LO3, a startup that brands itself as a "transactive energy company," is preparing to expand internationally after building the world's first blockchain microgrid.

The company pulled in new investments last week from Braemar Energy Ventures and Centrica Innovations. The capital raise completed a Series A round for the Siemens-backed firm based in Brooklyn, New York.

For the past couple of years, blockchain has been lauded as a potential game-changer in the energy industry, attracting millions of dollars in investment.

“There’s a lot of interest, a lot of hype in the blockchain industry right now,” said Scott Kessler, LO3’s director of business development, during a recent visit to the startup’s new Brooklyn office.

“Ninety-nine percent hype in blockchain,” CEO Lawrence Orsini chimed in.

Much of that attention has fallen on LO3 in the three years since it started using the technology. LO3’s core platform revolves around peer-to-peer energy trading on community microgrids where blockchain verifies the transactions. For all of the publicity that blockchain is getting, Kessler said the real innovation is around how companies are using it.

“We very much think of ourselves as an energy company that happens to use blockchain," said Kessler. "If another, more efficient way to communicate this data came out, we would use that.”

In addition to its latest funding round, LO3 recently announced two new projects underway in Germany. One, the Landau Microgrid Project, is a research project at the Karlsruhe Institute of Technology and a partnership with local utility EnergieSüdwest AG that includes 20 customers. It’s the first test of a local energy market in Germany. The other, in conjunction with energy provider Allgauer Uberlandwerk, will test a "virtual microgrid" based on disparate sources of distributed generation.

LO3 now has projects in Europe (including an as-yet-unannounced project in the U.K.), Australia and the U.S.

The crown jewel is LO3's Brooklyn microgrid project, which demonstrates the use of blockchain-enabled energy trading among a small group of residents.

The segment of Brooklyn where the project is located -- at the nexus of Gowanus, Park Slope and Boerum Hill -- was meant to be representative of a wide-reaching community and a diverse swath of buildings. Testing transactions there offers a model for how it could function on a larger scale.

LO3 started the project small, with just five energy-producing participants. It now has 60 of those prosumers and another 500 energy buyers participating.

“What we’re trying to do here is partially a business-model test,” said Kessler. “We don’t want this to be something that functions only for a certain type of person or a certain type of building. We have to make sure it works for the entire electric grid.”

Orsini describes the energy system of the future, interestingly enough, as being akin to specialty bottled water.

In the past, he said, people relied on cheap tap water that cost pennies per gallon. And though access to plentiful, cheap tap water still exists, many people spend dollars a day on the fancy stuff. The LO3 team suspects consumers may feel the same about bespoke energy as distributed energy resources become more commonplace. And what better place to test boutique energy purchases than in a fast-gentrifying portion of New York City?

A small monitor in the corner of the LO3 office details the core of the company's platform: the transactions moving through its Brooklyn project on any given day. On the day we visit, transactions are turning over with a 140-millisecond latency, the delay it takes for meters to communicate with each other.

Right now, LO3 is both a software and a hardware company. Because using a blockchain to verify energy transactions is still new, and the data used to run a blockchain and balance a grid requires near-instantaneous monitoring and reaction, LO3 had to build its own meters for customers in Brooklyn, Sacramento, Australia, and soon, Germany.

