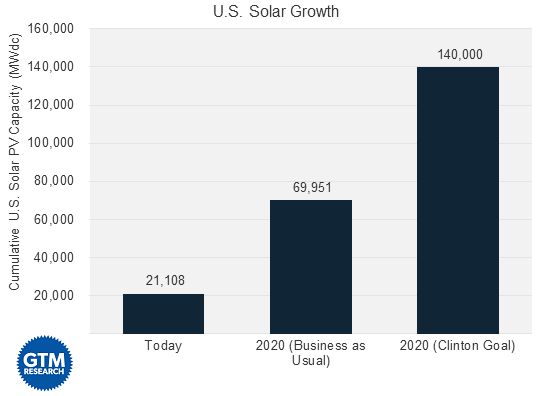

Yesterday, presidential candidate Hillary Clinton unveiled the first pillar in her climate and energy plan, including a target of 140 gigawatts of cumulative solar installed in the U.S. by 2020. This is the first specific solar capacity target issued by any candidate in the presidential race.

How ambitious is the target?

Clinton’s solar goal is no small task. Today, the U.S. is home to around 21 gigawattsdc of solar PV capacity, so this goal calls for a sevenfold increase over a span of five and a half years.

Source: GTM Research

Our base-case forecast, which assumes a current policy scenario, reaches nearly 70 gigawatts by the end of the decade. So Clinton’s goal would more than double our forecast.

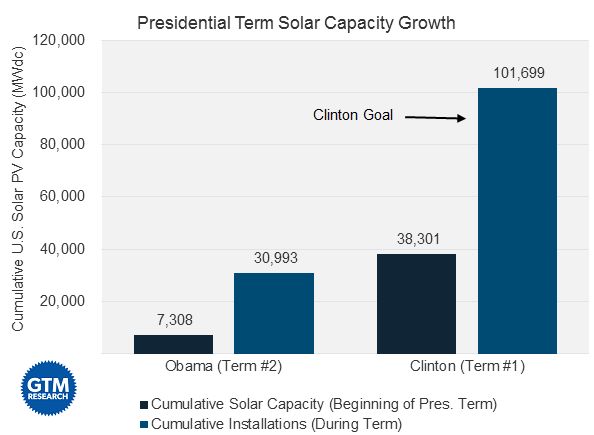

This is a highly aggressive goal. Hillary Clinton wouldn’t take office until 2017, so her ability to impact the solar market would be restricted to a four-year period. Assuming our 2015-2016 forecasts are accurate, the U.S. will be home to around 38 gigawatts by the end of 2016, leaving another 102 gigawatts for the four years of Hillary’s presidential term. In other words, Clinton’s first term would need to see a market that installs more than 2.5 times the cumulative market size at the date she takes office.

To be fair, by that metric, President Obama will likely have achieved that same goal in his second term. At the end of 2012, cumulative solar PV capacity sat at 7.3 gigawatts, and we expect it to reach 38.3 gigawatts by the end of 2016 thanks to falling solar costs, a stable policy landscape, and a wealth of solar innovation. Cumulative solar installations from 2013-2016 will be 31 gigawatts -- more than four times the cumulative capacity through 2012.

Source: GTM Research

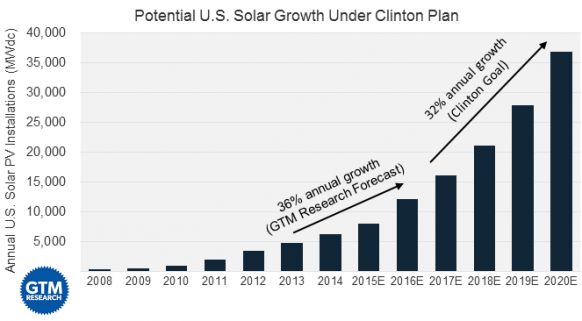

But the market’s growth during Obama’s second term is coming from a much smaller installed base. If you assume a steady growth rate throughout Clinton’s term, here’s how the annual installation picture might look.

Source: GTM Research, GTM/SEIA U.S. Solar Market Insight

So the size of the annual market in 2020 would have to be around 36 gigawatts, roughly equivalent to the size of the cumulative market on the day Hillary takes office.

Is it achievable?

In short, yes, but with a few caveats. Clinton’s target can be reached if the U.S. solar market grows at an annual rate of 32 percent from 2017-2020. This is roughly on par with our projected 36 percent growth rate from 2013-2016. In other words, the market just needs to keep growing at the same rate for another four years.

But that won’t happen under business-as-usual conditions, hence the big difference between our 2020 forecast and Clinton’s goal. In my view, reaching this target requires two big changes and a host of smaller ones.

- ITC Extension: The biggest swing factor in the market is the extension (or lack thereof) of the 30 percent federal Investment Tax Credit, which is scheduled to expire at the end of 2016. Although precipitous declines in solar costs will undoubtedly help the market weather the 2017 storm if the credit is not extended, a 30 percent growth rate from 2016 to 2017 amidst ITC expiration is almost impossible to conceive.

- Clean Power Plan: Toward the end of the timeframe (2018-2020), the Clean Power Plan could begin to spark solar development in many parts of the country where the market is currently absent -- if it is upheld and implemented expeditiously. Through Q1 2015, fully 70 percent of all solar capacity in the U.S. came from four states -- California, Arizona, New Jersey and North Carolina. But a 140-gigawatt target requires a much more geographically diverse landscape.

- Municipal- and State-Level Activity: Many of the most important solar market drivers are at the local, utility or state level. This includes permitting, interconnection, incentives, electricity rates, RPS standards, net energy metering rules, and more. Every revision to one of these mechanisms, especially in the 20 core solar states, impacts demand and would be vital to achieving the 140 GW goal.

- Solar Costs: Apart from political and regulatory drivers, solar market growth is contingent on rapid cost reductions. Even in today’s environment of relatively stable module prices, the cost to install solar is continually falling through a mixture of hardware and soft-cost reductions. Faster-than-expected cost reductions could be the biggest factor of all.

For the most part, this is exactly what Clinton’s fact sheet proposes. It mentions tax incentive extensions (read: ITC), solar access programs (read: community solar), and a Solar X-Prize to support communities that cut red tape. It also includes a variety of other proposals, most of which would either marginally support the solar market (e.g., renewable energy expansion on public lands) or have a significant but longer-term impact (investment in clean energy R&D).

Campaign goals are only so valuable, but this one is interesting because it presents perhaps the highest achievable target for solar in the U.S. for the rest of the decade.

***

Shayle Kann is the Senior Vice President of GTM Research. For more information, visit www.gtmresearch.com or contact [email protected].