Everywhere you look, the off-grid clean energy market is booming.

Sub-Saharan Africa is seeing 300 percent compound annual growth in off-grid lighting; Bangladesh is putting up 30,000 to 40,000 solar home systems every month; and d.light, a for-profit seller of solar lights, recently reached its 1 millionth customer.

If these numbers haven’t raised the attention of institutional investors, perhaps this will: half the planet’s population may be best served with pay-as-you-go solar technology, not grid services.

That’s cleantech’s next big frontier, according to energy expert Ted Hesser. I caught up with him after a recent presentation at Stanford University (video below) to get a better understanding of why he’s bullish on pay-as-you-go solar’s ability to end energy poverty -- and to make investors a whole lot of money.

Ted’s thesis is simple: poverty and profit tend not to mix -- except when it comes to solar power for the poor.

The best way to understand this is to consider the case of a villager in Tanzania. Let’s say she lives in a community where there is no grid, but she has a mobile phone or other device and really wants to keep it charged. So she opts for a small home solar system to cover basic needs like mobile charging.

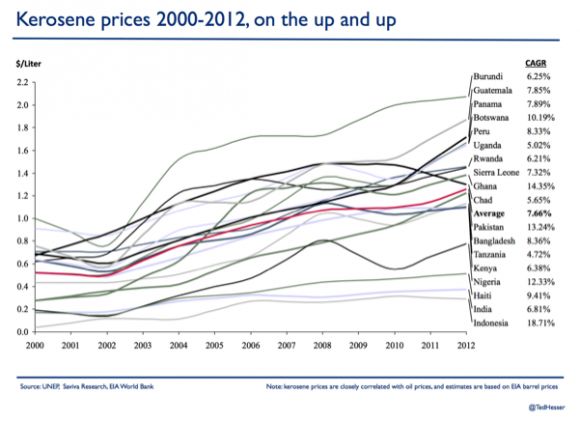

Due to a combination of newfound purchasing power, declining solar system costs, increasing kerosene costs, and advances in solar services business models, she can pay that system off in one to three years. Compare that to a person living in the Northeast U.S., where a homeowner could require a fifteen- to twenty-year payback, and you can see just how compelling the economics are for this market.

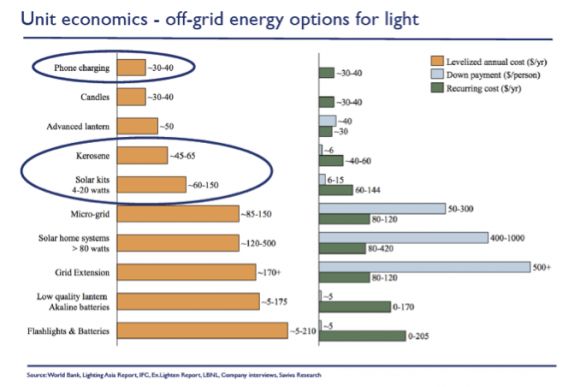

But here’s Ted’s most important point: solar is actually cheaper than the alternative (kerosene plus phone-charging) when financed.

That’s because close to 1 billion people have risen above the poverty line over the past twenty years, with an estimated 3 billion people now earning between $2 and $10 a day. That money is currently spent on costly and polluting energy sources like kerosene (or even worse, candles). Selling cheap basic services like solar electricity into this market through micropayment schemes is what makes pay-as-you-go solar not only economically viable, but perhaps the largest opportunity in energy services worldwide. After all, small is big.

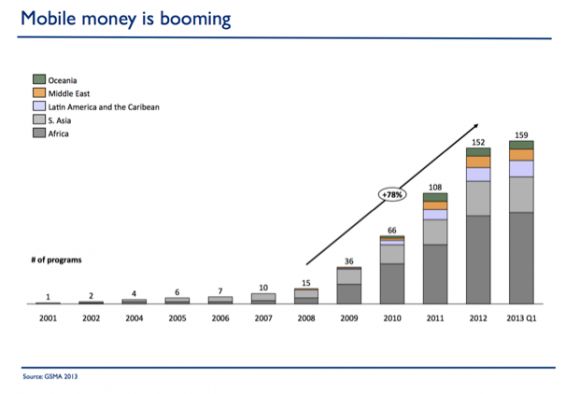

But just because the alternative is expensive, that doesn’t make solar an automatic solution. That’s because people still need financing to cover the upfront costs. That's where business model and financial innovation comes in. From mobile money to scratch cards, pay-as-you-go solar service models are unlocking this market just as third-party ownership did for residential and commercial solar in the U.S.

Another enabling factor is the use of mobile money: money loaded onto cell phones that the poor can use to pay for services like energy. It’s enabled by machine-to-machine technology that gives customers flexibility in how and where they pay.

Mobile money platforms are still nascent, but M-Pesa in Kenya has already enabled over 15 million people to access the financial system, accounting for $12.3 billion in transactions. An exciting example of this model in practice is M-KOPA, which uses mobile money to enable solar home system financing for solar lighting products.

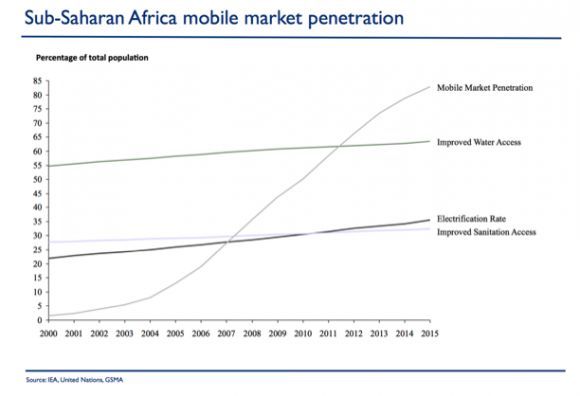

Clearly, mobile phones are important to this story. In 1998, mobile phone penetration in developing countries was just 1 percent. Today, roughly 75 percent of global mobile connections originate in emerging markets. Going forward, four out of every five new mobile connections will come from the developing world, where reliable grid access is scarce. For much of the world’s poor, access to mobile networks has surpassed access to energy, water and even basic sanitation -- leaving an estimated 550 million people with phones who can’t even charge them on a regular basis.

So if all these factors are aligned, why isn't more being done? The answer boils down to finance. Right now, the space is cash-starved and entrepreneurs are spending the vast majority of their time cobbling together financing, rather than serving their customers. To rectify the situation, a large group of entrepreneurs is calling for a $500 million fund from the World Bank for these small-scale projects. Solving the finance problem is the top priority.

Ted Hesser believes the problem is a mislabeling of the space. He doesn't call it "impact investing" or "social entrepreneurial activity" -- instead, he sees it as a pure profit play. Once investors realize the opportunity and develop the viable business models to harness it, the money will flow more readily into this vital market. The only question is which investor will be smart enough to move first.

For more on this topic, listen to last week's episode of the Energy Gang podcast.

Or you can watch Ted Hesser's presentation here:

***

Justin Guay leads the Sierra Club's international program.