New cleantech fundsSolarCity

has suffered some recent setbacks with its loan product offering and managing the expectations of Wall Street. Nevertheless, the capital markets and SolarCity's equity partners remain enthusiastic about investing in solar rooftops. The company just created a new tax equity fund to finance $249 million in solar projects. According to Radford Small, the company's executive VP of capital markets, "SolarCity has now created 50 project funds with 21 different financing partners."

Andrew Chung just closed on one of the largest first-time independent venture funds -- with $200 million "in the bank" for the recently formed 1955 Capital. Chung, most recently a partner at Khosla Ventures, spoke to GTM about "investing in technology in the U.S. and Europe that can solve the challenges in the developing world" in fields such as energy, food, agriculture, health care -- "all the save-the-world stuff, instead of what's hot." Chung was a board member on several of Khosla Ventures’ startups, including LanzaTech, Ecomotors, BioConsortia, Cogenra, Pellion and Wattpad.

Statoil ASA is looking to invest as much as $200 million in renewable energy as part of its plan to diversify Norway’s biggest oil and gas producer’s portfolio. "A new fund, Energy Ventures, will take a minority stake in startups developing technologies including wind power, energy storage and smart grids," according to a company statement, as reported by Bloomberg.

French oil and gas giant Total (the majority owner of SunPower) has taken modest ownership positions in at least two solar power startups through its $150 million Total Energy Ventures fund. Reuters notes that both startups focus on off-grid solar power in developing nations. "Off Grid Electric develops and distributes home solar systems and battery storage to power small appliances, while Powerhive develops and operates solar power microgrids with battery storage and local distribution."

AngelList now has its first investment syndicate dedicated to cleantech, led by investor and author Ramez Naam. Naam said he will focus on "energy storage, in startups that reduce the total system cost of solar or wind, and in software, finance, or internet of things startups that accelerate clean energy, energy storage, and energy efficiency.”

Cleantech M&A and IPOs

Kurion's business in nuclear-waste cleanup at Fukushima and other radioactive sites was acquired by Veolia for $400 million. Kurion was incubated by Lux Capital with investment from Firelake Capital and private investor Arthur Samberg. The company raised less than $6 million since its inception. A 43X return for the investment firm makes the Kurion acquisition one of the most successful VC multiples for a company in this sector that we've seen, perhaps ever.

The Financial Times notes that aspiring Japanese EV maker and Tesla competitor GLM is readying an IPO. The company has raised more than $18 million, according to reports.

Cleantech venture capital

Renew Financial raised $70 million in growth capital to expand its clean-energy and energy-efficiency finance products across the U.S., as reported by GTM's Katie Tweed. The startup offers financing including on-bill property-assessed clean energy (PACE) financing and energy efficiency loans. Last year, Renew Financial received $100 million from the New York Green Bank and Citi to expand its consumer lending program for energy efficiency. The company also completed its first securitization of residential PACE bonds in 2015. Investors in the growth capital round include Angeleno Group, Apollo Capital Management, Claremont Creek Ventures, LL Funds, NGEN Partners and Prelude Ventures.

Sunverge Energy closed a $36.5 million Series C round, as reported by GTM's Jeff St. John. The California startup calls itself a "utility-centric" storage integrator that wants to aggregate behind-the-meter batteries for demand response, frequency regulation, and smoothing intermittent renewables. The firm says it has between 700 and 800 systems in operation around the world. The battery systems (not including the controls software) cost between $8,000 and $15,000 and range from 6-kilowatt-hours to 23-kilowatt-hours in size. AGL Energy Limited, a large investor-owned utility in Australia, led the round.

Arctic Sand Technologies, an MIT spinoff commercializing a more efficient power conversion technology, raised $19 million in Series B funding led by Murata Manufacturing, along with GE Ventures, Northwater Capital and Arsenal Venture Partners. The initial market entry point is in powering LED backlighting for displays and microprocessor cores for mobile applications.

SunFunder raised $17 million in equity and debt in 2015 for off-the-grid solar projects from investors including Treehouse Investments, Khosla Impact, Schneider Electric, Better Ventures, Iberdrola, Deutsche Bank, and Ceniarth. The Series B investment is "aimed at helping SunFunder achieve its goal of catalyzing billions of debt financing into solar projects in emerging markets in the next decade."

Joi Scientific, a startup that produces hydrogen gas "safely, affordably and with no carbon emissions," raised more than $5 million for "the world’s first on-demand hydrogen production process based on the clean and cost-effective extraction of hydrogen from water at the point of use.“ Dean Woodman, co-founder and seed round investor of sports camera company GoPro, and co-founder of investment bank Robertson Colman Stephens and Woodman, was the lead investor.

