The consensus is clear: the global utility industry is on the cusp of a significant disruption. The driving force behind this is, of course, the growth of distributed energy resources. And, as with most disruptions, the enabling factors have been coming together for some time.

These factors include the increasing cost-competitiveness of renewables combined with the desire for energy self-sufficiency and concerns about the environment.

What makes this so disruptive?

As the combination of distributed energy resources (DER) and battery storage becomes a viable alternative, consumers increasingly have the choice to be independent of the grid.

This has the potential to unleash a death spiral for traditional utilities, which, because of declining revenues, cannot afford the infrastructure investments necessary to properly maintain, let alone upgrade, an electrical grid that was not designed to accommodate a high penetration of DER.

And make no mistake; the proliferation of distributed energy without proper grid integration can have negative, unintended consequences for the price, quality and reliability of power.

That’s because most DERs are not connected to supervisory control and data acquisition (SCADA) systems. This makes it difficult to monitor and control their security and efficiency. As a result, serious concerns have arisen about the impact on the grid from transient voltage variations and harmonic distortions that renewables such as solar PV and wind power can cause.

Nevertheless, the opportunity to aggregate decentralized sources of power is enormously attractive.

In a recent interview, NRG Energy CEO David Crane said: "Think of 50 million American homes each with a distributed solar system at $20,000 a pop on average. [...] That represents a trillion-dollar market [aggregation] opportunity.”

Enter the virtual power plant

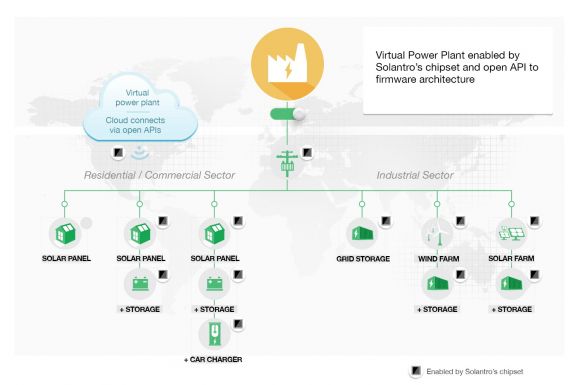

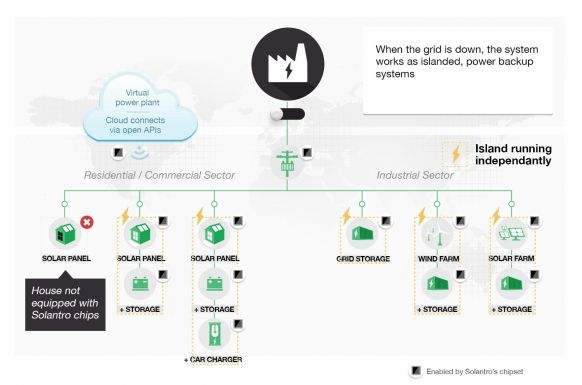

Through the use of specialized power electronics equipment and software, DERs can be clustered to function as a single virtual power plant (VPP) with centralized voltage control, storage, demand response, and distribution automation.

Seeing DERs as a complement rather than as a competitor is an important shift in perspective for incumbent utilities, as well as new market entrants. By aggregating and integrating this capacity, utilities have the potential not only to postpone investments in new power generation but also to improve grid stability.

German utility RWE, for example, began a pilot VPP in 2012 which now has approximately 80 megawatts of capacity. According to Jon-Erik Mantz, commercial director of RWE Energy Services in Germany, large utilities can “be part of a VPP and profit” even when their direct market share is falling due to increasing self-production and consumption on the part of consumers. “This is why we concentrate on building VPPs,” he added.

Despite their potential, most implementations of VPPs have remained at the pilot stage. But, if VPPs represent the ultimate example of our next-generation distributed electrical grid, what is preventing their rapid and ubiquitous deployment? In a word: cost.

There are two main cost drivers: the cost of the distributed power electronics hardware and the integration complexity caused by the lack of systems interoperability.

According to Matt Wakefield of the Electric Power Research Institute, “Lack of interoperability is one of the primary factors holding back utilities from deploying systems and third parties from furthering the development of controllable system interfaces and devices”.

Reducing the cost of power electronics

To achieve widespread adoption, the cost of advanced distributed power electronics must converge to $0.10 per watt. But since most power electronics are currently built using discrete electronic components that do not benefit from economies of scale, it’s unclear how this goal will be met.

