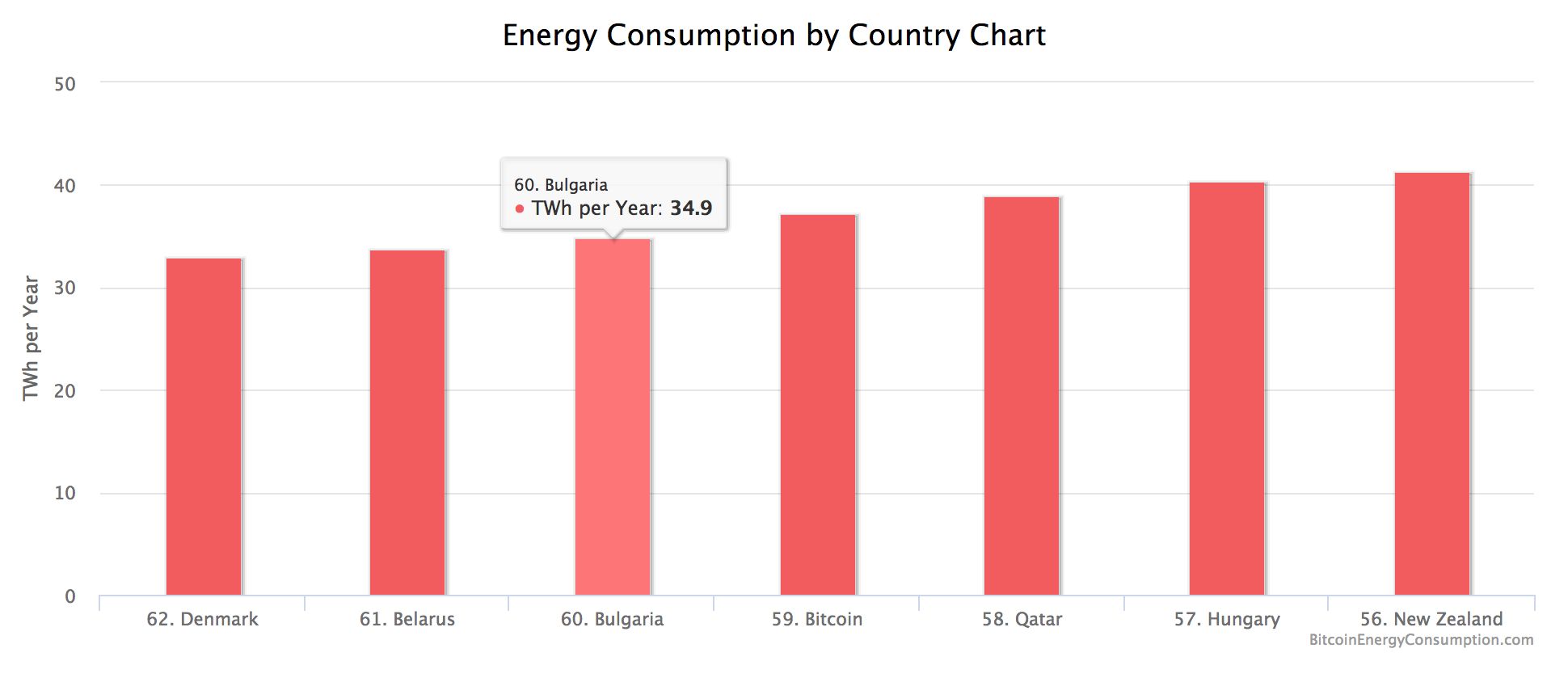

Bitcoin has a large and rapidly growing energy and environmental footprint. The bitcoin ecosystem now uses approximately the same power as the entire country of Bulgaria, about 0.2 percent of the global total for electricity.