EnTouch Controls, a provider of facility asset and energy management intelligence leveraging the commercial internet of things, completed its $8 million Series C round led by Egis Capital Partners with new investors Traverse Venture Partners, Aster Capital and Calvert Investments, along with existing investors SJF Ventures and Trailblazer Capital. The company added energy and facility management features that support demand response and peak energy management. It recently signed strategic partnership agreements with EnerNOC and Interface Security Systems.

Ecova, an energy management company, invested an undisclosed amount in data analytics firm Trove last week, joining Avista and Itron as investors. As Jeff St. John reported, "The company’s specialty is in pulling together hundreds of sources of data on utility customers, including property records, department of motor vehicle records, government information, and consumer and demographic information. It then merges all that data with the data coming from utility smart meters and puts it to use to solve specific utility business challenges."

American Solar Direct, a developer and financier of solar projects, won an undisclosed amount of funding from Dubai-based Adenium Capital.

GTM's earnings calls coverage

Enphase Meets Quarterly Guidance, Focuses on Cost Reduction Strategy

SolarEdge Holds the Lead in Module-Level Power Electronics

SunPower CEO: ‘Fundamentals for Solar Have Never Been Better’

Revenue Slumps in 2015, But EnerNOC Expects to Be Cash Flow Positive by 2018

Musk Builds Confidence on Ambitious Growth Targets as Tesla Reports Q4 Losses

A new way to fund a company

Stealthy Moore's Law Battery is not going the conventional route of raising money from strategic investors. Instead, the battery firm placed a full-page open letter to Elon Musk and Tim Cook in the Wall Street Journal last week.

The letter stated, in part:

This technology has been developed by a well-funded American company that will now reveal research results to a selected group of potential partners. It has not been, and will not be, disclosed in any research literature. All product manufacturers listed on the NYSE or Nasdaq having a market capitalization of more than $500 million may request an invitation to a meeting where additional technological results, including full-cell data, will be shared. No investment bankers, venture capital companies, government representatives, or members of the press will be allowed. Only those companies attending the meeting will receive further technical disclosures.

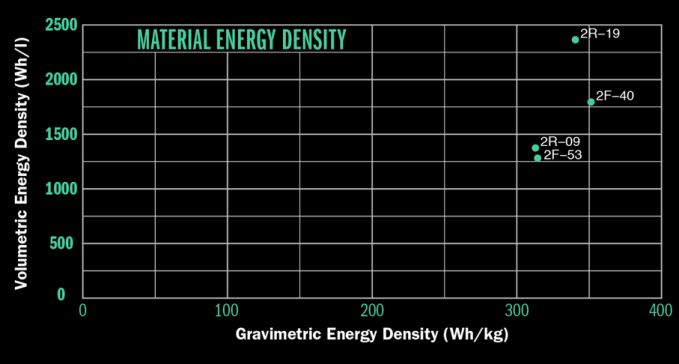

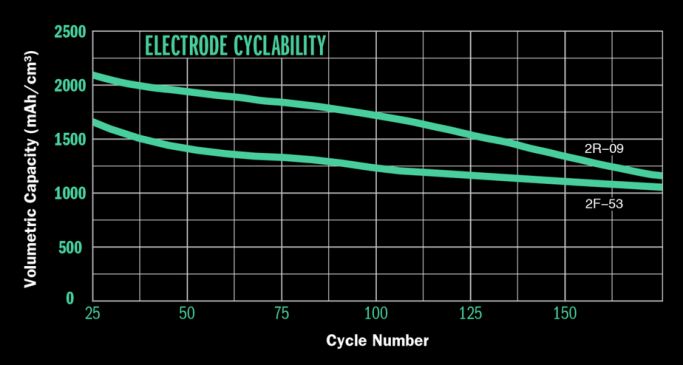

The company provided these battery performance specs:

A battery technologist colleague responds: "The energy density looks very good. The cyclability plot is disturbing; it shows 30 percent to 50 percent capacity loss in 200 cycles. I'd want to see about 10X better than that before buying the battery for a transportation application. I'm guessing with good density and poor cyclability, they are targeting portable or disposable applications."

SolarEdge goes Willy Wonka with $10,000 "golden" solar panel optimizers

SolarEdge, a market leader in module-level panel electronics, recently shipped its 10-millionth optimizer unit (5 million shipped in the last year.) To mark the occasion, SolarEdge is shipping 10 special "golden" optimizers, signed by the company's founders, that can be redeemed by the lucky customer for $10,000 in cash.