Canadian Solar (NASDAQ: CSIQ) reported its second-quarter financial results today.

While Q-Cells, SunPower, Trina, and even the mighty First Solar have had difficult quarters, firms like Ascent Solar are struggling, and Evergreen Solar has declared bankruptcy, Canadian Solar has exceeded expectations on revenue -- although it has seen some erosion of margins.

CSIQ Q2 2011 highlights from the earnings call:

- Solar module shipments were 287 megawatts, up 58.6 percent from 181 megawatts in the second quarter of 2010

- Net revenue was $481.8 million, up 46.6 percent from $328.7 million in the second quarter of 2010

- Gross profit was $63.7 million, up 42.8 percent from $44.6 million in the second quarter of 2010

- Gross margin was 13.2 percent, compared to 13.6 percent in the second quarter of 2010

Sales to European markets in the second quarter of 2011 accounted for 76.6 percent of revenue, while sales to North America represented 15.2 percent.

Inventories were still high at the firm and up from previous quarters. Guidance for the full year 2011 held at shipments of 1.2 gigawatts to 1.3 gigawatts. The firm is looking to gain market share with growth in the U.S., Japan, and India.

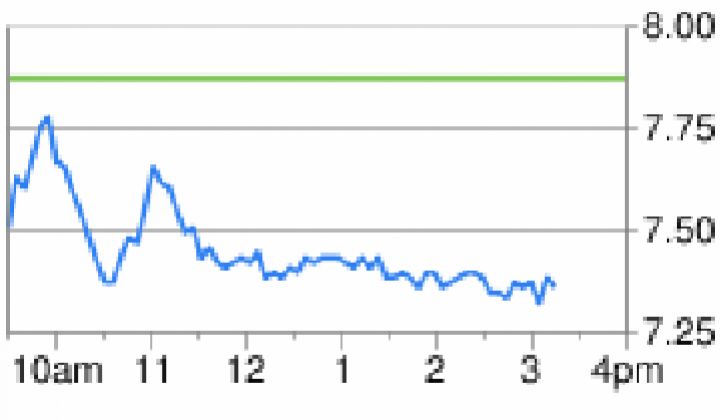

The stock price of the $319 million market cap company is down 6.7 percent in todays's trading.

The outlook on gross margin at Canadian next quarter is dismal. The heady days of 30 percent and 40 percent margins at solar companies might be limited to nostalgic reminiscences.