add nearly 9 gigawatts' worth of Senvion service contracts — and more than €200 million in associated annual services revenue — to SGRE’s balance sheet.

Services businesses are key to OEMs' survival

In May 2019, Wood Mackenzie published its view on the possible scenarios surrounding the path forward from Senvion’s insolvency in a brief entitled “Wind market woes: Senvion's future prospects." We emphasized how splitting up the entire company and selling the constituent pieces would make the most sense to secure the greatest value.

In this context, SGRE’s acquisition is a sound commercial strategy, given that Senvion’s service business remained among the company's strongest and most profitable segments.

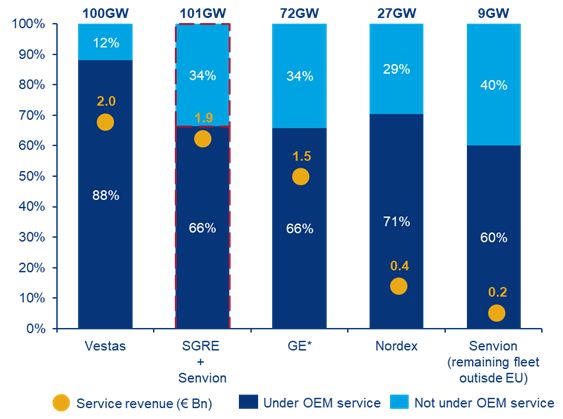

O&M remains the most profitable value-chain segment within the wind power industry, which explains the emphasis turbine OEMs place on servicing. These companies use the profits from services revenue to offset the steadily declining returns from new equipment sales. As global pricing pressure has compressed margins on turbine unit sales, mainly driven by a proliferation of competitive auctions, the O&M segment remains one stable path for OEMs to protect company profit margins.

Most of Senvion’s 18-gigawatt operating turbines are located in Europe, close to SGRE’s engineering centers and supply chain. More than half of this fleet is made up of Senvion's 2-megawatt MM platforms. This creates the perfect combination for servicing teams: a homogenous, demographically dense fleet with easy technician access and simplified spare-parts requirements.

Senvion has been very successful with service contract retention. Wood Mackenzie estimates that around 80 percent of Senvion’s installed capacity in 2018 was under original equipment manufacturer O&M agreements — an enviable proportion compared to its Western rivals.

Source: Wood Mackenzie Power & Renewables

The battle for multibrand services heats up

The addition of Senvion's contracts increases SGRE's competition with Vestas’ multibrand servicing segment, with both companies now equal in terms of third-party technology serviced, at more than an estimated 10 gigawatts each. Crucially, SGRE was able to add 9 gigawatts' worth of service contracts without having to renegotiate the agreement terms.

Although the scope of the deal is limited to Senvion’s European business, owners of Senvion turbines in other regions will be watching with interest to see how SGRE will integrate the turbine manufacturer's European service business and blade factory.

The acquisition's ultimate degree of success will be a big factor for owners of Senvion turbines deciding whether to choose SGRE for O&M contract extensions and renewals. U.S. self-performing asset owners may be particularly interested in a hybrid O&M arrangement with SGRE, especially if Senvion does not recover from insolvency.

While it is still too early to truly evaluate the success of the Senvion acquisition, SGRE does have several important advantages. The company has a strong services presence in multiple regions and a robust supply chain — which has only strengthened with the inclusion of the Senvion blade factory in Portugal. This allows SGRE to pick up additional Senvion services in markets where that company traditionally hasn’t had a strong presence, such as in Latin America and the U.S., as well as to optimize asset-owner servicing costs.

Should SGRE succeed in integrating its new acquisition, it will be in a prime position to grow its multibrand service offering.

***

Leila Garcia da Fonseca and Daniel Liu are Wood Mackenzie analysts covering solar and wind operations & maintenance. Wood Mackenzie's renewables O&M coverage includes, Offshore wind operations and maintenance trends 2019, Global Solar Operations and Maintenance Report 2018, The increasing role of digital in the solar PV O&M space, and the forthcoming Onshore wind operations & maintenance 2019.

In Paris for EU Utility Week? Register your interest in joining Wood Mackenzie's November 13 breakfast presentation on new power markets research, right down the street from the convention center.