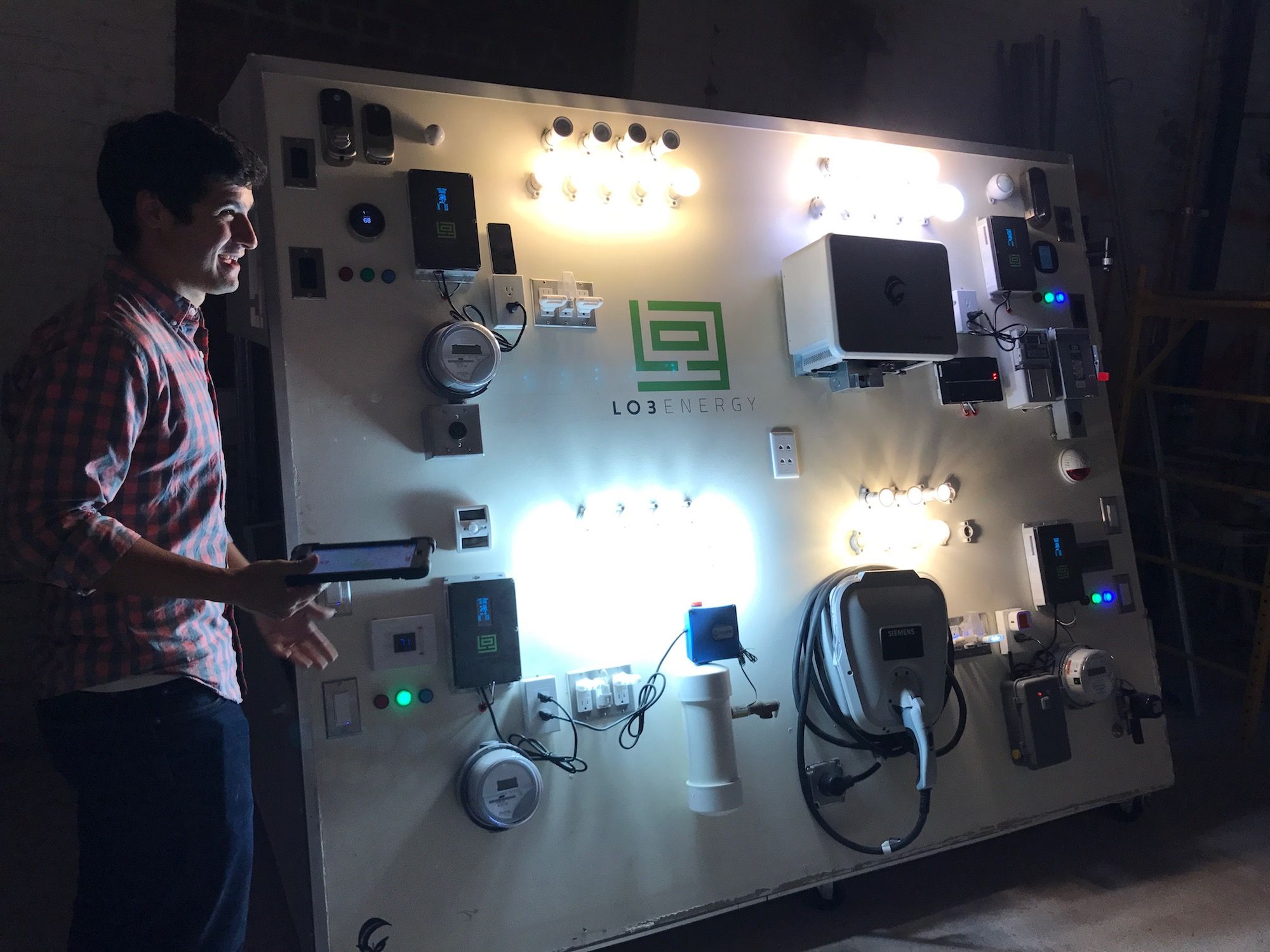

The meters, which communicate with each other to move energy between consumers, form the hardware backbone of the platform. But LO3 also built an application that makes smart contracts (an automated contract for electricity verified on the blockchain) and allows customers to control their energy usage.

Users on the Brooklyn microgrid can choose how much they want to spend on energy per day. Different resources can be priced at varying levels. In a demonstration LO3 gave on a microgrid installed in the lower level of its exposed-brick office, renewable generation cost a consumer more each day than the conventional power available to them. Users can click through to see exactly where their energy is coming from. They can also vote on sites where they think more solar should be installed in their neighborhood.

With the initial roll-out of its platform underway, LO3 is now looking to expand its consumer and prosumer network. Later this year, the company is scheduled to release a peer-reviewed white paper on its technology and the usefulness in energy applications. LO3 will also begin a “token event” to release parts of the platform so that others can build on top of it with permission to access its application programming interface.

How Brooklyn energy users take to the platform could help set the standard for blockchain in the energy industry. Beyond New York, LO3 has grand visions for the possibilities of transactive energy.

“What we’ve described so far ends up being a pretty small piece of it, because people buying and selling energy to one another should definitely be a function of this platform,” said Kessler. He and Orsini want to go further.

They describe near-limitless potential for how blockchain applications could smooth the production and distribution of energy. Possible next steps include paying consumers to turn devices on and off to meet demand. Or charging different amounts for the transmission infrastructure used to exchange electrons, thus increasing private investment in infrastructure instead of pushing those costs off on ratepayers.

Scott Kessler, LO3's director of business development, shows off the company's metering system. Image credit: Emma Foehringer Merchant.

It’s still early days for the model. LO3's Brooklyn project has about 500 participants, and it's now rolling out the platform’s beta application there.

LO3's blockchain works for transactive energy because it can respond within seconds to verify a transaction, rather than the minutes-long response time for Bitcoin. Speeding up the verification process is especially important when balancing energy.

“There is no command-and-control system that can manage a billion devices at the grid edge efficiently,” said Orsini. “So there’s a different way you have to manage the level of DERs that we’re going to have in the next few years. Blockchain, it turns out, is a really efficient communication platform for value.”

Orsini argues that energy actually has the biggest potential among blockchain applications.

Last year, NRG dispatcher Chris Taylor declared that “we are on the ground floor of one of the most significant transitions in human history.”

Blockchain energy companies have been “cropping up like mushrooms after the rain,” wrote GTM's Jason Deign recently.

“It’s very easy to describe a future in which the utility disappears, the grid is literally just a network of wires and endpoints, and there’s generating assets and users and management of it," said GTM CEO Scott Clavenna on a recent episode of The Interchange. "It’s very easy to hype that that’s where blockchain is taking us overnight, while the reality is there are a ton of obstacles to getting us there.”

LO3 executives have a sense of humor about the attention the technology is getting.

“I like to say that we basically started with the three most-hyped terms we could find, and it was blockchain, microgrid and Brooklyn,” said Kessler.

But that hype exists for a reason. LO3's experimentation with business models on the Brooklyn Microgrid could provide great value for utilities trying to understand how these platforms fit into the larger energy transition.

“It causes issues for existing utility business models, existing retailer business models, and the physical grid itself,” said Kessler. “We position ourselves as the company that’s showing you what the market of the future looks like."

Ultimately, what that market looks like will come down to experimentation. Orsini said he can’t envision a future with no central grid -- but it could look drastically different than the one that delivers energy today.

“Anybody who tells you they know the business model for the electric grid of the future is confused, because nobody knows what it is,” said Orsini. “We have to test these models. We have to see how people respond to new technology and new choices.”

***

GTM will host an entire panel session on Blockchain at the first annual U.S. Power & Renewables Conference in November. You'll get an in-depth look at how the renewable energy market will interact with the U.S. power market, and how those interactions can impact overall industry development and market growth. Curated by GTM Research, MAKE and Wood Mackenzie energy analysts, we’ll take an expansive view of key issues and timely topics, bringing together a diverse group of energy experts and stakeholders to discuss demand dynamics, economics and business model shifts, and policy and regulatory implications.