China may be the world’s biggest emerging market for renewable energy and smart grid technology. But to date, it has lagged behind North America and Europe on implementing another important technology to manage its electric grid: demand response.

But that’s starting to change, according to a report released earlier this year from Azure International. Over the past few years, China’s utilities and state agencies have launched a series of regional projects incorporating factories, offices and government buildings as participants in managing grid needs.

And importantly, in a Chinese energy regime that still maintains significant roadblocks to allowing demand-side resources to earn money for shedding and shifting load, one project quietly launched in Shanghai last summer added a critical component that others in the country have lacked: payment for services rendered.

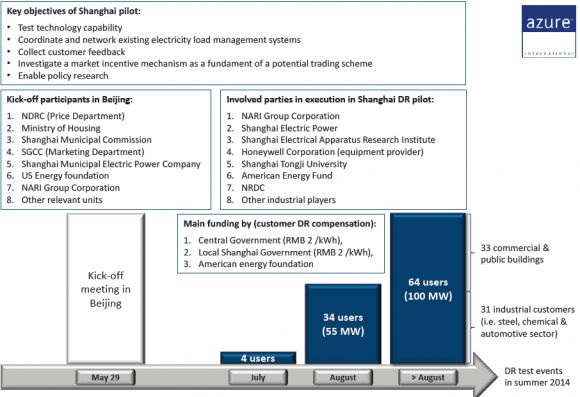

The project brought together Chinese partners including Shanghai Electric Power, NARI Group and the State Grid Corp. of China and international partners including Honeywell and the Natural Resources Defense Council. Starting quietly in May 2014, it signed up 33 commercial and public buildings and 31 steel, chemical and automotive industrial customers, with a combined 100 megawatts of load-shedding capacity.

Between July and August, the project expanded its test runs from only four buildings in July to 34 users and 55 megawatts of load reduction capacity by the end of August. In return, each participant was paid 2 renminbi (RMB) per kilowatt-hour of reduction by the central government, and an additional 2 RMB per kilowatt-hour from the local Shanghai government, which adds up to roughly 36 cents per kilowatt-hour, or four times the local retail electricity price, according to Azure’s report.

“Shanghai is the first official pilot, or demonstration project, that could be defined as real demand response with customers in place," Florian Stern, author of the report (PDF), said in an interview last week. It’s also “a foundation for a new market design, or at least recommendations for new policies,” set to be published some time this summer, he said.

China will need to create some unique market structures to get around its current challenges to demand response, noted Kevin Popper, Azure’s cleantech advisory manager. Unlike the United States and Europe, China has no true wholesale market for electricity, he said. Instead, power plant owners agree to annual generation quotas based on fixed wholesale prices. That lack of linkage between the cost of producing power and the value it has at different times of the day or the year has also made it difficult to incentivize “peaker” power plants, he noted.

That’s a problem, because roughly 5 percent of China’s peak electric load, or about 60 gigawatts, is generated only about 50 hours per year, according to Zhaoguang Hu, a vice president and researcher at the prominent State Grid Energy Research Institute. That’s a big fat target for technologies that can turn down loads at homes, businesses, factories or government facilities via price signals or market payments.

China’s National Development and Reform Commission (NDRC) is looking to the Shanghai pilot to lay the groundwork for future policies that could allow these linkages, he noted. “There’s obviously an inherent value for demand response, but the markets don’t allow them to develop it in a conventional sense. That’s why they’re so excited about the Shanghai pilot -- providing RMB per kilowatt-hour reduction could unlock some activities."

What’s more, “grid companies themselves don’t have control over pricing,” he said. That’s done by the NDRC, as well as by the provincial development and reform commissions at the province-wide level, he said. “It’s really up to them whether you’d want to create this repeatable market structure that can grow beyond the pilots.”

Meanwhile, U.S. and European companies have been eyeing China’s potential for demand-side management (DSM), including Siemens, Alstom, Schneider Electric, IBM and Honeywell. Honeywell first started working with State Grid on demand response in 2011, and in early 2012 announced its first Chinese demand response project, testing its OpenADR-enabled grid-to-building control system in the city of Tianjin.

But Honeywell, like the rest of its non-Chinese brethren pursuing demand-side management opportunities in the country, is working primarily as an equipment and systems integration provider, Stern noted. Some companies are also partnering with Chinese companies to compete in a country that keeps tight controls over international participation in its critical industrial sectors, which definitely includes energy, he said. The opportunities for demand-response aggregators like EnerNOC are far more limited, given the country's lack of markets to bring customers and grid operators together.

A GTM Research report from 2012 estimated China’s demand response market potential at $300 million by 2016, but noted that this would require the creation of markets to realize that capacity. But with pressure to reduce pollution and carbon emissions from its coal-fired generator fleet, and massive amounts of wind and solar power coming on-line, it’s hard to imagine that the country won’t find some way to bring demand-side capacity into play to manage its looming supply-side challenges.