Broad tax legislation advanced by the U.S. Congress in recent weeks is headed toward a conference committee, where Republicans in the House and Senate will hash out their differences. In this article we identify which provisions matter most for clean energy.

Electric vehicles

Currently, buyers are eligible for a federal tax credit of up to $7,500 per electric vehicle. The existing program is capped at the first 200,000 qualifying vehicles sold by each auto manufacturer. The House bill repeals this credit, while the Senate bill keeps it.

While some manufacturers, like Tesla and General Motors, are already close to hitting the 200,000-vehicle limit, repealing the tax credit could still have a significant impact. Under current law, after the limit is hit, unlimited credits are available for the subsequent year -- at $7,500 for the first two quarters, $3,750 for the third quarter and $1,875 for the fourth quarter. Therefore, eliminating the credit could still impact tens of thousands of Chevy Bolt and Model 3 buyers.

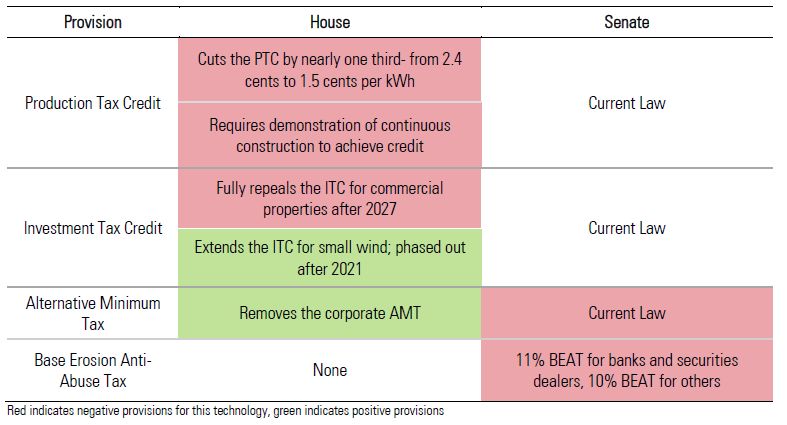

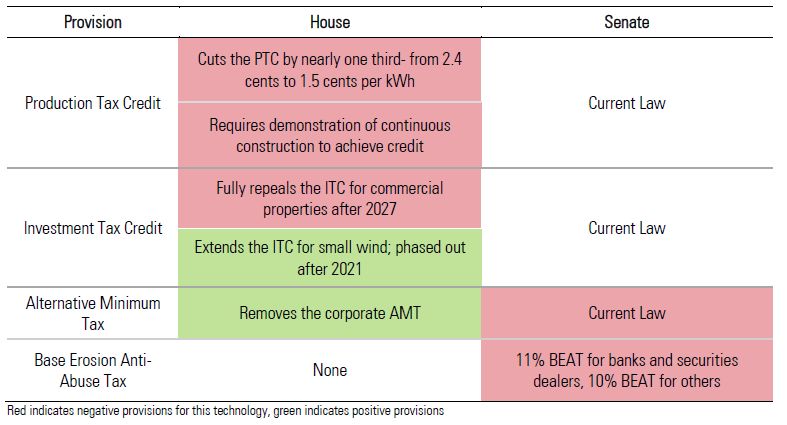

Wind

The House bill removes the inflation adjustment in the Production Tax Credit (PTC), returning it to its original 1.5 cent per kilowatt-hour level, down from the current 2.4 cents per kilowatt-hour. It also changes the qualification criteria from simply commencing construction on a project to having to show a plan of continuous construction. Less important, but still negative, is removing the 10 percent Investment Tax Credit (ITC) after 2027. On the plus side, the House bill extends the 30 percent ITC for small wind that expired in 2016 until 2021.

It also removes the current 20 percent corporate alternative minimum tax, which didn’t previously matter for wind developers but will if the regular corporate income tax rate is reduced to 20 percent as well (a provision included in both the House and Senate bills). In that scenario, more companies will likely pay the AMT, under which only four years of wind production can receive the PTC, rather than the normal 10.

The Senate bill leaves the PTC and ITC untouched but retains the corporate AMT. Even more concerning to wind developers is the inclusion of a Base Erosion Anti-Abuse Tax (BEAT), which is intended to prevent “earnings stripping,” whereby companies use cross-border payments to reduce their U.S. tax liability. The BEAT aims to combat this by imposing a 10 percent minimum tax (11 percent for banks and securities brokers) on an income calculation that excludes cross-border payments.

Because taking advantage of renewable energy tax credits reduces some companies’ regular corporate tax rate to less than 10 percent, the BEAT provision in the Senate bill could reduce the market for those credits.

Solar

The House bill reduces the value of the solar ITC. As with the wind PTC, it changes the solar ITC qualification from simply commencing construction on a project to having to show a plan of continuous construction. This will limit solar project developers’ ability to get longer-term projects in ahead of the phase-down of the current 30 percent ITC in 2020 by doing some site prep and prepurchasing some equipment. The House bill also eliminates the permanent 10 percent solar ITC in 2027. Far more damaging to the solar market is the BEAT provision in the Senate bill, for the reasons discussed above.

Geothermal electric

Geothermal electric power plants currently have a permanent 10 percent ITC. Under the House bill, this would be eliminated in 2027. Geothermal would also likely get hit by the BEAT provision in the Senate bill, though not nearly as much as wind and solar due to less reliance on tax equity partners.

Nuclear

The 2005 Energy Policy Act provided a 1.8 cent per kilowatt-hour tax credit for up to 6 gigawatts of new nuclear reactors. That credit was originally scheduled to expire in 2020, but the House bill removes that deadline. This will ensure that the two AP1000 reactors Southern Company is adding to its Vogtle site will receive the credit (if they are completed). There will also be additional capacity available for small modular or other advanced nuclear power plants in the future.

Fuel cells

The House bill was welcome news for fuel cell technology. The 30 percent ITC, which had expired in 2016, is extended to 2019 and then phased out in 2022. This provision was not included in the Senate bill. Fuel cells would be negatively impacted by the BEAT provision, but to a lesser extent than wind and solar.

Carbon capture

Under current law, state and local governments can issue private activity bonds (PABs) to fund projects with a public purpose, such as affordable housing, water and sewer facilities or infrastructure. The provision has been used to finance carbon-capture projects. The House bill eliminates PABs while the Senate bill leaves them intact.

CHP, geothermal heat pumps and microturbines

For combined heat and power, geothermal heat pumps and microturbines, the House bill extends the 10 percent ITC that expired in 2016 through 2021. This provision is not included in the Senate bill. These energy sources could be negatively impacted by the Senate bill’s BEAT provision, but much less than wind or solar.

This story was republished with permission from the Rhodium Group. View the original research note here.