An organization with members including ExxonMobil and the governments of Australia, the United Kingdom and the United States released a report on Tuesday arguing for the key role of carbon capture and storage in confronting the challenge of climate change.

Members of the Global CCS Institute said 2018 could represent a turning point in the CCS industry because of a critical mass of favorable policies and investments from global governments. The group unveiled its 2018 Global Status of CCS report in an event held at the global climate conference in Katowice, Poland.

Perhaps most noteworthy are the report’s contributors. Though Global CCS Institute members include several national governments and fossil fuel companies, the report highlighted wide-reaching contributions from experts in economics, climate change and Fatih Birol, executive director of the International Energy Agency.

The report aims to undercut common criticisms of CCS in combating climate change — namely, that the technology is still too expensive and not deployable at scale — by pointing out projects planned around the world and the amount of carbon dioxide stored to date.

Source: Global CCS Institute

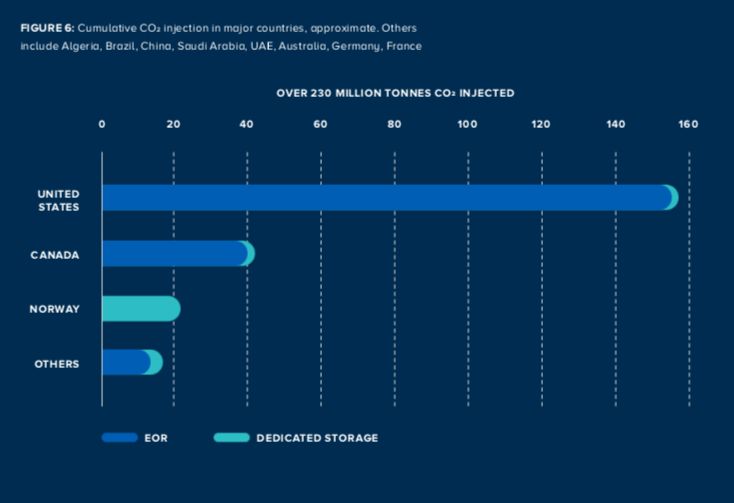

Carbon capture has seen the most success in the United States, where so far projects have stored nearly 160 million metric tons of carbon dioxide. According to the report, 10 of the world’s operating CCS facilities are located in the U.S. (one is a capture facility located in the U.S., but the carbon dioxide is injected across the border in Canada). The U.S. has several large-scale facilities, but only one of those projects is a large-scale CCS power facility: Petra Nova in Texas.*

In the U.S., most captured carbon has gone to enhanced oil recovery, a process that pushes out more oil from a producing well after the extractor has already used primary and secondary methods. That added revenue from EOR helped Petra Nova’s economics. It’s also used at other plants like the Great Plains Synfuels Plant in North Dakota.

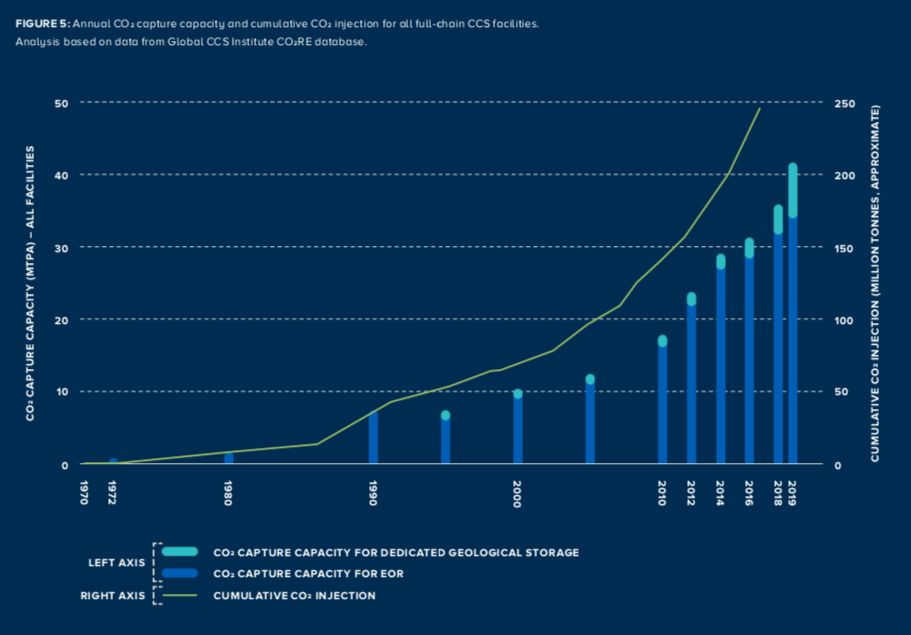

Collectively, U.S. plants can capture about 25 million metric tons per year. For context, in 2017 the U.S. power sector alone emitted 1,744 million metric tons of carbon dioxide, according to the U.S. Energy Information Administration.

But carbon-capture advocates are very bullish, in part because of an energy tax credit, 45Q, that the U.S. passed this year. Under the new credit, projects will get $35 per ton of carbon captured and used for enhanced oil recovery and $50 for carbon captured and stored in geological storage. The previous credits were $10 and $20, respectively.

While proponents of CCS technology said the new credit could make a big difference in the deployment of more projects, a report released this year by power consulting company Wood Mackenzie estimated that projects would need carbon prices of at least $60 to pencil out economically.

The International Energy Agency has said an incentive of less than $40 per ton could support the storage of 450 million metric tons of carbon dioxide per year. The organization calls CCUS (using an acronym that includes "utilization") a “massive untapped opportunity.”

In the report released on Tuesday, the carbon-capture group said 45Q is a keystone policy for an industry gaining momentum. But the group also pointed to the 43 large-scale CCS facilities in operation, under construction or under development around the world. Other countries are beginning to more earnestly invest in CCS policies, with efforts like the United Kingdom’s CCUS Cost Challenge Task Force and a European Commission innovation fund valued at over €9 billion (over USD $10 billion) to support renewables and CCUS energy demonstration projects.

Pushing further carbon-capture policies forward, the group argues, is essential, because CCS is needed to meet the goals set out in the Paris Agreement. In an October report on keeping global temperatures below 2 degrees Celsius, the Intergovernmental Panel on Climate Change stated that the world needs carbon capture in order to reach next-zero emissions.

But carbon capture as an industry depends on a continued reliance on fossil fuels, since carbon dioxide is so commonly used in EOR.

Though carbon-capture capacity increased between 2010 and 2019, relatively few projects use geological storage.

Only in Norway have carbon-capture projects mostly used geological storage.

Australia’s Gorgon project could help change that. When fully online, as it’s slated to be in 2019, the project will be the largest geological storage facility in the world.

*Updated to reflect that Petra Nova is the only largescale CCS power facility in the U.S., not the only largescale facility.