Can organic solar cell technology be successfully commercialized in an unforgiving solar market dominated by crystalline silicon and First Solar?

Heliatek of Dresden, Germany thinks so.

In 2009, Heliatek's sample cells had a 6.0 percent conversion efficiency verified by The Fraunhofer Institute. In 2010, it was 8.3 percent. This week the startup announced an efficiency of 9.8 percent for a 1.1 cm² tandem cell on glass. The firm claims that the 9.8 percent is a world record for this technology and a 10 percent cell is expected next year. The company admits that these are lab results but insists that it is a consistently repeatable value. The efficiency value would be 8.5 percent when deposited on a flexible substrate, according to the firm.

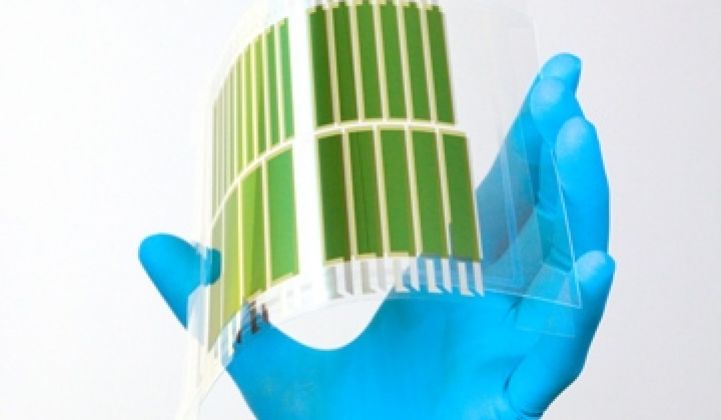

Organic solar cells (OSCs) are sometimes referred to as third-generation solar technology, after crystalline silicon and thin-film solar technology. OSCs can be divided into two categories: polymer-based (large molecules) and oligomer-based (small molecules).

Heliatek uses vacuum deposition of very homogenous layers of small molecule oligomers at low temperature. It's a process that doesn't use solvents as in a printing process, and it's that process that "separates us from the other guys," according to Heliatek's CEO, Thibaud Le Séguillon, who suggests that the firm's technology can be thought of as an OLED in reverse. Heliatek itself is developing the organic materials used in the process. The firm claims to use just one gram of organic material per square meter in its roll-to-roll process.

Rather than use the Konarka approach of massive overpromising and underdelivering, Heliatek has raised relatively little money and has kept relatively quiet, a trait Le Séguillon attributes to the German culture of getting the engineering precisely right before embarking on the marketing push.

Back in late 2009, organic solar cell developer Heliatek raised $27 million to build its first factory from venture capital investors Wellington Partners, RWE Innogy Ventures, and BASF Venture Capital, as well as industrial giant Bosch. The firm was founded in 2006 as a spinoff of the Universities of Dresden and Ulm. It is looking to raise a larger round in 2012.

Organic solar cells (OSCs) are lightweight, nontoxic, and semi-transparent. They hold the promise of low-cost manufacturing, but their efficiencies tend to be very low -- until now, at least. And their long-term reliability has been called into question. In 2009, GTM Research estimated worldwide capacity of OSCs to be just 5 megawatts.

Organic Solar Cell Competitors

Other organic and dye-sensitized solar cell (DSSC) developers and aspirants include Konarka (printing large molecule polymers), Dyesol, Solarmer, Plextronics, EPFL, Mitsubishi, Peccell, and G24i.

Konarka's main business for the last decade or so has been raising funding -- they have raised over $150 million so far with little to show in terms of true commercial product. Dyesol, a publicly traded firm, builds equipment to manufacture DSSCs; however, the firm's primary product appears to be press releases.

Recently, Eight19 Limited raised $7 million from the Carbon Trust and Rhodia to develop plastic organic solar cells. (The "Eight19" refers either to the time it takes sunlight to reach the earth or the price per watt.) Ireland's SolarPrint has eliminated the liquid part of DSSC and replaced it with nanomaterials and printing. This means that all of the active elements of SolarPrint's cells are applied through printing.

Even Intel has done some research into OSCs.

Market Target: Building Integrated Photovoltaics

I reminded Heliatek's CEO of the current challenges in the solar PV market and he said that the firm is "staying out of the commodity market. There is no money to be made in any commodity market." [Editor's note: Oil is a commodity and that seems to generate profit for some.]

The CEO said, "We need to command a better price," and to that end, Heliatek is focused on the promised-land market of building-integrated photovoltaics (BIPV). This includes windows and facades, as well as concrete and other building materials.

Le Séguillon said that OSCs are "the killer app for windows." It's true that OSCs are lightweight and semi-transparent -- that's helpful in the PV window department. Electronics and longevity might be more of a challenge.

When it comes to BIPV, this author shares the opinion that Gandhi had of Western civilization: I think it would be a good idea. There is no real BIPV market today in the true sense of BIPV. (See The Realities of Building Integrated PV.)

In favor of Heliatek and of BIPV is the EU mandate that any new building must be net-zero emission and carbon-neutral by the end of this decade. BIPV and OSCs might be a way of making that happen -- along with a legislative push.