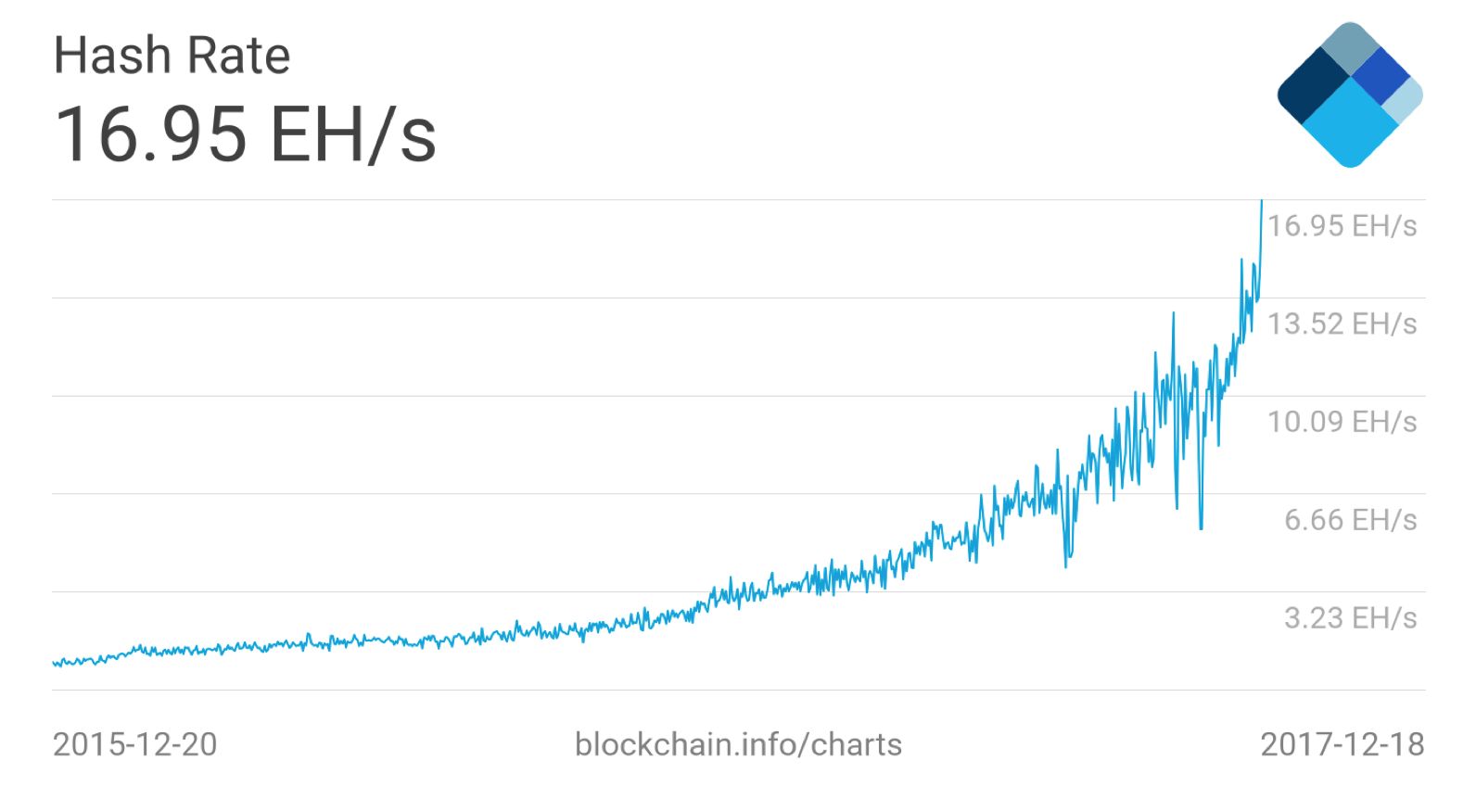

Bitcoin’s computing network has grown at an 1,100 percent average annual pace over the last five years. So if we project out just a few years, we get a truly massive energy demand for the new king of coins: Bitcoin would use more electricity than the entire world uses today, by 2020, if the recent growth trend in bitcoin mining power continues.

As of December 2017, the global hashrate is about 17 exahash per second (EH/s), up from just 2.5 at the beginning of the year, and up from just about 10,000 terahash per second (TH/s) at the beginning of 2014. (The hashrate is the processing speed of the bitcoin network.)

What will happen if and when bitcoin starts consuming a significant portion of global power? The massive profits available to miners provide a strong incentive to continue mining even with dirty power, consequences be damned.

I’ve suggested here that solar-powered bitcoin mining is part of the solution, because solar power’s environmental footprint is relatively benign compared to its competitors. But even solar has a footprint -- a rather large one in terms of the land it uses. It has no emissions and almost no visual footprint, but the habitat it potentially displaces, or the agricultural activities it may displace, are important environmental factors to consider.

Here’s the crux of the problem: There is no upper limit to the price of bitcoin and therefore no upper limit to how much energy and resources could be appropriated to mine bitcoin -- even if we continue to see substantial improvements in the efficiency of new mining machines.

The fact that only 21 million bitcoin can be mined doesn’t limit either the price or the mining power, since the bitcoin algorithm adjusts difficulty upward, with no upper limit, in order to keep mining one block every 10 minutes. If more and more people pile into bitcoin in the coming years, the price will keep going up with no limit, and, equivalently, the mining power will keep going up with no limit.

Even if all bitcoin mining was done with solar power, with no upper limit to the amount of mining that could take place, it wouldn’t be long at current growth rates before literally all available land would be used for solar power and mining.

