A little while back, I was at an industry happy hour (hey, remember those?) where I ran into a friend and well-known industry analyst, Wood Mackenzie’s Michelle Davis. We had caught up earlier in the week to chat about the commercial and industrial (C&I) solar sector, in which my firm specializes and which she researches regularly. And on that street corner in Salt Lake City, we each made a few passing comments about the conference, the growth in C&I solar, the flood of capital into the sector, the increasing interest level and how challenging it is to scale. These challenges exist for a lot of reasons, but as we discussed the sector a bit more, we drifted into the topic of the local and regional nature of C&I. As we were leaving, Davis said to me, “Yes, the tail is very, very long.”

What struck me was not that she was right — as an industry-leading analyst, of course she was. It was more her concise way of describing the market and, frankly, our business model, which is to chase that long tail of C&I solar. And as we have seen recently, it is not just our firm’s business model; it is becoming an asset class increasingly sought after not just by traditional strategic investors, private equity funds and infrastructure funds, but also by investors of all types who are looking for a combination of long and stable returns with a focus on environmental and social governance.

What is the long tail?

As I thought more about the long tail of C&I solar, I began reading about other industries and came across the book that helped coin the phrase: The Long Tail. The author is Chris Anderson, former writer for The Economist and editor-in-chief at Wired. The meaning of its title is encapsulated in its subtitle: “Why the Future of Business Is Selling Less of More.” Anderson discusses three themes that are leading to a longer tail in business: democratization of production, democratization of distribution, and a better connection between supply and demand.

The democratization of production is perhaps most obvious in media and entertainment. The ability to record a song, movie or write a blog post that can be shared across the world in a matter of minutes has spawned businesses such as YouTube and TikTok. Spotify and Netflix are examples of capturing the long tail by democratizing distribution — songs, movies and documentaries previously unavailable or hard to find online or at a physical store are now just part of a consumer’s monthly subscription. Amazon is the archetypal example of a business that better connects supply and demand.

The book introduces us to the producers including YouTube stars and Etsy artists, new markets like those for documentaries on Netflix or the latest esoteric craft beer, and the new tastemakers spawned through Amazon reviews and Instagram influencers.

How does the "long tail" concept relate to C&I solar?

The C&I solar market has its own version of these players. The new producers are developers whose original business may have been energy efficiency, mechanical engineering, roofing installations or commercial real estate. The new markets are not just state markets with policies friendly to renewable energy but also submarkets like rooftop industrial customers in Maryland that host community solar.

But the new tastemakers are perhaps the most important players. They include institutional investors demanding investments with positive environmental and social governance (ESG) criteria, advocacy groups pushing large energy users to reduce their carbon footprints, and innovative energy buyers like Google and Amazon with innovative procurement strategies and contracts that allow long-tail customers such as a village in Ohio to easily procure solar energy and save money at the same time.

These new producers, markets and tastemakers are emerging from a C&I solar sector that’s becoming one of the most compelling and attractive asset classes. Beyond the ESG motivations and the desire for stable, long-term cash flows, the sector is becoming popular relative to other seemingly similar subsectors of ESG and renewables. Within solar and renewable energy, C&I solar has the benefit of offsetting retail energy rates, which are higher than wholesale energy rates offset by utility-scale wind and solar projects. C&I solar is also naturally distributed in nature, which provides investors with portfolio diversity across utility zones, state markets and customer credit profiles.

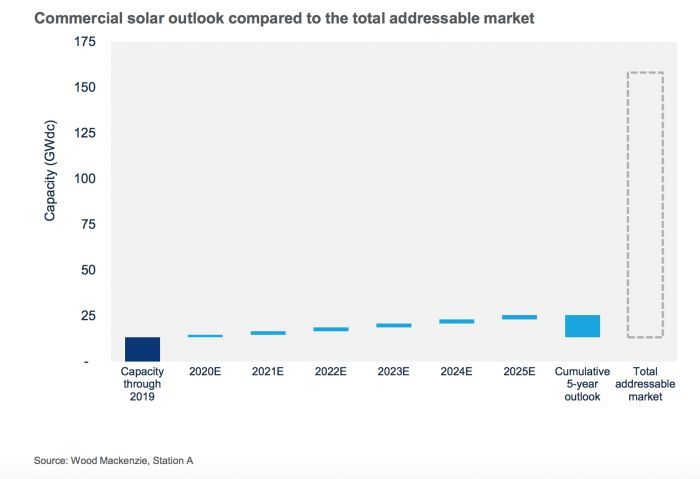

The total addressable market is massive, as made clear from this chart from an insightful report from Wood Mackenzie and Station A, an AI-powered clean energy marketplace.

Capturing the long tail of C&I solar

But while the C&I sector now makes up just over 10 percent of its total addressable market, it can feel incredibly crowded and saturated at times — precisely because of the long tail. There is no doubt that investing in C&I solar makes sense. The market opportunity is there, the policy support is only increasing, the economic case is compelling, and the consumer and corporate demand is growing exponentially. However, many of these new entrants and investors fail to understand just how long the tail is, and more importantly, how hard it is to access the tail.

Processes run by investment banks and tender processes run by consultants only get you so far and are generally a race to the bottom. Bilateral transactions on the long part of the tail require industry expertise, long-term relationships built on trust, and execution certainty that comes from having the full capital stack at hand and technical know-how to build and manage a solar project. On the capital side, it is easy to have a commitment from a fund in a press release, but you also need a lender that understands the complexities of C&I, and most importantly, a tax equity investor that is willing to eat away at their tax bill a few million dollars at a time.

It is undoubtedly more exciting to plan for the perfect situation, raise capital on an idea and a pipeline, and over-engineer a white-board strategy on the front end that sounds good to investors. It takes more patience and expertise to understand and get to know the local partners and markets that the long tail comprises. Often it is best to go through a live transaction and then replicate it once you have proven that the deals do exist and there is a workable process in place. The first deal is always the hardest — and if there are too many soft costs and guardrails involved, there likely will not be a second deal.

Success in C&I solar also requires flexibility. An investor must provide local partners with a flexible platform that funds C&I solar today, but might fund battery storage tomorrow, and EV charging infrastructure next year. If the platform is designed with the local partners in mind first, then the replication and deal flow will take care of itself.

There is an old saying that all politics are local. The same can be said for C&I solar. There is no shortcut in capturing the long tail. It is found over time with certainty, speed and trust. We hear it every day in our business. One day, it’s a baseball coach that needs an amendment to a site lease and says that he will ask the building owner tonight at their son’s baseball practice. The next day, it may be a developer leaving a conference a day early on a red-eye flight to make their local utility commission meeting.

The more local the C&I market becomes, the longer the tail will be. As WoodMac's Michelle Davis so succinctly put it, the tail of C&I solar is very, very long. To fully realize the massive potential of the industry, we need to better connect supply and demand by better connecting high-quality local projects to institutional capital. Let’s hope the industry happy hours come back again soon so we can capture the long tail together!

***

Richard Walsh is a managing partner at Madison Energy Investments, a platform that develops, owns and operates distributed generation projects within the commercial and industrial and small utility-scale sectors.