As China primes its energy market for explosive growth, the country could see 1 gigawatt of solar power generation capacity by 2011, said a new report by GTM Research.

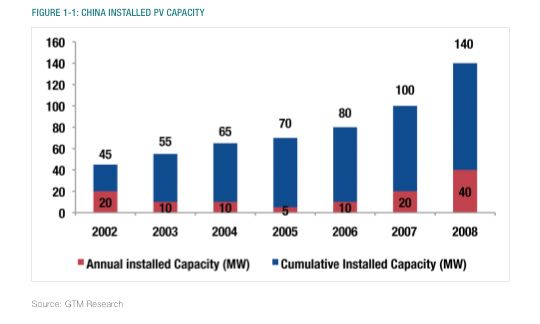

That would be a big jump from the current 140 megawatts of mostly off-grid solar power generation capacity, assuming that China is on track to deploy the incentives it outlined earlier this year and approve projects without delay, the report said.

If the government is able to speed up approval and distribute funds quickly, then the installed capacity could grow to roughly 1.8 gigawatts. But first, the government will likely go through some learning curve though next year.

"Growth is likely to be lumpy and uneven, as bottlenecks will inevitably arise in the project approval and funding disbursement process," wrote the report's two authors, China-based Matt Miller and Matthiah Larkin. "This is principally because there are many political layers involved (local government, provincial DRC, NDRC, and the Ministry of Finance, at a minimum), and because application volume will be extremely high."

The report offers a detailed look at China's power industry and policies over the last three decades, and how they could shape the country's solar energy development (see the summary).

The authors based their projections on information from the myriad of projects proposed by power producers and China-based solar energy equipment makers, and they took into consideration these projects' development time frame, policies that affect their costs and the likelihood of securing the necessary financing.

China is poised to become a breakout star in the solar world as the government embarks on ambitious plans to dramatically increase the country's generation capacity. The goal isn't just to embrace cleaner energy, however.

The government has announced two programs this year that it hopes will help out domestic solar energy equipment manufacturers. These companies have grown quickly in recent years thanks mainly to the generous solar incentives in European countries such as Germany and Spain.

The recession – and Spain's decision to cut its subsidies for 2009 – have battered Chinese solar companies, which export more than 95 percent of their products.

It was only two years ago when the government was setting a new energy policy that called for reaching 300 megawatts of solar generation capacity by 2012 and 1.8 gigawatts by 2020, the report said. Back in 2007, more than 50 percent of the cumulative capacity came from off-grid installations, and the government through similar trends would continue.

China is looking at setting a goal of reaching 10 gigawatts by 2020.

The first incentive program announced by the Chinese government earlier this year would subsidize the costs of installing solar energy systems on building (see Confusion, Political spat Emerge for China Solar Subsidies). The government proposed offering up to 20 RMB ($2.93) per watt for solar-panel installations that are 50-kilowatt or larger. That amount could pay for 50 percent to 60 percent of a system's installation costs.

The second program, called the Golden Sun, would see the government paying for 50 percent of the costs of building grid-connected a solar power projects and up to 70 percent for off-grid projects in remote areas (see Chinese Gov't Will Pay to Install 500MW Solar).

The government also is expected to announce a feed-in tariff program for setting solar electricity prices. The pricing would be higher than what's paid for conventional power in order to spur solar power plant development.

In 2006, China began imposing a surcharge to generate money for renewable energy development, and the fund could support 5 gigawatts of solar projects from 2009 to 2013, said the report. But that much development would happen only if the government doesn't use the money for wind, biomass or other renewable energy projects.

The fund for 2009 is estimated at $1.06 billion, and it could reach $1.45 billion in 2013.

Given the dynamics of China's power industry, power plant projects developers could see thin profit margins.

The government hasn't set a solar feed-in tariff, but it could be as low as 1.09 yuan per kilowatt hour ($0.16). Some other solar companies are hoping to a higher tariff.

The 1.09-yuan figure was the winning bid for a 10-megawatt project that just began construction in Dunhuang City, Gansu province. The China Guandong Nuclear Power Holdings, LDK Solar and Enfinity are heading the project.

Although the government is keen on expanding renewable energy generation aggressively, it also is inclined to keep electricity pricing low to keep boosting the country's economic growth.

The National Reform and Development Commission (NDRC) sets wholesale and retail electricity prices and often has to deal with strong resistance from local officials and businesses when it considers rate increases.

This dynamic makes it "unlikely that any company outside of a government-owned or affiliated developer will be a major player in domestic project development. For foreign developers or joint ventures, it is likely that the only way to make project economics work at current and proposed tariff rates would by selling" carbon offset credits, the report said.

But solar panel makers and their suppliers wouldn't face a similar squeeze, given that a major goal of these government programs is to help boost their growth.

China should have the capacity to produce about 7 gigawatts of solar cells in 2010 and 8.1 gigawatts in 2012.

While the government invests in adding solar energy to the country's power mix, it also is looking at slowing the expansion of its solar energy equipment manufacturing industry. The government issued a statement saying that "overcapacity and redundant projects" are now plaguing steel, cement, wind and silicon businesses. It could restrict these industries' access to financing and markets and toughens environmental and land-use regulations to rein in these sectors.