It is highly unlikely that we will reach a point where even a substantial fraction of our available land will be devoted to solar bitcoin mining, but knowing where current trends could lead is important in assessing the scope of the problem and the potential solutions.

We will likely see governments step in and regulate (or even ban) bitcoin mining long before it becomes such a serious energy or land problem. However, with such large potential profits from bitcoin mining, currently and for many decades to come, there will be a very strong incentive for developers to continue to expand mining operations. Mining will be profitable through at least 2140. The bitcoin algorithm requires that it will take until that time to mine all 21 million bitcoins, released in one block every 10 minutes until 2140, with the amount of coins currently at 12.5 per block but declining by half every four years.

(Some readers may think that the quadrennial halving of bitcoin block rewards will make mining unprofitable long before 2140, but this is very unlikely. We have seen the opposite trend in the last couple of years. The price/difficulty ratio, a measure I’ve created, hit its highest point in late 2017 -- over five times its lowest point in early 2017 -- as the price has far outpaced difficulty increases and halvings.)

Proof of work is how bitcoin dispenses with trusted third parties

There are alternatives to the bitcoin mining system, however, that may not require heavy-handed government action to intervene. Let’s first look at how bitcoin currently works.

New coins are mined through a system known as proof of work. The “work” in this case is performed by computers to find hash keys that represent the next block of coins. Hash keys are very long cryptographic codes that get more and more difficult as more and more people mine bitcoin.

The hash key discovery process is why bitcoin is called a “cryptocurrency,” and why it can operate as a purely peer-to-peer currency with no regulators and no trusted third parties. The hash keys go into the blockchain, an electronic distributed ledger, and cannot be faked or duplicated without as much or more computing power that was required to create the first hash key.

Each transaction on the bitcoin blockchain must be confirmed by a number of other parties before it is considered valid. This redundancy is required in order to avoid fraud or conflicting transactions. It would require 51 percent of the vast bitcoin computing network to fake transactions -- this is known as a 51 percent attack. Such an attack could undermine bitcoin, but no party or group of parties has yet achieved 51 percent mining power. (See The Book of Satoshi for thoughts from Satoshi Nakamoto, the creator of bitcoin, on the potential for 51 percent attacks.)

The end result is a highly secure system that has worked almost flawlessly for about nine years. While there have been many high-profile cases of hacking various bitcoin exchanges, bitcoin itself has almost never been hacked. (There is a rather glaring exception to this history, which recently came to light, and may eventually lead to serious problems down the road for bitcoin.)

But back to proof of work and why it was adopted by bitcoin. Proof of work substitutes computers and mathematics for central banks and aggressive militaries in order to build a functional global currency. I won’t debate here whether this change is wise. Instead, I’m going to examine whether a shift to proof of stake, the key alternative to proof of work, is warranted given the looming energy and environmental problems facing bitcoin, as well as whether or not it’s likely to happen.

Proof of stake as an alternative to proof of work

Proof of stake offers a different way of ensuring the validity of each block and transaction. Investopedia provides a succinct discussion: "The proof of stake (POS) seeks to address [the energy use] issue by attributing mining power to the proportion of coins held by a miner. This way, instead of utilizing energy to answer POW puzzles, a POS miner is limited to mining a percentage of transactions that is reflective of his or her ownership stake. For instance, a miner who owns 3% of the bitcoin available can theoretically mine only 3% of the blocks."

This change eliminates the incentive to amass more and more mining power. The computing power required for POS systems is apparently a small fraction of the comparable POW systems.

A more detailed discussion can be found at the Bitcoin Wiki website here, including discussion of a hybrid POW and POS system, combining the best features of both.

How do we convince very wealthy bitcoin mining owners to agree to a shift to POS, which may lock in their mining power at a static level indefinitely? Recent attempts to improve the bitcoin software to allow for larger block sizes, which has been very difficult in terms of achieving any kind of consensus, doesn’t bode well for achieving such a significant change in how new blocks are discovered.

All the incentives in the bitcoin system seem to be pushing hard to keep proof of work in place. This is a classic “tragedy of the commons” problem that is the root of many environmental issues. Each individual is incentivized to use as much of the commons (in this case the global environment) as it can in order to profit individually, but as everyone pursues their individual good, the commons itself is quickly destroyed.

Could a hard fork be implemented to change bitcoin to proof of stake?

There may be ways to get around these unintended consequences of bitcoin. There have already been a number of hard forks (i.e., protocol upgrades) to bitcoin, including Bitcoin Cash, Bitcoin Gold, Bitcoin Silver, Bitcoin Diamond and others. Some of these are doing quite well, particularly Bitcoin Cash, which has hit 50 percent of the price of bitcoin.

