Today’s smart grid is a tangled web of communications technologies, some of them decades old, some of them brand new -- but almost all of them proprietary in nature. Where standards for interoperability do exist, they’re complicated by the fact that utilities still need them to interoperate with existing gear, ranging from SCADA systems to the latest in 4G wireless, and everything in between.

Enter the Wi-SUN Alliance, a Japanese group with international partners including Silver Spring Networks and, most recently, Cisco. Wi-SUN is working on a complicated goal: to get a global set of manufacturers to agree on some common specifications for the communications gear they’re building for the smart grid.

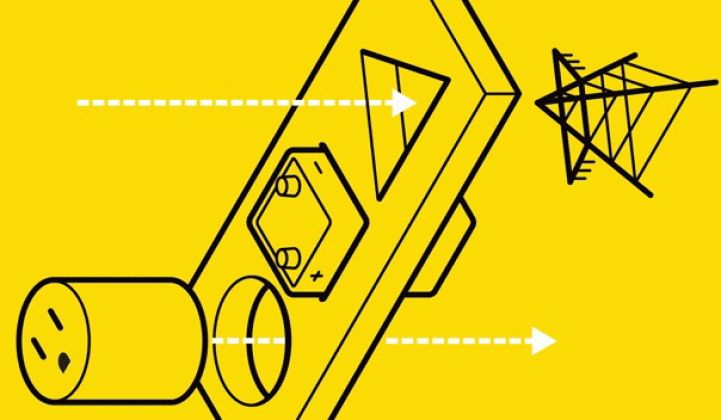

In a Tuesday morning blog post, Cisco laid out its role in Wi-SUN (so named for "smart utility networks"), focused on its vision of field-area networks (FAN) built on devices from multiple partners, all built on Internet Protocol (IP). Other Wi-SUN partners include Fuji Electric, Murata Manufacturing, Omron Corp., Osaki Electric, Renesas Electronics and Japan's National Institute of Information and Communications Technology (NICT).

Wi-SUN has thrown two interoperability events so far, but it hasn’t set any hard dates for when it expects the first set of certifications to be released. As Gary Stuebing, global smart grid standards managing engineer for Cisco’s connected energy networks (i.e., smart grid) business, noted in a Monday interview, the group has a long road ahead of it.

To get there, Wi-SUN members are busy hashing out a certification regime, likely based on existing technologies in key markets like North America, Europe and Japan/Asia, he said. At the end of the line, “What we really want is devices from different manufacturers that can talk to each other at some base level,” he added.

Wi-SUN is focused on the IEEE 802.15.4g and 802.15.4e specifications, which deal with the physical and media access control (i.e., PHY/MAC) layers of the network in which these devices operate. It’s not the only Japanese group working on these standards -- another group, including NICT, Elster, Itron, Landis+Gyr and Silver Spring Networks, announced their participation on the latest 802.15.4g efforts in May.

Elster, Itron, Silver Spring and Landis+Gyr, which was bought by Toshiba for $2.2 billion in 2010, also represent a list of likely contenders for Japan’s much-anticipated smart meter deployment plans. Tokyo Electric Power Co. (TEPCO), the country's biggest utility, wants to deploy about 17 million smart meters over the span of the decade, and could help set nationwide standards in choosing its partners. New Wi-SUN Alliance partners also include Huawei and Toshiba, indicating other communications contenders on the horizon.

Cisco, of course, is already supplying its own IPv6-ready, 802.15.4g-congruent wireless-and-wireline communications technology, via its smart grid switches and routers being deployed by utility partners worldwide, as well as through partners including Itron, Elster and Alstom. Last month it landed its first toehold in Asia with a pilot project for China Light and Power Hong Kong, featuring Itron’s cellular-connected meters and Cisco’s connected grid management system.

But Wi-SUN members will also need to contend with some key regional differences, including the use of different radio bands for the underlying 802.15.4g technology in different regions, Stuebing noted. For example, Elster, Itron, Landis+Gyr and Silver Spring all use 900-megahertz radios for North American smart meter deployments, but those bands are largely reserved for other uses in Europe and Japan, requiring a different approach.

Other complications arise in matching field-area or neighborhood-area networks -- FAN and HAN, in smart grid parlance -- to the different wireless technologies meant for so-called home area network (HAN) use. For example, while U.S. smart meters have largely chosen the low-power ZigBee wireless standard, “the Japanese have a strong interest in EchoNet,” an alternative standard, Stuebing said -- “so if we want to operate in Asia, we have to be interested in EchoNet as well.” At the same time, we’ve seen IPv6-capable home area networks rolled out by contenders like GreenWave Reality and NXP, and promised by Google’s Android@Home platform.

Cisco would certainly like to see future Wi-SUN certified devices integrate well with its own technology, particularly on the distribution automation front, Stuebing said. He previously worked for Duke Energy, the country’s biggest utility and a big Cisco smart grid partner, on its slow and measured approach to its smart grid deployments, so he’s aware of how long it takes for the utility industry to get on board with new technologies.

But one thing’s for sure, he said -- “Utilities love standards, because that means they don’t have to single-source anything.” That basic idea of opening up the smart grid to a plug-and-play approach is far more complex to implement in the real world, of course -- and Cisco no doubt would like to be the platform of choice to make it all happen.