Though this may seem like a daunting challenge, other industries have demonstrated how it can be done. For example, by partnering with chipset vendors, cell phone OEMs were able to replace their discrete electronic components. This enabled the industry to transition from a vertical to a horizontal integration model that drove costs down to the point where mobile phones became ubiquitous.

Moreover, these cost efficiencies were amplified by a growing addressable market led by new service providers looking to win market share by selling more innovative services and smarter phones. This can happen in the utility industry as well.

As in every growth market in its early phases, the ecosystem is not yet optimized with clear standards. This means different companies attack the problem at different angles with proprietary solutions. To address this, the utility industry needs its own “Intel Inside” standard that will have:

- Open API/open architecture

- Chipset economics

- Horizontal integration

Adopting this type of standard will dramatically reduce costs through the mass scalability enabled by semiconductor integration. Unfortunately, today’s chipsets were designed to process information and are not ideal for power processing and conversion applications.

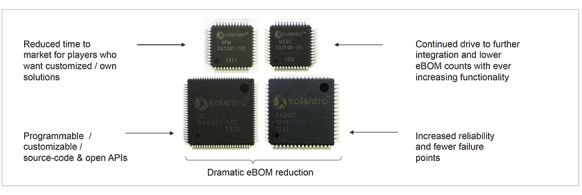

But earlier this year, Solantro Semiconductor Corp. started offering its partners a chipset that is the ideal building block for next-generation grid applications. With it, Solantro became the first company with a dedicated chipset for power conversion from renewables.

Unlike existing integrated circuits, Solantro’s chips are designed and built specifically to measure, process and drive complex power architectures. The same chipset can be used for solar, battery storage, wind, generators, and power correction applications.

Solantro’s chipset replaces multiple outdated electronic components with state-of-the-art chips. This can reduce the engineering bill of materials in a typical application by more than 60 percent. In addition, unlike discrete electronic components, Solantro’s chips offer significant cost benefits from economies of scale.

Plug-and-play integration

On its own, Solantro’s power chipset offers many advantages over non-specialized offerings. But when combined with the company’s open API to firmware architecture (that taps directly into the chipset’s capabilities), it offers massively scalable solutions.

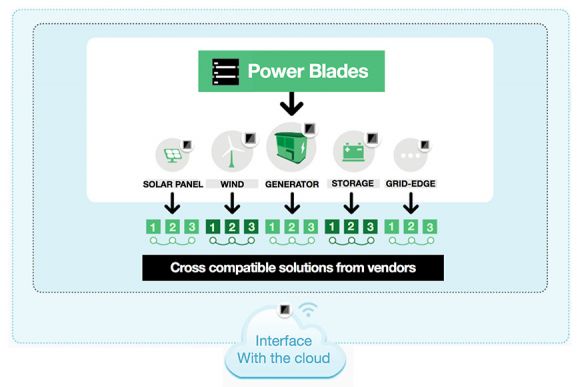

One interesting application for the chipset is in power blades. These hot-swappable and fully redundant power conversion boards (DC-DC, DC-AC, AC-DC, AC-AC) allow for power conversion tasks to be dispatched, shared and virtualized across a many blades -- eliminating any single point of failure.

Power blades have the potential to unleash the free market to further develop innovative products and services that enable interoperability at all levels of power systems. That’s because the cross-compatibility of vendors’ solutions is built into the Solantro chipset in a way that allows OEMs to preserve the investment in their existing software and tools.

Solantro is leading this evolution and actively partnering with world-class OEMs. These forward-thinking companies understand that their future competitiveness is tied to the ability to offer differentiated solutions using the software, hardware and cloud interfaces that enable VPPs to support the grid, as well as to act as sources of power when the grid is down.

Another sign of increased momentum in this area is U.S. utility Duke Energy’s “coalition of the willing,” which includes Accenture, Alstom, Ambient, Echelon, S&C Electric, and Verizon. Together, they have put in place an active outreach program with vendors to open up their grid applications so that they can become interoperable.

Raiford Smith, Duke’s director of smart grid emerging technology, said that because of this open-systems approach, the company’s McAlpine VPP pilot project in Charlotte, North Carolina saw order-of-magnitude improvements in terms of cost and implementation time.

With initiatives like these, the answer to the question: “Can we build a next-generation distributed electrical grid?” is a resounding “Yes, we can.”

***

About Solantro Semiconductor Corp.:

Solantro’s chipsets and reference platforms demonstrate world-class performance and engineering bill-of-materials reductions. The company is actively partnering with power electronics companies to realize the vision of horizontal integration and relentless cost reductions while preserving OEMs’ investment in existing software and tools.