Could a hard fork to bitcoin POS be done? Anyone can do a hard fork of the open-source bitcoin software. The question isn't whether it can be done; rather, it's whether it will be adopted. We can’t know the answer until someone implements the fork and puts it out there for the community to consider.

Lightning Bitcoin is an already-announced hard fork of bitcoin that would use a type of POS and have a very rapid 3-second block time. Lightning Bitcoin’s hard fork took place on December 23, so we may see very shortly how a bitcoin POS coin will fare in the increasingly crowded crypto marketplace.

A big shift toward an existing crypto like Peercoin, which already uses a hybrid POS system, could be another option. Peercoin uses the same hashing algorithm as bitcoin (SHA-256), so all existing bitcoin miners could in theory switch to mining Peercoin, which is required to create Peercoin coins, based on their allotted stake, resulting in a far less energy-intensive future. Peercoin is now in the top 100 of cryptocurrencies in terms of market capitalization. (The Peercoin white paper is here.)

PIVX (formerly known as DarkNet) is another POS hybrid crypto that also includes enhanced privacy options. PIVX is based on Bitcoin Core and is a fork of Dash, so it is already a type of bitcoin hard fork that uses POS. (The PIVX white paper is here.) It’s currently the 46th most valuable coin and climbing.

The last altcoin I’ll mention is Ethereum (with coins known as ether). Ethereum is switching to POS in the next year or two, in a slow, phased-in process (the date hasn’t been announced yet), an undertaking which has sparked much discussion. Ethereum is not meant to be a widely used cryptocurrency; rather, it was designed to be a smart contracts platform and a type of fully distributed “world computer.” But Ethereum's adaptability could allow it to become an alternative to bitcoin as a digital currency.

Ethereum is well established as the second most valuable cryptocurrency today, with a $96 billion market cap compared to bitcoin’s approximate $264 billion (as of this writing). It is not unrealistic to imagine that Ethereum may one day dethrone bitcoin -- particularly if POS becomes the preferred solution for avoiding the looming environmental catastrophe posed by bitcoin under POW.

Summing up

It seems likely that most or all bitcoin mining will need to use renewable energy like solar, wind, biomass, geothermal or hydropower in order to minimize its environmental footprint. Some governments may step in and require this shift in order for entities to be allowed to continue mining. Under this scenario, mining with renewable energy may be a way to “future-proof” one’s mining operations.

We may also see a strong push for a shift to proof of stake instead of proof of work, either in new forks or updates to Bitcoin Core, or with the creation of entirely new cryptocurrencies. We'll have to watch these POS alternatives in the marketplace to find out if they're going to catch on.

If there is a significant shift of SHA-256 mining power away from bitcoin because of POS or other factors, the massive global mining power already built up will have to shift mining operations, at least in part, to other coins, if those alternatives are profitable. In that event, environmental concerns will likely continue.

Epilogue: Is bitcoin a type of world-eating artificial intelligence?

Journalist Eric Holthaus recently hinted that we may be witnessing the type of runaway artificial intelligence that philosopher Nick Bostrom worried about in his book Superintelligence: Paths, Dangers, Strategies.

Bostrom worries that machines with rudimentary AI -- but with a very effective and focused production mission -- may escape the control of their creators and end up destroying us. Bostrom uses the example of an automated paper-clip maker that is so good, it ends up using all the world’s resources to make ever-growing mountains of paper clips, literally drowning humans in paper clips.

This example is fanciful, but meant to illustrate the danger of simple AIs that are extremely good at their defined tasks. We may not need to imagine an AI that is far more intelligent than humans in order to be worried about the potential for harm.

The rapidly growing bitcoin mining network isn’t itself intelligent in any traditional sense. But given the very powerful financial incentives inducing humans to grow the network and exponentially consume more and more power, it is a clear example of what Bostrom worries about: rudimentary intelligence leading to very perverse large-scale outcomes.

Will bitcoin end up controlling its creators and eventually consuming more and more resources on our small planet?

Again, such a scenario is fanciful. But we should start thinking about how to prevent this remote-but-dangerous future from playing out.

***

Tam Hunt is a lawyer and owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii, co-founder of Solar Trains LLC, and author of the new book, Solar: Why Our Energy Future Is So Bright.

--

Join GTM at the Blockchain in Energy Forum on March 8 in NY. Innovators from utilities, start-ups, investors and policymakers will come together for a full day of networking, dynamic conversations, and learning what the future may hold for this technology. From transactive energy, to supply chain management, to asset tokenization, this event will get everyone up to speed on the distributed ledger technology and its real-world use cases.